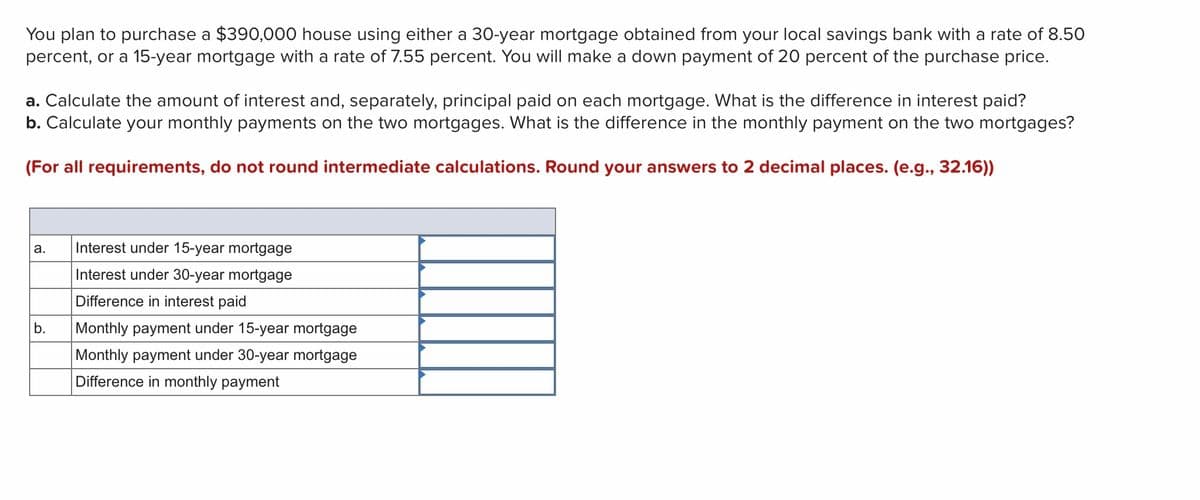

You plan to purchase a $390,000 house using either a 30-year mortgage obtained from your local savings bank with a rate of 8.50 percent, or a 15-year mortgage with a rate of 7.55 percent. You will make a down payment of 20 percent of the purchase price. a. Calculate the amount of interest and, separately, principal paid on each mortgage. What is the difference in interest paid? b. Calculate your monthly payments on the two mortgages. What is the difference in the monthly payment on the two mortgages? (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))

You plan to purchase a $390,000 house using either a 30-year mortgage obtained from your local savings bank with a rate of 8.50 percent, or a 15-year mortgage with a rate of 7.55 percent. You will make a down payment of 20 percent of the purchase price. a. Calculate the amount of interest and, separately, principal paid on each mortgage. What is the difference in interest paid? b. Calculate your monthly payments on the two mortgages. What is the difference in the monthly payment on the two mortgages? (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter5: Making Automobile And Housing Decisions

Section: Chapter Questions

Problem 7FPE

Related questions

Question

Transcribed Image Text:You plan to purchase a $390,000 house using either a 30-year mortgage obtained from your local savings bank with a rate of 8.50

percent, or a 15-year mortgage with a rate of 7.55 percent. You will make a down payment of 20 percent of the purchase price.

a. Calculate the amount of interest and, separately, principal paid on each mortgage. What is the difference in interest paid?

b. Calculate your monthly payments on the two mortgages. What is the difference in the monthly payment on the two mortgages?

(For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))

a.

Interest under 15-year mortgage

Interest under 30-year mortgage

Difference in interest paid

b.

Monthly payment under 15-year mortgage

Monthly payment under 30-year mortgage

Difference in monthly payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning