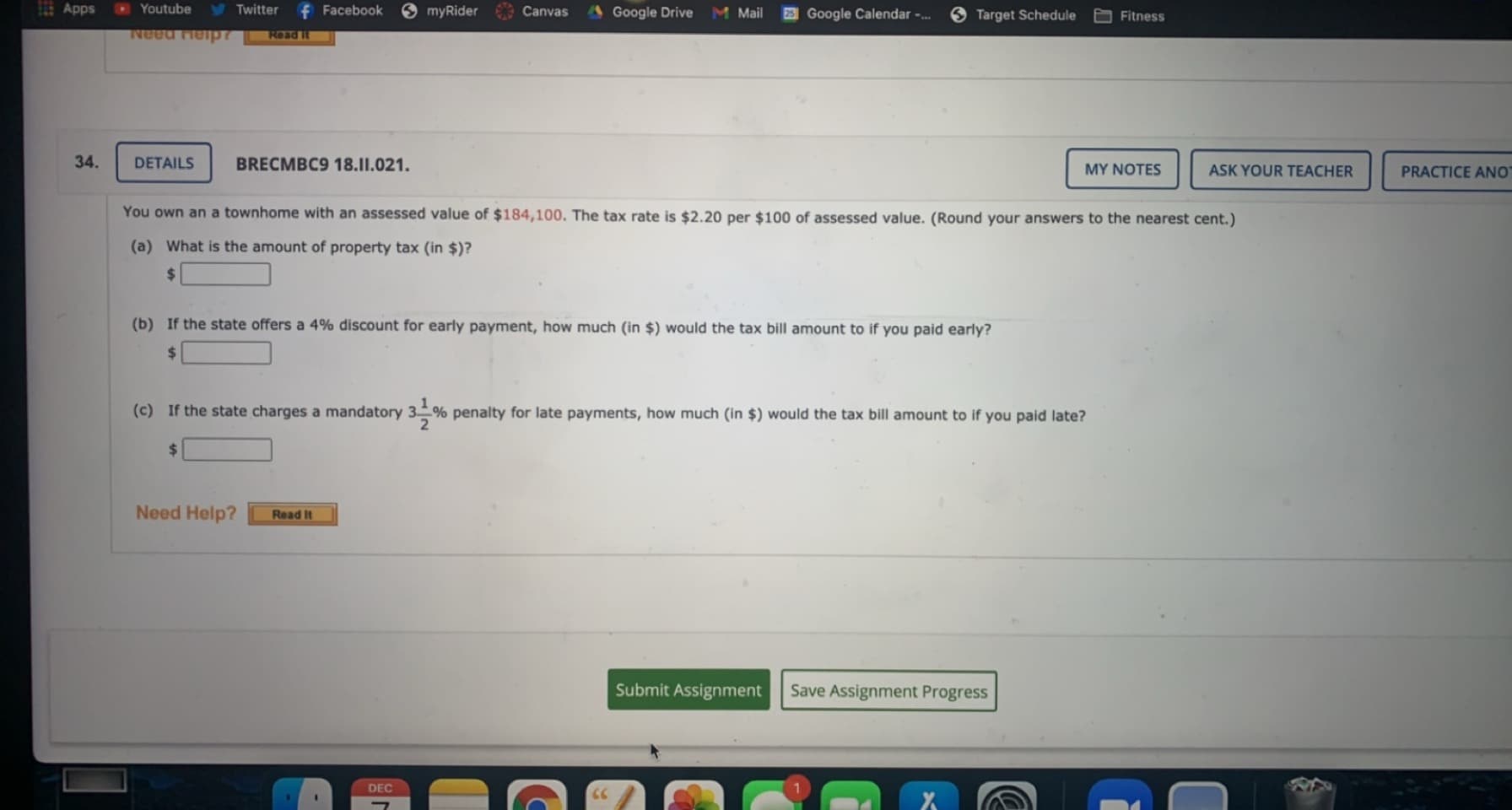

You own an a townhome with an assessed value of $184,100. The tax rate is $2.20 per $100 of assessed value. (Round your answers to the nearest cent.) (a) What is the amount of property tax (in $)? %24 (b) If the state offers a 4% discount for early payment, how much (in $) would the tax bill amount to if you paid early? %24 (c) If the state charges a mandatory 3% penalty for late payments, how much (in $) would the tax bill amount to if you paid late? %24

You own an a townhome with an assessed value of $184,100. The tax rate is $2.20 per $100 of assessed value. (Round your answers to the nearest cent.) (a) What is the amount of property tax (in $)? %24 (b) If the state offers a 4% discount for early payment, how much (in $) would the tax bill amount to if you paid early? %24 (c) If the state charges a mandatory 3% penalty for late payments, how much (in $) would the tax bill amount to if you paid late? %24

Chapter3: Income Sources

Section: Chapter Questions

Problem 35P

Related questions

Question

100%

Transcribed Image Text:You own an a townhome with an assessed value of $184,100. The tax rate is $2.20 per $100 of assessed value. (Round your answers to the nearest cent.)

(a) What is the amount of property tax (in $)?

%24

(b) If the state offers a 4% discount for early payment, how much (in $) would the tax bill amount to if you paid early?

%24

(c) If the state charges a mandatory 3% penalty for late payments, how much (in $) would the tax bill amount to if you paid late?

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College