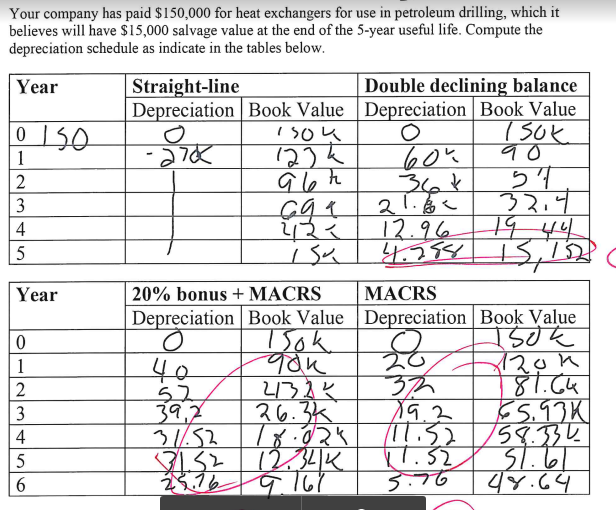

Your company has paid $150,000 for heat exchangers for use in petroleum drilling, which it believes will have $15,000 salvage value at the end of the 5-year useful life. Compute the depreciation schedule as indicate in the tables below. Straight-line Depreciation | Book Value | Depreciation | Book Value Year Double declining balance 0150 60% 36¢ 1 12)k 32.4 1944 12く 12.96 4.2584 4 Year 20% bonus + MACRS МАCRS Depreciation | Book Value | Depreciation Book Value Tsok 20 40 52 39,2 31/.52 1 ג כב 36.3k 2 3 E5.93K T8.024 ll.32 /58.334 11.52 3.76 711.52 4 5 12.34K 23.16 23

Your company has paid $150,000 for heat exchangers for use in petroleum drilling, which it believes will have $15,000 salvage value at the end of the 5-year useful life. Compute the depreciation schedule as indicate in the tables below. Straight-line Depreciation | Book Value | Depreciation | Book Value Year Double declining balance 0150 60% 36¢ 1 12)k 32.4 1944 12く 12.96 4.2584 4 Year 20% bonus + MACRS МАCRS Depreciation | Book Value | Depreciation Book Value Tsok 20 40 52 39,2 31/.52 1 ג כב 36.3k 2 3 E5.93K T8.024 ll.32 /58.334 11.52 3.76 711.52 4 5 12.34K 23.16 23

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 3EB: Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is...

Related questions

Question

Transcribed Image Text:Your company has paid $150,000 for heat exchangers for use in petroleum drilling, which it

believes will have $15,000 salvage value at the end of the 5-year useful life. Compute the

depreciation schedule as indicate in the tables below.

Straight-line

Depreciation | Book Value Depreciation Book Value

Year

Double declining balance

0150

60%

36¢

21.6く

12.96

1

12)k

2

32,4

19,44

3

4

5

Year

20% bonus + MACRS

МАCRS

Depreciation Book Value |Depreciation | Book Value

Tsok

120k

40

52

39,2

31.52

1

2132K

36.3k

11.52

11.52

3.76

158.334

51.6.

44.64

4

12.34K

9.167

5

23.76

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning