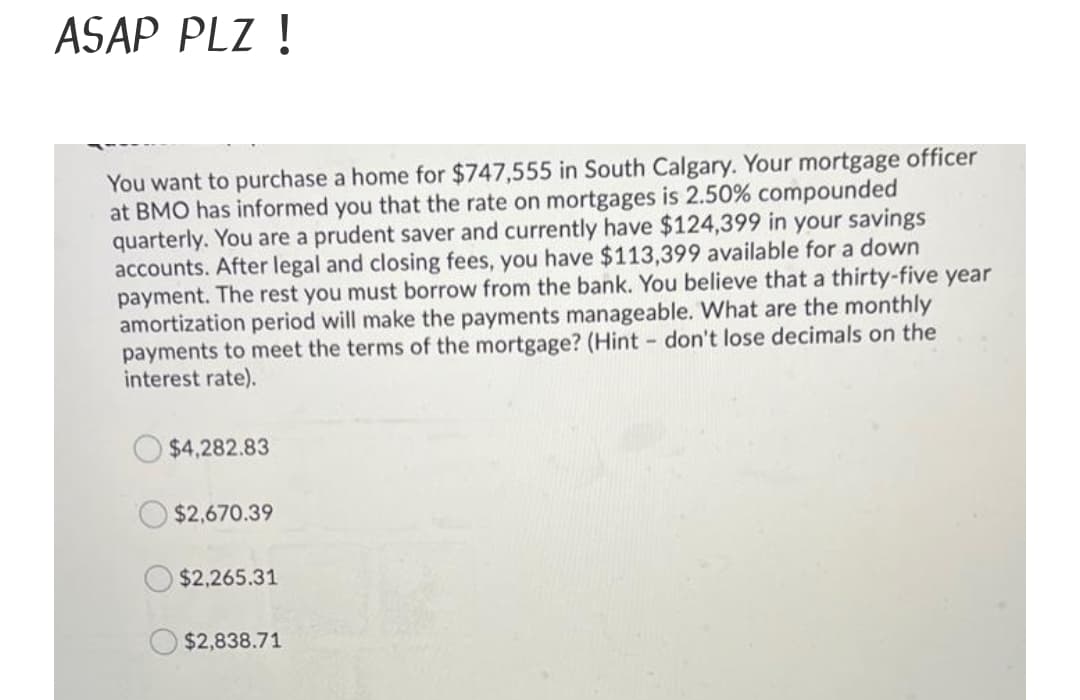

You want to purchase a home for $747,555 in South Calga at BMO has informed you that the rate on mortgages is 2.50% compounded quarterly. You are a prudent saver and currently have $124,399 in your savings accounts. After legal and closing fees, you have $113,399 available for a down payment. The rest you must borrow from the bank. You believe that a thirty-five year amortization period will make the payments manageable. What are the monthly payments to meet the terms of the mortgage? (Hint don't lose decimals on the interest rate). ry.

You want to purchase a home for $747,555 in South Calga at BMO has informed you that the rate on mortgages is 2.50% compounded quarterly. You are a prudent saver and currently have $124,399 in your savings accounts. After legal and closing fees, you have $113,399 available for a down payment. The rest you must borrow from the bank. You believe that a thirty-five year amortization period will make the payments manageable. What are the monthly payments to meet the terms of the mortgage? (Hint don't lose decimals on the interest rate). ry.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter5: Making Automobile And Housing Decisions

Section: Chapter Questions

Problem 8FPE

Related questions

Question

Transcribed Image Text:ASAP PLZ !

You want to purchase a home for $747,555 in South Calgary. Your mortgage officer

at BMO has informed you that the rate on mortgages is 2.50% compounded

quarterly. You are a prudent saver and currently have $124,399 in your savings

accounts. After legal and closing fees, you have $113,399 available for a down

payment. The rest you must borrow from the bank. You believe that a thirty-five year

amortization period will make the payments manageable. What are the monthly

payments to meet the terms of the mortgage? (Hint don't lose decimals on the

interest rate).

$4,282.83

$2,670.39

$2,265.31

$2,838.71

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning