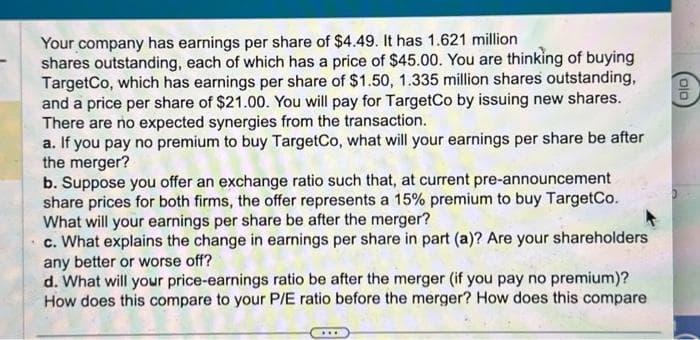

Your company has earnings per share of $4.49. It has 1.621 million shares outstanding, each of which has a price of $45.00. You are thinking of buying TargetCo, which has earnings per share of $1.50, 1.335 million shares outstanding, and a price per share of $21.00. You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. a. If you pay no premium to buy TargetCo, what will your earnings per share be after the merger? b. Suppose you offer an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 15% premium to buy TargetCo. What will your earnings per share be after the merger? c. What explains the change in earnings per share in part (a)? Are your shareholders any better or worse off? d. What will your price-earnings ratio be after the merger (if you pay no premium)? How does this compare to your P/E ratio before the merger? How does this compare

Your company has earnings per share of $4.49. It has 1.621 million shares outstanding, each of which has a price of $45.00. You are thinking of buying TargetCo, which has earnings per share of $1.50, 1.335 million shares outstanding, and a price per share of $21.00. You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. a. If you pay no premium to buy TargetCo, what will your earnings per share be after the merger? b. Suppose you offer an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 15% premium to buy TargetCo. What will your earnings per share be after the merger? c. What explains the change in earnings per share in part (a)? Are your shareholders any better or worse off? d. What will your price-earnings ratio be after the merger (if you pay no premium)? How does this compare to your P/E ratio before the merger? How does this compare

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:Your company has earnings per share of $4.49. It has 1.621 million

shares outstanding, each of which has a price of $45.00. You are thinking of buying

TargetCo, which has earnings per share of $1.50, 1.335 million shares outstanding,

and a price per share of $21.00. You will pay for TargetCo by issuing new shares.

There are no expected synergies from the transaction.

a. If you pay no premium to buy TargetCo, what will your earnings per share be after

the merger?

b. Suppose you offer an exchange ratio such that, at current pre-announcement

share prices for both firms, the offer represents a 15% premium to buy TargetCo.

What will your earnings per share be after the merger?

c. What explains the change in earnings per share in part (a)? Are your shareholders

any better or worse off?

d. What will your price-earnings ratio be after the merger (if you pay no premium)?

How does this compare to your P/E ratio before the merger? How does this compare

010

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning