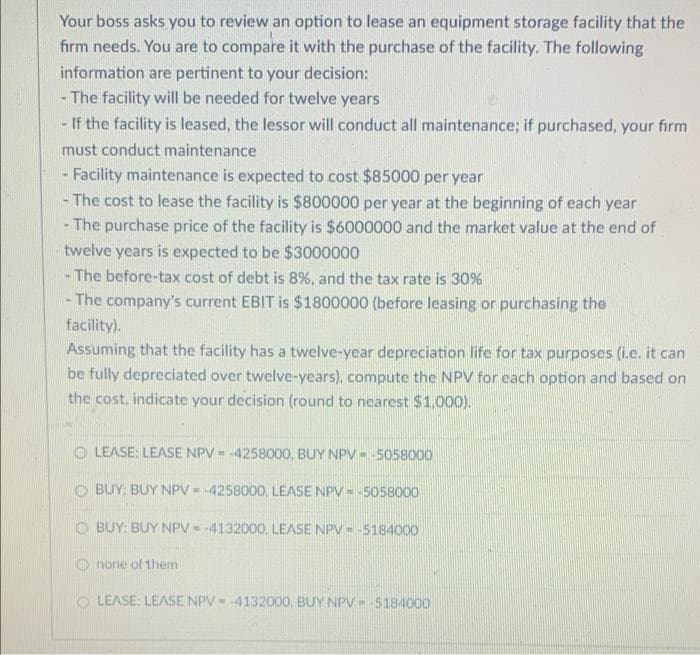

Your boss asks you to review an option to lease an equipment storage facility that the firm needs. You are to compare it with the purchase of the facility. The following information are pertinent to your decision: - The facility will be needed for twelve years If the facility is leased, the lessor will conduct all maintenance; if purchased, your firm must conduct maintenance Facility maintenance is expected to cost $85000 per year - The cost to lease the facility is $800000 per year at the beginning of each year - The purchase price of the facility is $6000000 and the market value at the end of twelve years is expected to be $3000000 - The before-tax cost of debt is 8%, and the tax rate is 30% - The company's current EBIT is $1800000 (before leasing or purchasing the facility). Assuming that the facility has a twelve-year depreciation life for tax purposes (i.e. it can be fully depreciated over twelve-years), compute the NPV for each option and based on the cost, indicate your decision (round to nearest $1,000). O LEASE: LEASE NPV - -4258000, BUY NPV- -5058000 BUY: BUY NPV--4258000, LEASE NPV - -5058000 O BUY: BUY NPV4132000, LEASE NPV- -518400O O norie of them

Your boss asks you to review an option to lease an equipment storage facility that the firm needs. You are to compare it with the purchase of the facility. The following information are pertinent to your decision: - The facility will be needed for twelve years If the facility is leased, the lessor will conduct all maintenance; if purchased, your firm must conduct maintenance Facility maintenance is expected to cost $85000 per year - The cost to lease the facility is $800000 per year at the beginning of each year - The purchase price of the facility is $6000000 and the market value at the end of twelve years is expected to be $3000000 - The before-tax cost of debt is 8%, and the tax rate is 30% - The company's current EBIT is $1800000 (before leasing or purchasing the facility). Assuming that the facility has a twelve-year depreciation life for tax purposes (i.e. it can be fully depreciated over twelve-years), compute the NPV for each option and based on the cost, indicate your decision (round to nearest $1,000). O LEASE: LEASE NPV - -4258000, BUY NPV- -5058000 BUY: BUY NPV--4258000, LEASE NPV - -5058000 O BUY: BUY NPV4132000, LEASE NPV- -518400O O norie of them

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:Your boss asks you to review an option to lease an equipment storage facility that the

firm needs. You are to compare it with the purchase of the facility. The following

information are pertinent to your decision:

- The facility will be needed for twelve years

-If the facility is leased, the lessor will conduct all maintenance; if purchased, your firm

must conduct maintenance

- Facility maintenance is expected to cost $85000 per year

- The cost to lease the facility is $800000 per year at the beginning of each year

- The purchase price of the facility is $6000000 and the market value at the end of

twelve years is expected to be $3000000

The before-tax cost of debt is 8%, and the tax rate is 30%

- The company's current EBIT is $1800000 (before leasing or purchasing the

facility).

Assuming that the facility has a twelve-year depreciation life for tax purposes (i.e. it can

be fully depreciated over twelve-years), compute the NPV for cach option and based on

the cost, indicate your decision (round to nearest $1.000).

O LEASE: LEASE NPV - -4258000, BUY NPV =-5058000

O BUY: BUY NPV - -4258000, LEASE NPV = -5058000

O BUY: BUY NPV = -4132000, LEASE NPV- -5184000

O norie of them

O LEASE: LEASE NPV-4132000, BUY NPV- 5184000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College