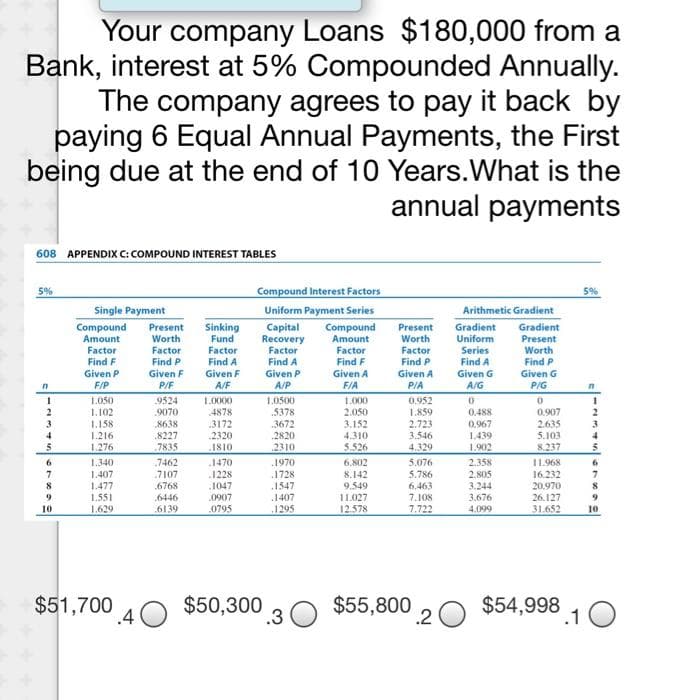

Your company Loans $180,000 from a Bank, interest at 5% Compounded Annually. The company agrees to pay it back by paying 6 Equal Annual Payments, the First being due at the end of 10 Years.What is the annual payments 608 APPENDIX C: COMPOUND INTEREST TABLES 5% Compound Interest Factors 5% Single Payment Compound Arithmetic Gradient Uniform Payment Series Present Sinking Fund Factor Find A Given F A/F Capital Recovery Factor Find A Compound Amount Factor Gradient Gradient Present Worth Find P Given G Present Amount Factor Find F Worth Worth Uniform Factor Find P Factor Series Find F Find P Find A Given P Given F Given P A/P Given A Given A Given G F/P P/F F/A P/A A/G P/G 1.050 1.102 1.158 9524 1.0000 1.0500 1.000 2.050 3.152 0.952 1.859 2.723 3.546 5378 4878 3172 2320 0,488 0.967 1.439 1.902 0.907 2.635 5.103 9070 8638 .8227 7835 3672 2820 2310 4. 1.216 1.276 4.310 1810 5.526 4.329 8.237 2.358 2.805 3.244 1.340 7462 5.076 5.786 .1470 .1970 6.802 11.968 6 1728 .1547 .1407 1295 7107 1228 1047 8.142 9.549 11.027 1.407 16.232 20.970 26.127 31.652 1.477 1.551 .6768 6.463 7.108 7.722 8 8 .6446 0907 3,676 10 1.629 6139 0795 12.578 4.099 10 $51,700 .4 $50,300 .3 $55,800 .20 $54,998 1 0

Your company Loans $180,000 from a Bank, interest at 5% Compounded Annually. The company agrees to pay it back by paying 6 Equal Annual Payments, the First being due at the end of 10 Years.What is the annual payments 608 APPENDIX C: COMPOUND INTEREST TABLES 5% Compound Interest Factors 5% Single Payment Compound Arithmetic Gradient Uniform Payment Series Present Sinking Fund Factor Find A Given F A/F Capital Recovery Factor Find A Compound Amount Factor Gradient Gradient Present Worth Find P Given G Present Amount Factor Find F Worth Worth Uniform Factor Find P Factor Series Find F Find P Find A Given P Given F Given P A/P Given A Given A Given G F/P P/F F/A P/A A/G P/G 1.050 1.102 1.158 9524 1.0000 1.0500 1.000 2.050 3.152 0.952 1.859 2.723 3.546 5378 4878 3172 2320 0,488 0.967 1.439 1.902 0.907 2.635 5.103 9070 8638 .8227 7835 3672 2820 2310 4. 1.216 1.276 4.310 1810 5.526 4.329 8.237 2.358 2.805 3.244 1.340 7462 5.076 5.786 .1470 .1970 6.802 11.968 6 1728 .1547 .1407 1295 7107 1228 1047 8.142 9.549 11.027 1.407 16.232 20.970 26.127 31.652 1.477 1.551 .6768 6.463 7.108 7.722 8 8 .6446 0907 3,676 10 1.629 6139 0795 12.578 4.099 10 $51,700 .4 $50,300 .3 $55,800 .20 $54,998 1 0

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 20P

Related questions

Concept explainers

Risk and return

Before understanding the concept of Risk and Return in Financial Management, understanding the two-concept Risk and return individually is necessary.

Capital Asset Pricing Model

Capital asset pricing model, also known as CAPM, shows the relationship between the expected return of the investment and the market at risk. This concept is basically used particularly in the case of stocks or shares. It is also used across finance for pricing assets that have higher risk identity and for evaluating the expected returns for the assets given the risk of those assets and also the cost of capital.

Question

Transcribed Image Text:Your company Loans $180,000 from a

Bank, interest at 5% Compounded Annually.

The company agrees to pay it back by

paying 6 Equal Annual Payments, the First

being due at the end of 10 Years.What is the

annual payments

608 APPENDIX C: COMPOUND INTEREST TABLES

5%

Compound Interest Factors

5%

Single Payment

Compound

Arithmetic Gradient

Uniform Payment Series

Present

Worth

Gradient

Present

Worth

Find P

Sinking

Fund

Capital

Recovery

Factor

Find A

Given P

Compound

Amount

Factor

Present

Gradient

Worth

Factor

Find P

Amount

Uniform

Factor

Factor

Series

Find A

Given G

Factor

Find F

Given P

F/P

Find P

Find A

Find F

Given F

P/F

Given A

Given F

A/F

Given A

Given G

A/P

F/A

P/A

A/G

P/G

9524

9070

8638

8227

.7835

0.952

1.859

2.723

3.546

4.329

1.050

1.0000

1.0500

1.000

1.102

1.158

5378

3672

2820

2310

2.050

3.152

4878

3172

2320

1810

0.488

0.967

0.907

3.

2.635

1.216

4.310

1.439

5.103

1.276

5.526

1.902

8.237

.7462

7107

1.340

.1470

1228

1970

1728

1547

2.358

2.805

3.244

3,676

6,802

5.076

11.968

6

8.142

9.549

11.027

12.578

5.786

6.463

7.108

1.407

16.232

20.970

26.127

31.652

8

1.477

6768

1047

8

1.551

1.629

6446

6139

0907

0795

9

.1407

10

.1295

7.722

4.099

10

$51,700

.4

$50,300

.3

$55,800

.2O $54,998

1 O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning