You plan to deposit $900 PER YEAR into an account earning 5.25% interest compounded annually. How much money will be in the account after 6 years, assuming the deposits are made at the BEGINNING of each year?

You plan to deposit $900 PER YEAR into an account earning 5.25% interest compounded annually. How much money will be in the account after 6 years, assuming the deposits are made at the BEGINNING of each year?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 2STP

Related questions

Question

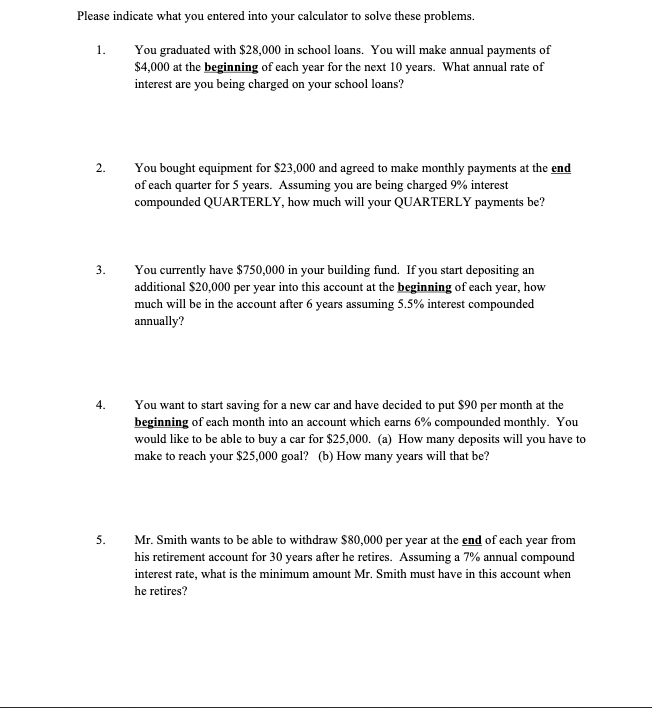

Transcribed Image Text:Please indicate what you entered into your calculator to solve these problems.

1.

You graduated with $28,000 in school loans. You will make annual payments of

$4,000 at the beginning of each year for the next 10 years. What annual rate of

interest are you being charged on your school loans?

2.

You bought equipment for $23,000 and agreed to make monthly payments at the end

of each quarter for 5 years. Assuming you are being charged 9% interest

compounded QUARTERLY, how much will your QUARTERLY payments be?

3.

You currently have $750,000 in your building fund. If you start depositing an

additional $20,000 per year into this account at the beginning of each year, how

much will be in the account after 6 years assuming 5.5% interest compounded

annually?

4.

You want to start saving for a new car and have decided to put S$90 per month at the

beginning of each month into an account which earns 6% compounded monthly. You

would like to be able to buy a car for $25,000. (a) How many deposits will you have to

make to reach your $25,000 goal? (b) How many years will that be?

5.

Mr. Smith wants to be able to withdraw $80,000 per year at the end of each year from

his retirement account for 30 years after he retires. Assuming a 7% annual compound

interest rate, what is the minimum amount Mr. Smith must have in this account when

he retires?

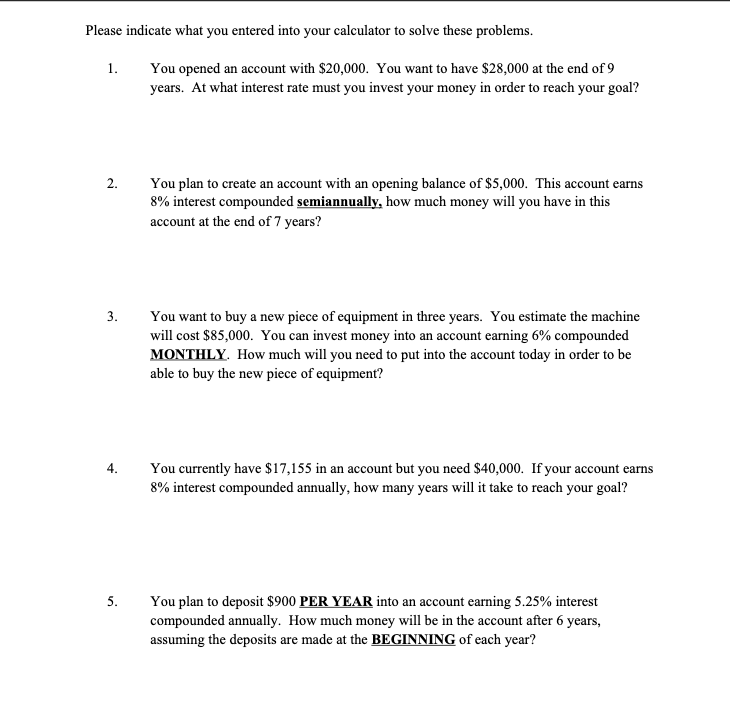

Transcribed Image Text:Please indicate what you entered into your calculator to solve these problems.

1.

You opened an account with $20,000. You want to have $28,000 at the end of 9

years. At what interest rate must you invest your money in order to reach your goal?

2.

You plan to create an account with an opening balance of $5,000. This account earns

8% interest compounded semiannually, how much money will you have in this

account at the end of 7 years?

3.

You want to buy a new piece of equipment in three years. You estimate the machine

will cost $85,000. You can invest money into an account earning 6% compounded

MONTHLY. How much will you need to put into the account today in order to be

able to buy the new piece of equipment?

4.

You currently have $17,155 in an account but you need $40,000. If your account earns

8% interest compounded annually, how many years will it take to reach your goal?

5.

You plan to deposit $900 PER YEAR into an account earning 5.25% interest

compounded annually. How much money will be in the account after 6 years,

assuming the deposits are made at the BEGINNING of each year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning