You wish to have $21,000 in 8 years. Use Table 11-2 to create a new table factor, and then find how much you should invest now (in $) at 6% interest, compounded quarterly in order to have $21,000, 8 years from now. (Round your answer to the nearest cent.)

You wish to have $21,000 in 8 years. Use Table 11-2 to create a new table factor, and then find how much you should invest now (in $) at 6% interest, compounded quarterly in order to have $21,000, 8 years from now. (Round your answer to the nearest cent.)

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 2P

Related questions

Question

100%

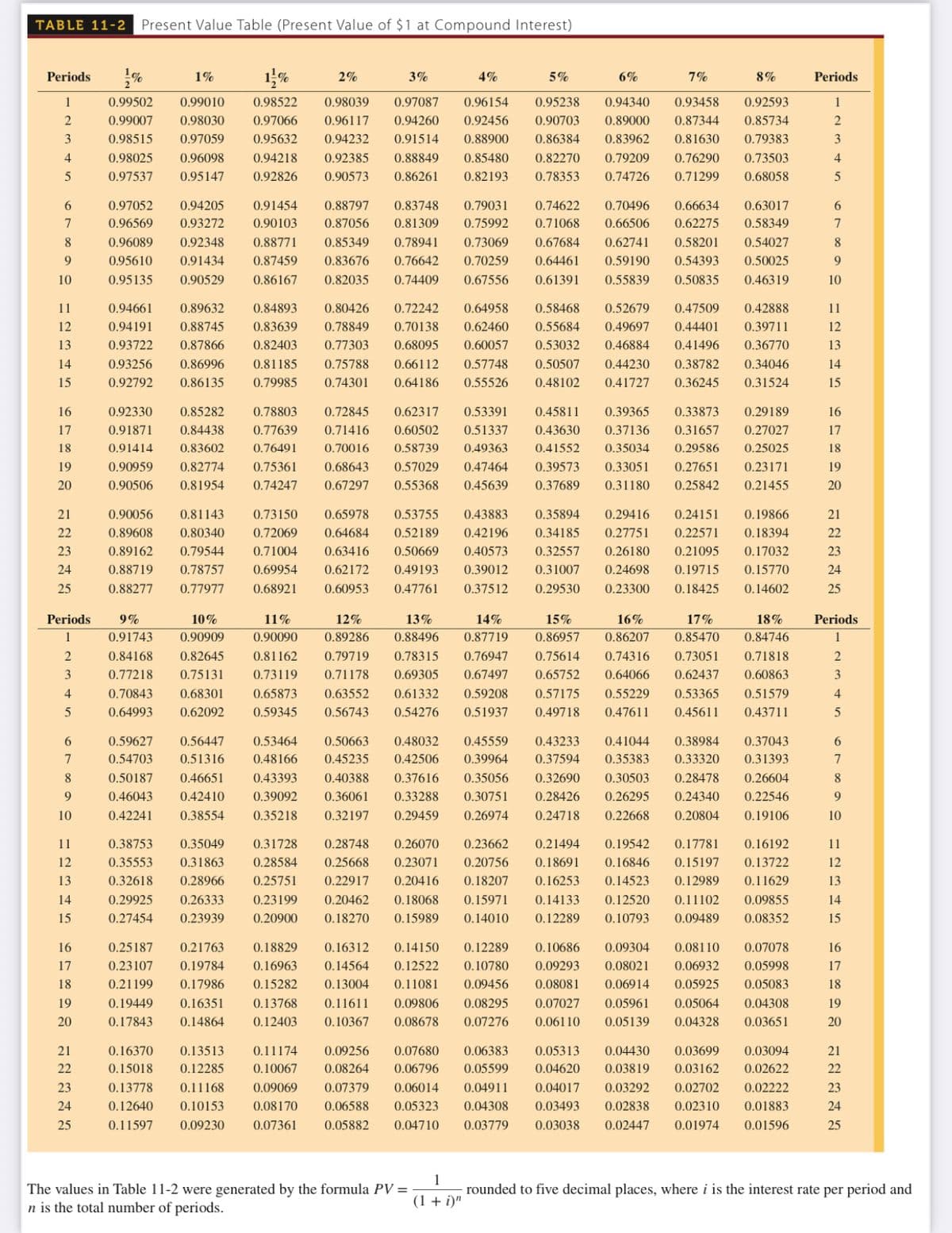

Transcribed Image Text:TABLE 11-2 Present Value Table (Present Value of $1 at Compound Interest)

1%

Periods

1%

2%

3%

4%

5%

6%

7%

8%

Periods

1

0.99502

0.99010

0.98522

0.98039

0.97087

0.96154

0.95238

0.94340

0.93458

0.92593

1

2

0.99007

0.98030

0.97066

0.96117

0.94260

0.92456

0.90703

0.89000

0.87344

0.85734

0.98515

0.97059

0.95632

0.94232

0.91514

0.88900

0.86384

0.83962

0.81630

0.79383

3

4

0.98025

0.96098

0.94218

0.92385

0.88849

0.85480

0.82270

0.79209

0.76290

0.73503

4

0.97537

0.95147

0.92826

0.90573

0.86261

0.82193

0.78353

0.74726

0.71299

0.68058

5

6.

0.97052

0.94205

0.91454

0.88797

0.83748

0.79031

0.74622

0.70496

0.66634

0.63017

6.

7

0.96569

0.93272

0.90103

0.87056

0.81309

0.75992

0.71068

0.66506

0.62275

0.58349

7

8

0.96089

0.92348

0.88771

0.85349

0.78941

0.73069

0.67684

0.62741

0.58201

0.54027

8.

9

0.95610

0.91434

0.87459

0.83676

0.76642

0.70259

0.64461

0.59190

0.54393

0.50025

9

10

0.95135

0.90529

0.86167

0.82035

0.74409

0.67556

0.61391

0.55839

0.50835

0.46319

10

11

0.94661

0.89632

0.84893

0.80426

0.72242

0.64958

0.58468

0.52679

0.47509

0.42888

11

12

0.94191

0.88745

0.83639

0.78849

0.70138

0.62460

0.55684

0.49697

0.44401

0.39711

12

13

0.93722

0.87866

0.82403

0.77303

0.68095

0.60057

0.53032

0.46884

0.41496

0.36770

13

14

0.93256

0.86996

0.81185

0.75788

0.66112

0.57748

0.50507

0.44230

0.38782

0.34046

14

15

0.92792

0.86135

0.79985

0.74301

0.64186

0.55526

0.48102

0.41727

0.36245

0.31524

15

16

0.92330

0.85282

0.78803

0.72845

0.62317

0.53391

0.45811

0.39365

0.33873

0.29189

16

17

0.91871

0.84438

0.77639

0.71416

0.60502

0.51337

0.43630

0.37136

0.31657

0.27027

17

18

0.91414

0.83602

0.76491

0.70016

0.58739

0.49363

0.41552

0.35034

0.29586

0.25025

18

19

0.90959

0.82774

0.75361

0.68643

0.57029

0.47464

0.39573

0.33051

0.27651

0.23171

19

20

0.90506

0.81954

0.74247

0.67297

0.55368

0.45639

0.37689

0.31180

0.25842

0.21455

20

21

0.90056

0.81143

0.73150

0.65978

0.53755

0.43883

0.35894

0.29416

0.24151

0.19866

21

22

0.89608

0.80340

0.72069

0.64684

0.52189

0.42196

0.34185

0.27751

0.22571

0.18394

22

23

0.89162

0.79544

0.71004

0.63416

0.50669

0.40573

0.32557

0.26180

0.21095

0.17032

23

24

0.88719

0.78757

0.69954

0.62172

0.49193

0.39012

0.31007

0.24698

0.19715

0.15770

24

25

0.88277

0.77977

0.68921

0.60953

0.47761

0.37512

0.29530

0.23300

0.18425

0.14602

25

Periods

9%

10%

11%

12%

13%

14%

15%

16%

17%

18%

Periods

1

0.91743

0.90909

0.90090

0.89286

0.88496

0.87719

0.86957

0.86207

0.85470

0.84746

1

2

0.84168

0.82645

0.81162

0.79719

0.78315

0.76947

0.75614

0.74316

0.73051

0.71818

3

0.77218

0.75131

0.73119

0.71178

0.69305

0.67497

0.65752

0.64066

0.62437

0.60863

3

4

0.70843

0.68301

0.65873

0.63552

0.61332

0.59208

0.57175

0.55229

0.53365

0.51579

4

0.64993

0.62092

0.59345

0.56743

0.54276

0.51937

0.49718

0.47611

0.45611

0.43711

6.

0.59627

0.56447

0.53464

0.50663

0.48032

0.45559

0.43233

0.41044

0.38984

0.37043

6.

7

0.54703

0.51316

0.48166

0.45235

0.42506

0.39964

0.37594

0.35383

0.33320

0.31393

7

0.50187

0.46651

0.43393

0.40388

0.37616

0.35056

0.32690

0.30503

0.28478

0.26604

8

9

0.46043

0.42410

0.39092

0.36061

0.33288

0.30751

0.28426

0.26295

0.24340

0.22546

9

10

0.42241

0.38554

0.35218

0.32197

0.29459

0.26974

0.24718

0.22668

0.20804

0.19106

10

11

0.38753

0.35049

0.31728

0.28748

0.26070

0.23662

0.21494

0.19542

0.17781

0.16192

11

12

0.35553

0.31863

0.28584

0.25668

0.23071

0.20756

0.18691

0.16846

0.15197

0.13722

12

13

0.32618

0.28966

0.25751

0.22917

0.20416

0.18207

0.16253

0.14523

0.12989

0.11629

13

14

0.29925

0.26333

0.23199

0.20462

0.18068

0.15971

0.14133

0.12520

0.11102

0.09855

14

15

0.27454

0.23939

0.20900

0.18270

0.15989

0.14010

0.12289

0.10793

0.09489

0.08352

15

16

0.25187

0.21763

0.18829

0.16312

0.14150

0.12289

0.10686

0.09304

0.08110

0.07078

16

17

0.23107

0.19784

0.16963

0.14564

0.12522

0.10780

0.09293

0.08021

0.06932

0.05998

17

18

0.21199

0.17986

0.15282

0.13004

0.11081

0.09456

0.08081

0.06914

0.05925

0.05083

18

19

0.19449

0.16351

0.13768

0.11611

0.09806

0.08295

0.07027

0.05961

0.05064

0.04308

19

20

0.17843

0.14864

0.12403

0.10367

0.08678

0.07276

0.06110

0.05139

0.04328

0.03651

20

21

0.16370

0.13513

0.11174

0.09256

0.07680

0.06383

0.05313

0.04430

0.03699

0.03094

21

22

0.15018

0.12285

0.10067

0.08264

0.06796

0.05599

0.04620

0.03819

0.03162

0.02622

22

23

0.13778

0.11168

0.09069

0.07379

0.06014

0.04911

0.04017

0.03292

0.02702

0.02222

23

24

0.12640

0.10153

0.08170

0.06588

0.05323

0.04308

0.03493

0.02838

0.02310

0.01883

24

25

0.11597

0.09230

0.07361

0.05882

0.04710

0.03779

0.03038

0.02447

0.01974

0.01596

25

1

rounded to five decimal places, where i is the interest rate per period and

The values in Table 11-2 were generated by the formula PV =

n is the total number of periods.

(1 + i)"

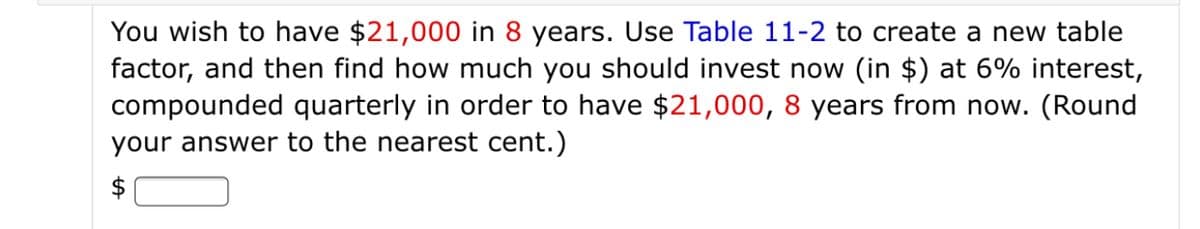

Transcribed Image Text:You wish to have $21,000 in 8 years. Use Table 11-2 to create a new table

factor, and then find how much you should invest now (in $) at 6% interest,

compounded quarterly in order to have $21,000, 8 years from now. (Round

your answer to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College