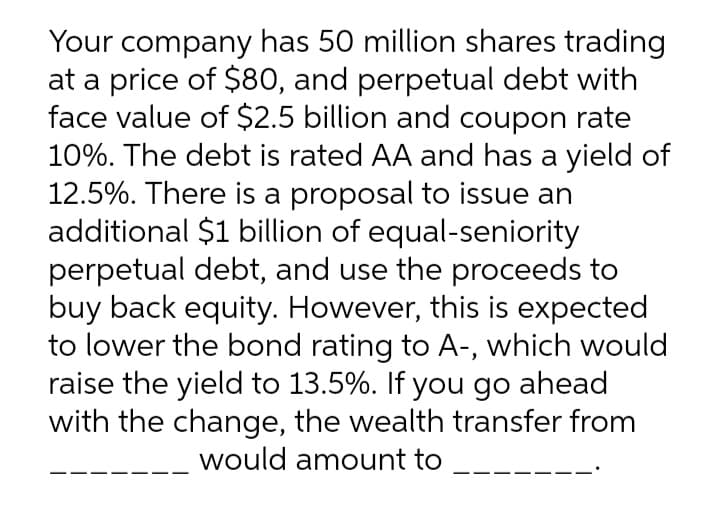

Your company has 50 million shares trading at a price of $80, and perpetual debt with face value of $2.5 billion and coupon rate 10%. The debt is rated AA and has a yield of 12.5%. There is a proposal to issue an additional $1 billion of equal-seniority perpetual debt, and use the proceeds to buy back equity. However, this is expected to lower the bond rating to A-, which would raise the yield to 13.5%. If you go ahead with the change, the wealth transfer from would amount to

Q: Q10 Two major investment projects have the same initial outlay of €1,000 milion. The expected net…

A: Given: Project A Project B Year Particulars Cash flows Cash flows 0 Initial investment -€…

Q: small business that produces two types of ready-to-use multigrain flours using organic products such…

A: From the given data: Let the decision variables be as shown below (all in lbs): Wheat…

Q: xplain the calculation to find value of the bonds

A: The value of bond is the present value of coupon payment and present value of par value of bond…

Q: Which of the following terms describes how the value of real estate is influenced by the addition of…

A: There are 4 major factors that affect the value of real estate. They are1. Economic conditions2.…

Q: What is the break-even quantity for the new credit policy? (Do not round intermediate calculations…

A: Credit Cost = Price per unit as per new policy x Required Return In the given case, the break even…

Q: A down town bank is advertising that if you deposit $1,000 with them, and leave it there for 65…

A: In the given question we requires to calculate the monthly interest rate paid by the bank. Details…

Q: Assume that the capital requirement of "Purchase new equipment" in Year 3 is 3000. Suppose that if…

A: Choosing investments: The availability of capital is one of the significant factors determining the…

Q: A loan is repaid by making payments of $2000 at the end of every six months for 12 years. If…

A: Semiannual payment (c) = $2000 Semiannual period (n) = 24 (i.e. 12 years * 2) Nominal interest rate…

Q: hat is the current market view on AUD/USD? (Will it appreciate and which depreciate? and why

A: The exchange rate depends on the interest rate in the market and inflation in the market and goes up…

Q: Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,100 cases of Oktoberfest-style…

A: Answer journal entries to account for this import purchase.

Q: Suppose an investor, Erik, is offered the investment opportunities described in the table below.…

A:

Q: Sue has contributed $2,843.00 every three months for the last 11 years into an RRSP fund. The…

A: Future value of the money include the amount being deposited and amount of compounding interest…

Q: The Barnsdale Corporation has the following ratios: A0*/S0 = 1.6; L0*/S0 = 0.4; profit margin =…

A: Additional Funds needed (AFN): A company may need to raise funds needed for expansion when its…

Q: A bank charges 11% discount on short term loan& Find the sum received by the borrower who requests…

A:

Q: As a medical administrator at the local hospital, you made a total purchase of $4447.85. Currently,…

A: Given: Total purchases = $4447.85 Saline solutions =40 Catheters = 25 Syringe = 150 Cost per saline…

Q: what are the advantages and drawbacks for digital Technology: How It Could Transform the…

A: Digital technology is referred as an usage of an advanced communication as well as information…

Q: It is 25 July 2022; you observe two treasury bills Price 99.7985 25 March 2023 98.3855 Maturity 25…

A:

Q: Consider a two-period binomial tree model with u = 1.1 and d = 0.90. Suppose the current price of…

A: The binomial option pricing is used to find the value of the options that have multiple values over…

Q: Mr. Abdullah is planning to invest $ 100,000 and looking for a good investment opportunity. that…

A: An individual faces several investment options. We need to advise the best investment option backed…

Q: Sunburn Sunscreen has a zero coupon bond issue outstanding with a face value of $25,000 that matures…

A: Given: Particulars Sunburn Thermalwear Current stock price $27,200 $34,400 Standard deviation…

Q: What amount of money (in Php) invested today at 11.97% interest can provide the following…

A: Please note the last payment of 55,060 will be made into perpetuity. Now let us break this question…

Q: monthly. After this period, the accumulated money was left in the account for anothe same interest…

A: The future value of the amount includes the amount being accumulated over the period and amount of…

Q: What is the capital cost allowance in the first year

A: The project will require $286,600 for the purchase of the new machine. There will be $11,000 in…

Q: Discuss your objectives as a Price Taker in the dealing session. Where applicable, describe…

A: Price taker is referred as an individual or the corporation, which used to accept the prevailed…

Q: Sales Less Cost of goods sold Gross profit Less Operating expenses Operating income Less Interest…

A: Financial Statements: Financial statements are the reports that shoes the financial performance of a…

Q: Eva opened a savings account with an initial deposit of $897. They then deposit $897 into that…

A: We need to use future value of annuity formula to calculate saving balance after 8 years. B(t)…

Q: Suppose you have decided to put $500 at the beginning of every month in a savings account that…

A: Monthly deposit (m) = $500 Monthly interest rate (r) = 0.00416666666666667 (i.e. 0.05 / 12) Number…

Q: Which investment project(s) should the business undertake assuming each project is: (a) divisible…

A: Capital rationing is a situation where a company cannot invest in all profitable projects, even…

Q: At the end of 2021, the price per share of CAA PLC was 140 pence with a book value per share of 60…

A: Hi, since you have posted a question with multiple subparts we will answer the first three as per…

Q: I can't see the answers to questions there block off

A: Rate caps :3/2/6 means 3% on first adjustment 2% on each subsequent adjustment 6% life time cap

Q: nformation: Revenues = Estimated at $1,000,000 for the upcoming year and anticipated to grow by 5%…

A: Lease is a contract in which lessee gets right to use a fixed asset of lessor over the contract…

Q: Financial Corporation wants to acquire Great Western Inc. Financial has estimated the enterprise…

A: Data given: Estimated enterprise value = $104 million Market value of long- term debt = $15 million…

Q: Explain the meaning and composition of the "return" of a financial investment

A: Financial Investment Funds invested for the purpose of earning returns over a specified period of…

Q: Richmond Corporation was founded 20 years ago by its president, Daniel Richmond. The company…

A: Net cash flows refer to the profit or loss after payment of all debts over a period. When incomes…

Q: Tarell purchased a car for $54,700; he paid 5% of the cost as a down pay the balance amount at 3.4%…

A: Loans are paid by the equal monthly installments and these carry the payment for principal amount…

Q: You are evaluating a project. The cash flow of this project is as follows: Year Cash…

A: Net Present Value or NPV : It is the sum of the present values of all future cash inflows less…

Q: Find the values for the following: An initial $500 compoundedmonthlyfor 1 year at 6 percent. An…

A: Solution: An amount invested earns interest over it. So, we have, FV = PV (1+i)t where, FV = Future…

Q: If the beta of Asset A is 2.2, the risk free rate is 2.5%, and the expected return on Asset A is 8%,…

A: Expected return on market refers to the money that is invested for expecting to make an investment…

Q: government-funded wind-based electric power generation company in the southern part of the country…

A: B/C is the ratio of present value of benefits to the present value of cost taken on cost of capital…

Q: One year ago, Richard purchased 90 shares of common stock for $15 per share. During the year, he…

A: The stock return is the measure of the performance of a stock. It shows a stock's profit or loss…

Q: Micheal Co is a software development company that headquarters in Toronto and covers Canada, the…

A: Cost of equity = Risk free rate + Beta of stock*(Market return - Risk free rate) = 4% +…

Q: Use the formulas you learned about in the previous stage of the problem to answer the following…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Montclair Manufacturing is considering leasing some equipment. The annual lease payment would be…

A: Given: Particulars Amount Interest rate 7% Tax rate 25% Years (NPER) 9 Annual lease…

Q: Over the last five years, you have earned the following returns on the NZX Year Return (ending in…

A: Note: The question mentions over the last 5 years. However, the data is for last 9 years. Hence, 9…

Q: Please solve complete in one hour

A: Answer (a) The Balanced Scorecard approach considers non-financial performance as well as financial…

Q: any four ways that render a contract voidable

A: These factors sometimes replicate that:There has been miscommunication round the agreement by either…

Q: Thoroughly describe the concept of hedging, focusing on the FX markets. In addition to the economic…

A: Foreign exchange market is defined as the globally decentralized or an over the counter market…

Q: Neil Corporation has three projects under consideration. The cash flows for each project are shown…

A: The Payback period is one of the techniques of capital budgeting that ignores the concept of the…

Q: You have learnt three approaches that can be used in determining the discount rate in equity…

A: Capital asset pricing model (CAPM) It describes the relation between the systematic risk and the…

Q: Consider a European call option for a non-dividend paying stock currently priced at S(0) with strike…

A: ANSWER; 1

Step by step

Solved in 7 steps

- Your company has 50 million shares trading at a price of $80, and perpetual debt with face value of $2.5 billion and coupon rate 10%. The debt is rated AA and has a yield of 12.5%. There is a proposal to issue an additional $1 billion of equal-seniority perpetual debt, and use the proceeds to buy back equity. However, this is expected to lower the bond rating to A-, which would raise the yield to 13.5%. If you go ahead with the change, the wealth transfer from _______ would amount to _______.The total book value of WTC's equity is $13 million, and book value per share is $20. The stock has a market-to-book ratio of 1.5, and the cost of equity is 9%. The firms bonds have a face value of $9 million and sell at a price of 110% of face value. The yield to maturity on the bonds is 7% andthe firm's tax rate is 21%. What is the company's WACC? (Don't round intermediate calculations, enter final answers as a percent rounded to 2 decimal places.)he total book value of WTC’s equity is $7 million, and book value per share is $14. The stock has a market-to-book ratio of 1.5, and the cost of equity is 12%. The firm’s bonds have a face value of $4 million and sell at a price of 110% of face value. The yield to maturity on the bonds is 9%, and the firm’s tax rate is 21%. What is the company’s WACC? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) WACC= ______%

- TT Industries is trading for $20 per share and has 25 million shares outstanding. TT Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten-year maturity and a yield to maturity of 8%. Which of the following best describes TT's debt using a put option? A) Short $200 million in risk-free debt and Long a put option on the firm's assets with a $200 strike price B) Long $200 million in risk-free debt and Short a put option on the firm's assets with a $700 strike price C) Long $200 million in risk-free debt and Short a put option on the firm's assets with a $200 strike price D) Short $200 million in risk-free debt and Long a put option on the firm's assets with a $700 strike priceIRIS Corp. has determined its optimal capital structure as follows. Debt: The firm can sell a 10-year, $1,000 par value, 7 percent bond for $950. A flotation cost of 3percent of the par value would be required in addition to the discount of $50. Preferred Stock: The firm has determined it can issue preferred stock at $45 per share par value. The stock will pay an $6.5 annual dividend. The cost of issuing and selling the stock is $2.5 per share. Common Stock: The firm's common stock is currently selling for $25 per share. The dividend expected to be paid at the end of the coming year is $3.75. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $1.45. It is expected that to sell, a new common stock issue must be underpriced at $2 per share and the firm must pay $0.75 per share in flotation costs. Additionally, the firm's marginal tax rate is 20 percent. Calculate the firm's weighted average cost of capital assuming the…MV Pfd Corporation has debt with a coupon rate of 5% and a yield to maturity of 7%, a cost of equity of 15% and a cost of preferred stock of 10%. Its debt has a market value of $130 million and a book value of $150 million. The common equity has a book value of $80 million and the preferred stock has a book value of $60 million. The preferred stock is currently trading at a 25% premium over its book value per share, while the common stock trades at $20 per share, with 8 million shares outstanding. The tax rate is 30%. What is this firm’s value of preferred stock, P(for use in the weights)? A. $150 million B. $75 million C. $80 million D. $160 million E. $180 million F. $130 million G. $15 million H. $60 million I. $140 million

- IRIS Corp. has determined its optimal capital structure as follows: (ATTACHED) Debt: The firm can sell a 10-year, $1,000 par value, 7 percent bond for $950. A flotation cost of 3percent of the par value would be required in addition to the discount of $50. Preferred Stock: The firm has determined it can issue preferred stock at $45 per share par value. The stock will pay an $6.5 annual dividend. The cost of issuing and selling the stock is $2.5 per share. Common Stock: The firm's common stock is currently selling for $25 per share. The dividend expected to be paid at the end of the coming year is $3.75. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $1.45. It is expected that to sell, a new common stock issue must be underpriced at $2 per share and the firm must pay $0.75 per share in flotation costs. Additionally, the firm's marginal tax rate is 20 percent. Calculate the firm's weighted average cost of capital…DMC currently has 100,000 shares of common stock outstanding with a market price of $50 per share. It also has $2 million in 7% bonds currently selling at par. The company is considering a $4 million expansion program that it can finance either (I) all common stock at $50 per share, or (II) all bonds at 9%. The company estimates that if the expansion is undertaken, it can attain, in the near future, $1 million EBIT. Which plan is riskier, I or II? Why?Becker industries is considering an all equity capital structure against one with both debt and equity. The all equity capital structure would consist of 42,000 shares of stock. The debt and equity option wuld consist of 21,000 shares of stock plus $285000 of debt with an interest rate of 8 percent. What is the break-even level of earnings before interest and taxes between these two options? Ignore taxes

- ABC Corp has 20,000 shares of bonds outstanding with a coupon rate of 6%, face value of $1,000, and 30 years to maturity. The bonds are selling for 110 percent of par and make semiannual payments. The company also has 600,000 shares outstanding of common stock selling for $67 per share. The beta of the stock is 1.29 and the tax rate is 21%. a. If the Treasury bill rate is 3% and the market risk premium is estimated at 7%., what is ABC’s cost of equity capital? b. What is the WACC? c. ABC Corp plans to expand the current operations. If the project will pay a cash flow of 10,000 next year and then cash flows growing at a rate of 4% over the next 3 years (for a total of 4 of cash flows), what is the most ABC is willing to spend on the initial investment for this project? Please show exceln formulasHema Corp. is an all-equity firm with a current market value of $1,230 million (i.e., $1.23 billion), and will be worth $1,107 million or $1,722 million in one year. The risk-free interest rate is 5%. Suppose Hema Corp. issues zero-coupon, one-year debt with a face value of $1,292 million, and uses the proceeds to pay a special dividend to shareholders. Suppose that in the event Hema Corp. defaults, $90 million of its value will be lost to bankruptcy costs. Assume there are no other market imperfections. a. What is the present value of these bankruptcy costs, and what is their delta with respect to the firm's assets? b. In this case, what is the value and yield of Hema's debt? c. In this case, what is the value of Hema's equity before the dividend is paid? What is the value of equity just after the dividend is paid?Foust has 25-year non-callable bonds outstanding with a face value of $1,000, an 12% annual coupon, and a market price of $1,320. Foust can issue perpetual preferred stock at a price of $47.50 a share. The stock would pay a constant annual dividend of $3.80 a share. Its capital structure, considered to be optimal, is as follows: Debt $111,000,000 Preferred Stock $4,000,000 Common equity $155,000,000 Total liabilities and equity $270,000,000 If the firm’s bonds earn a return calculated in part (i), based on the bond-yield-plus-risk-premium approach, what will be cost of common equity?