You plan to deposit $100 at the end of every quarter (3 months) for 8 years starting at the end 8f month 3. Then after leaving the money in the account for several years, you plan to withdraw everything 15 years from today. How much is available to withdraw at the end of year 15 if the account pays a nominal annual rate of 8% compounded quarterly (every 3 months)?

You plan to deposit $100 at the end of every quarter (3 months) for 8 years starting at the end 8f month 3. Then after leaving the money in the account for several years, you plan to withdraw everything 15 years from today. How much is available to withdraw at the end of year 15 if the account pays a nominal annual rate of 8% compounded quarterly (every 3 months)?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 11PROB

Related questions

Question

Typed and correct answer please. I ll rate

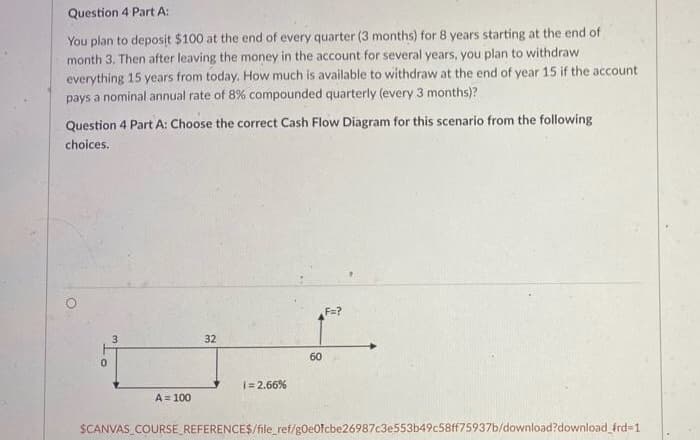

Transcribed Image Text:Question 4 Part A:

You plan to deposit $100 at the end of every quarter (3 months) for 8 years starting at the end of

month 3. Then after leaving the money in the account for several years, you plan to withdraw

everything 15 years from today. How much is available to withdraw at the end of year 15 if the account

pays a nominal annual rate of 8% compounded quarterly (every 3 months)?

Question 4 Part A: Choose the correct Cash Flow Diagram for this scenario from the following

choices.

F=?

3

32

60

1= 2.66%

A= 100

SCANVAS COURSE_REFERENCE$/file ref/g0eOfcbe26987c3e553b49c58ff75937b/download?download_frd=1

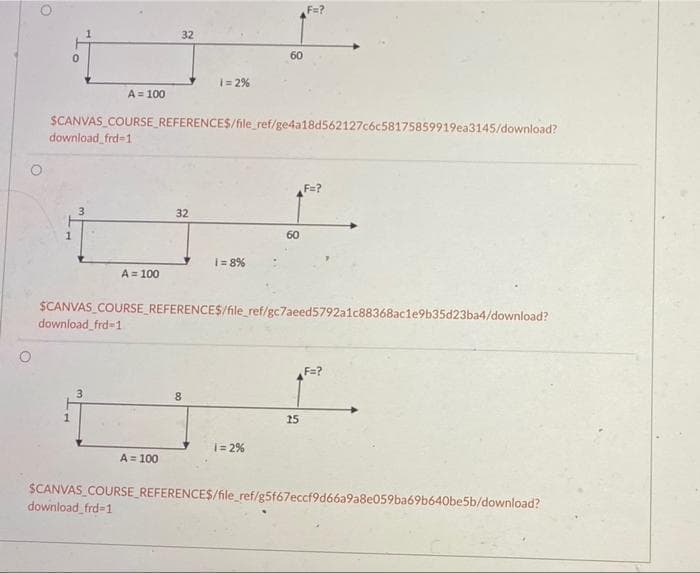

Transcribed Image Text:F=?

32

60

1= 2%

A = 100

SCANVAS COURSE REFERENCES/file_ref/ge4a18d562127c6c58175859919ea3145/download?

download_frd=1

F=?

3

32

60

I= 8%

A= 100

SCANVAS_COURSE REFERENCES/file_ref/gc7aeed5792alc88368acle9b35d23ba4/download?

download_frd=1

Fa?

3

25

|= 2%

A = 100

$CANVAS COURSE_REFERENCE$/file_ref/g5f67eccf9d66a9a8e059ba69b640be5b/download?

download_frd=1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning