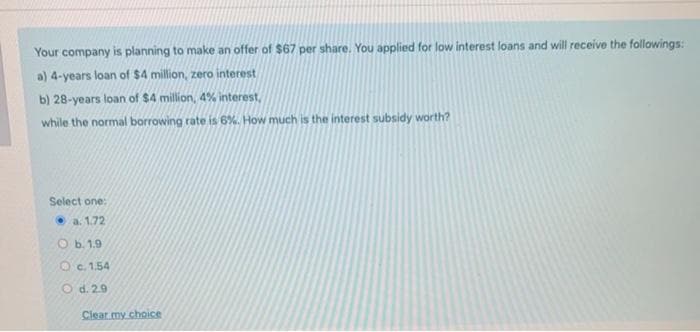

Your company is planning a) 4-years loan of $4 million, zero interest b) 28-years loan of $4 million, 4% interest, while the normal borrowing rate is 6%. How much is the interest subsidy worth? Select one: • a. 1.72 O b. 1.9 O c. 1.54 O d. 2.9

Q: 2. Two alternatives for a carwash business include a fully automatic systems at an initial cost of…

A:

Q: Auto Industrial Corporation issues zero coupon bonds at a price of $378 per bond and the face value…

A: FORMULA YTC = (CP/PP)1/T-1 Where YTC - Yield to call CP - Call price i.e. $1050 PP - Purchase price…

Q: 1involveo ptenning, organizing, directing, and controlingthe financial activities such of the…

A: The difference between a company's current assets and working capital, also known as net working…

Q: Compute the interest of the following: 2. P25,000 at 6% simple interest for 1 year.

A: Compounding: A compounding is the interest charged on interest. When any investment is made for…

Q: Mike joins a savings program where he deposits $1000 at the beginning of he will earn a perpetuity…

A: Amount deposited begining of the year is $1000 Perpetuity amount is $63000 Time period of deposit is…

Q: the main role of liquidity ratio for pepsi CO.?

A: Ratio is a tool which is used to measure the performance of the company by establishing the relation…

Q: Which of the following is/are TRUE? I. A stock with a beta of zero would be expected to have a rate…

A: Stock is referred as the security, which used to represent an ownership share in the firm. At the…

Q: Ataxia Fitness Center is considering an investment in some additional weight training equipment. The…

A: Payback period refers to the length of time or amount of time that it takes for recovering the cost…

Q: 6. Celeste Company provided the following transactions, among others, for the current year. Sold…

A: Factoring can be defined as the financial service offered by a factoring company which tends to…

Q: A company is going to change all light bulbs of its buliding. The initial cost is 57000 . all bulbs…

A: Given, Details about a light bulb company.

Q: Quad Enterprises is considering a new three-year expansion project that requires an initial fixed…

A: NPV refers to the Net value added by a decision. This is computed as the present value of cash…

Q: Investors can use certain metrics to assess a stock or stock portfolio's risk. One of them is the…

A: Sortino ratio is a measure of return of an investment that is adjusted for risk. It can be…

Q: Conside thể following ate of Labanos Company: Year Investment Cash Inflow 1 4,000 1,000 2 3 2,000 4…

A: Given: Year Investment Cash inflows 1 -$4,000 $1,000 2 $0 3 $2,000 4 -$2,000 $1,000…

Q: When valuing private companies, we use public companies as comparables to gain insights into how the…

A: Valuation of private companies is not easy simply because of the fact that limited information are…

Q: 2. You have been approved for a $72,000 4-year loan earning 10.8% compounded monthly. (a) What are…

A: pv Loan amount $ 72000 nper Period of loan 4 years 48 months Interest rate yearly…

Q: 18. The average monthly budget for Camille and Zohan is shown. Camille Zohan INCOME (S) 4100 3900…

A: Solution:- Variable expenses are the expenses which vary according to the use, while fixed expenses…

Q: You deposited P1,000 in a savings account that pays 8 percent interest, compounded quarterly,…

A: The future value is the amount that will be received at the end of a certain period. In simple…

Q: An annuity with a cash value of $12,000 pays $2,050 at the beginning of every six months. The…

A: Annuity: An annuity is the series of payments which is received or paid for a certain period of…

Q: If you borrowed S 15,000 to be repaid in 20 equal quarterly payments and after your 10th payment you…

A: Loan Amount = $15,000 Number of payments = 20 quarterly payments Interest rate = 12% (compounded…

Q: Kinston Industries just announced that it will cut its dividend from $3.00 to $2.00 and use the…

A: Answer - Step 1 - Calculation of Cost of Equity - Stock Price = Dividend / (Cost of Equity -…

Q: Jeffery Johnson is saving $1,450,000 per year in a savings account that is paying annual compound…

A: The value of equal payments or a single payment at any specific date which falls in future is called…

Q: Nivea Company is planning to introduce a new product. Market research information suggests that the…

A: New product should sell 1000 units at OMR 225 per unit Hence total revenue will be =1000*OMR…

Q: A debt of $1908 with interest at 6.3% compounded annually is to be repaid by equal payments at the…

A: Solution:- When a loan is taken, it is to be repaid in lump sum or in installments. If it is paid in…

Q: Obtain information on the following two funds: Colonial First State Developing Companies Fund…

A: An investor is someone who invests money in the hope of making a profit or gaining an advantage in…

Q: A stock has had returns of 11 percent, -8 percent, 6 percent, 21 percent, 24 percent, and 16 percent…

A: The geometric return is calculated as compounded annualized return

Q: ulate the present value of each cashflow using a discount rate of 7%. Which do you prefer me w and…

A: Present value is value of money today considering the interest and period of time that is to be…

Q: Water damage from a major flood in a Midwestern city resulted in damages estimated at $108 million.…

A: Insurance companies can be important for financial system stability because they are large investors…

Q: Question 31: An analyst has assembled the following information regarding Net-Zone Incorporated and…

A: Net Zone Dividend paid Yeasterday is $2.15 Dividend growth rate is 3% Expected return on S&P 500…

Q: a) What is the residual value of the car at the end of the lease? Mode N = PV = FV = b) How much…

A: Lease refers to a contract between two parties under which one party who is the real owner of an…

Q: s the discounted value of payments of $120.00 made at the end of each month for 7.5 years if…

A: Discounted value of money is the present value of monthly payment that is equivalent to money today…

Q: 10. Assume a preferred stock has a dividend of 1.8$/year. The required rate of return on similar…

A: The intrinsic value of preferred stock is calculated as preferred dividend divided by the required…

Q: Having finally entered the working world, Troy took out an $863,000 loan at 3.60% interest…

A: Solution:- When a loan is taken, it is repaid with interest. The original amount of loan is called…

Q: Find the present value of the following perpetuity. Perpetuity Payment Made Payment Period Interest…

A: Perpetuity is the stream of cash flows or payments that are made at equal intervals that do not have…

Q: Mr. Harrington had a new heating system installed in his office. The balance owing to the heating…

A: Here,

Q: Mid-State BankCorp recently declared a 7-for-2 stock split. Prior to the split, the stock sold for…

A: Here, Price per share sold is $100 Stock Split is 7 for 2 that means 7 shares were issued for every…

Q: What is the premium or discount and the purchase price of the bonds to yield 9% compounded

A: Bond valuation refers to a method which is used to compute the current value or present value (PV)…

Q: A $96,000 mortgage is to be amortized by making monthly payments for 20 years. Interest is 7.1%…

A: Mortgage means amount which is borrowed by external sources to meet financial obligation or purchase…

Q: The Closing the Gaps initiative by the Texas Higher Education Coordinating Board established the…

A: The yearly rate of increases can be computed as the compounded annual growth rate (CAGR).

Q: Nick’s Novelties, Incorporated, is considering the purchase of new electronic games to place in its…

A: Answer - Part 1 - The simple rate of return would be: Simple rate of return = Annual incremental…

Q: ent power failure of Ceramics Plant, a disbursement a day would be $3,500. To avoid future power…

A: NPV= Present value of cash inflows - Present value of cashoutflows, if results are positive then it…

Q: 7. Von Bora Corporation is expected to pay a dividend of $1.40 per share at the end of this year and…

A: Here, Dividend in Year 1 is $1.40 Dividend in Year 2 is $1.50 Stock Price in Year 2 is $25 Cost of…

Q: olly purchased a car. She paid ₱150,000 as down payment and pays ₱5,500 at the end of each month…

A: A part of the cost of an asset paid at the time of purchase of an asset is known as a down payment.…

Q: 1a) Market participants, including financial institutions, fund managers and corporations, must…

A: Given, In this question, we have to give some examples on the economic indicators.

Q: Sun Instruments expects to issue new stock at $35 a share with estimated flotation costs of 9…

A: Cost of retained earnings = (Expected dividend/Current price) + Growth rate =[(2.5*1.08)/35]+0.08…

Q: The Bank of Jamaica offers to sell you a bond for $813.81. No payments will be made until the bond…

A: A bond is a debt instrument that is used by companies to raise capital. It can be actively traded on…

Q: From the interest statement of 18% per year, compounded monthly, determine the value for compounding…

A: Compounding period is referred as the period, which is the span of time that are between the…

Q: Given the following historical returns, what is the variance? Year Return 1 7 percent 3 percent 3.…

A: Return in year 1 (R1) = 7% R2 = 3% R3 = 19% R4 = -11% R5 = -1% Let R = Average return

Q: Direction: Read the statements carefully. Write TRUE if the statement is correct. Otherwise, write…

A: Because you have asked question with multiple parts (MULTI PART) , we will solve the first 3 parts…

Q: What would be r in this problem? A P100,000 loan is to be paid monthly for 2 years with an interest…

A: Effective Annual Rate: The effective annual rate of interest is the actual or the real rate of…

Q: An engineer in an industry has received a year- end bonus of $10,000 which will be invested…

A: FV = PV * (1 + r)n FV = Future value PV = present value = $10,000 r = rate of interest = 8% n =…

please help me to solve this problem

Step by step

Solved in 3 steps

- Del Hawley, owner of Hawleys Hardware, is negotiating with First City Bank for a 1-year loan of 50,000. First City has offered Hawley the alternatives listed here. Calculate the effective annual interest rate for each alternative. Which alternative has the lowest effective annual interest rate? a. A 12% annual rate on a simple interest loan, with no compensating balance required and interest due at the end of the year b. A 9% annual rate on a simple interest loan, with a 20% compensating balance required and interest due at the end of the year c. An 8.75% annual rate on a discounted loan, with a 15% compensating balance d. Interest figured as 8% of the 50,000 amount, payable at the end of the year, but with the loan amount repayable in monthly installments during the yearEffective Cost of Short-Term Credit Yonge Corporation must arrange financing for its working capital requirements for the coming year. Yonge can: (a) borrow from its bank on a simple interest basis (interest payable at the end of the loan) for 1 year at a 12% nominal rate; (b) borrow on a 3-month, but renewable on rate with 12 end-of-month payments; or (d) obtain the needed funds by no longer taking discounts and thus increasing its accounts payable. Yonge buys on terms of 1/15, net 60. What is the effective annual cost (not the nominal cost) of the least expensive type of credit, assuming 360 days per year?ABC Inc. asked your company for a 7-year loan of $50,000. The repayment of the loan will be as follows: ABC will pay $5,000 at the end of Year 1, $10,000 at the end of Year 2, and $15,000 at the end of Year 3, and fixed unspecified cash flow (assume X) at the end of each of the following years (Year 4 through Year 7). Assuming 8% as an appropriate rate of return on low risk but an illiquid 7-year loan. Find out the cash flow that this investment must provide at the end of each of the final 4 years (year 4 to year 7), that is, find out the X?

- ABC is inclined to take a bank loan that has a face amount of P5,000,000, a term of 6 months, interest of 10%, and required compensating balance of P700,000. Compute for the following: 1. How much is the simple effective annual interest of the loan? 2. Should ABC accept this loan if another loan has similar terms but has a simple effective cost of 11%?FINCORP has two debtors who each make a $10, 000 purchase. Debtor 1 pays their account in 10 days, while debtor 2 pays in 30 days. a) In simple terms, what nominal annual interest rate is debtor 2 incurring for the benefit of delaying payment? Note: base your answer on the following logic. If a borrower pays 3% for a 30-day loan, we could express the nominal annual rate as roughly 36.5% i.e 3% x 365/30 = 36.5% that payment is due within 30 days but debtors will receive a 5 percent discount if they pay within 14 days. I'm quite unsure if that 5% as it is a discount, is handy or the steps to calculate the nominal interest rateVisa Inc. asked your company for a 5-year loan of $50,000. The repayment of the loan will be as follows: Visa Inc. will pay $5,000 at the end of Year 1, $10,000 at the end of Year 2, and $15,000 at the end of Year 3, and fixed unspecified cash flow (assume X) at the end of each of the following years (Year 4 and Year 5). Assuming 8% as an appropriate rate of return on low risk but an illiquid 5-year loan. Find out the cash flow that this investment must provide at the end of each of the final 2 years (year 4 and year 5), that is, find out the X?

- Southwestern Bank offers to lend you $55,000 at a nominal rate of 6.40%, compounded monthly. The loan (principal plus interest) must be repaid at the end of the year. Woodburn Bank also offers to lend you the $55,000, but it will charge an annual rate of 7.2%, with no interest due until the end of the year. How much higher or lower is the effective annual rate charged by Woodburn versus the rate charged by Southwestern? Group of answer choices 0.67% 0.83% 0.75% 0.53% 0.61%A company can borrow $780000 for 5 years by issuing bonds, on which interest is paid monthly at = 8% and the principal is paid off using a sinking fund earning = 3%. The other option is to borrow $780000 from a bank and repay the loan over 5 years with equal monthly payments at = 11%. Which option will result in a smaller periodic cost for the company? Answer: Select One How much will you save each period with this option? Answer: $In a discount interest loan, you pay the interest payment up front. For example, if a 1-year loan is stated as $42,000 and the interest rate is 8.50%, the borrower “pays” 0.0850 × $42,000 = $3,570 immediately, thereby receiving net funds of $38,430 and repaying $42,000 in a year. a. What is the effective interest rate on this loan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. What is the effective annual rate on a 1-year loan with an interest rate quoted on a discount basis of 18.50%? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

- The Flatiron Group, a private equity firm headquartered in Boulder, Colorado, borrows £5,000,000 for one year at 7.375% interest (assume annual compounding). What is the dollar cost of this debt if the pound depreciates from $2.0625/£ to $1.9460/£ over the year? Please enter your answer as % -- e.g. if your answer is 2.34% type in 2.34.You purchased a 270-day $1,000,000 banker's acceptance (BA) six months ago at a discount rate of 6.75%. You sell it today, with 90 days remaining to maturity, at a discount rate of 5.95%. a) What is your rate of return? Use 360-day to annualize. b) What 90-day discount rate when selling the BA today will yield a rate of return of 10% instead of the one obtained in question (a)? c) Explain why a BA is conisdered an off-balance sheet item?Drake Corporation takes out a term loan payable in 12 year-end annual installments of P5,000 each. The interest rate is 14 percent. (a) What is the amount of the loan? (b) what is the loan balance at the end of year 2? CHOOSE THE LETTER OF ANSWERA. (a)P27,301.50 and (b) P26,080.63B. (a)P15,301.50 and (b) P26,080.63C. (a)P26,301.50 and (b) P26,080.63D. (a)P25,301.50 and (b) P26,080.63E. None of the above