You own a small networking startup. You have just received an offer to buy your firm from a large, publicly traded firm, JCH Systems. Under the terms of the offer, you will receive 1 million shares of JCH. JCH stock currently trades for $25.38 per share. You can sell the shares of JCH that you will receive in the market at any time. But as part of the offer, JCH also agrees that at the end of one year, it will buy the shares back from you for $25.38 per share if you desire. Suppose the current one-year risk-free rate is 6.23% , the volatility of JCH stock is 30.7%, and JCH does not pay dividends. Round all intermediate values to five decimal places as needed. a. Is this offer worth more than $25.38 million? Explain. b. What is the value of the offer?

You own a small networking startup. You have just received an offer to buy your firm from a large, publicly traded firm, JCH Systems. Under the terms of the offer, you will receive 1 million shares of JCH. JCH stock currently trades for $25.38 per share. You can sell the shares of JCH that you will receive in the market at any time. But as part of the offer, JCH also agrees that at the end of one year, it will buy the shares back from you for $25.38 per share if you desire. Suppose the current one-year risk-free rate is 6.23% , the volatility of JCH stock is 30.7%, and JCH does not pay dividends. Round all intermediate values to five decimal places as needed. a. Is this offer worth more than $25.38 million? Explain. b. What is the value of the offer?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 17P

Related questions

Question

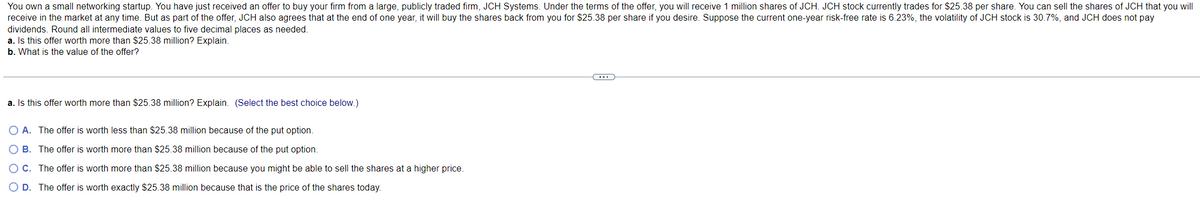

Transcribed Image Text:You own a small networking startup. You have just received an offer to buy your firm from a large, publicly traded firm, JCH Systems. Under the terms of the offer, you will receive 1 million shares of JCH. JCH stock currently trades for $25.38 per share. You can sell the shares of JCH that you will

receive in the market at any time. But as part of the offer, JCH also agrees that at the end of one year, it will buy the shares back from you for $25.38 per share if you desire. Suppose the current one-year risk-free rate is 6.23%, the volatility of JCH stock is 30.7%, and JCH does not pay

dividends. Round all intermediate values to five decimal places as needed.

a. Is this offer worth more than $25.38 million? Explain.

b. What is the value of the offer?

a. Is this offer worth more than $25.38 million? Explain. (Select the best choice below.)

O A. The offer is worth less than $25.38 million because of the put option.

O B. The offer is worth more than $25.38 million because of the put option.

O C.

The offer is worth more than $25.38 million because you might be able to sell the shares at a higher price.

O D. The offer is worth exactly $25.38 million because that is the price of the shares today.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT