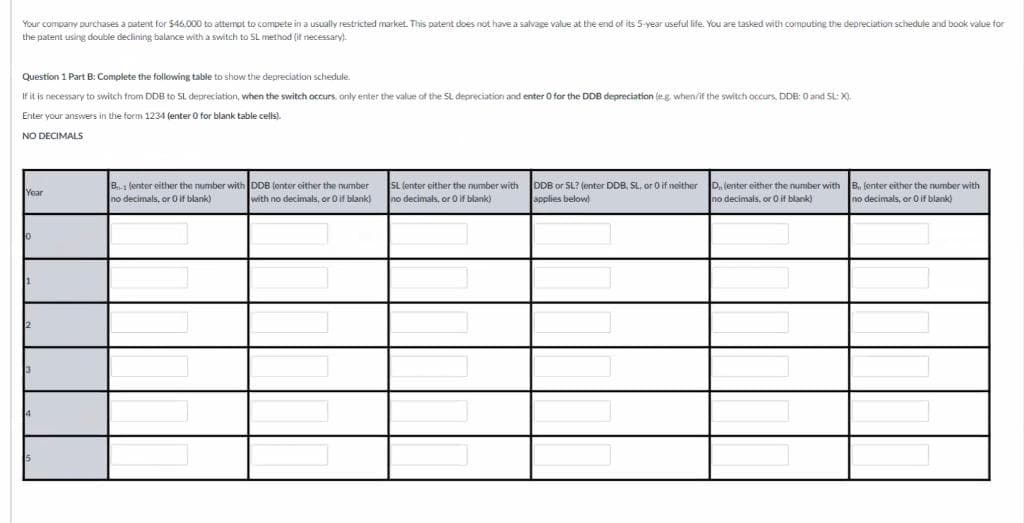

Your company purchases a patent for $46,000 to attempt to compete in a usually restricted market. This patent does not have a salvage value at the end of its 5-year useful life. You are tasked with computing the depreciation schedule and book value for the patent using double declining balance with a switch to SL method (if necessary). Question 1 Part B: Complete the following table to show the depreciation schedule. If it is necessary to switch from DDB to SL depreciation, when the switch occurs, only enter the value of the SL depreciation and enter 0 for the DDB depreciation (eg, when/if the switch occurs, DDB: 0 and SL: X). Enter your answers in the form 1234 (enter 0 for blank table cells). NO DECIMALS Year B. (enter either the number with DDB (enter either the number no decimals, or 0 if blank) with no decimals, or 0 if blank) SL (enter either the number with no decimals, or 0 if blank) DDB or SL? (enter DDB, SL, or 0 if neither applies below) D., (enter either the number with no decimals, or 0 if blank) B., (enter either the number with no decimals, or 0 if blank)

Your company purchases a patent for $46,000 to attempt to compete in a usually restricted market. This patent does not have a salvage value at the end of its 5-year useful life. You are tasked with computing the depreciation schedule and book value for the patent using double declining balance with a switch to SL method (if necessary). Question 1 Part B: Complete the following table to show the depreciation schedule. If it is necessary to switch from DDB to SL depreciation, when the switch occurs, only enter the value of the SL depreciation and enter 0 for the DDB depreciation (eg, when/if the switch occurs, DDB: 0 and SL: X). Enter your answers in the form 1234 (enter 0 for blank table cells). NO DECIMALS Year B. (enter either the number with DDB (enter either the number no decimals, or 0 if blank) with no decimals, or 0 if blank) SL (enter either the number with no decimals, or 0 if blank) DDB or SL? (enter DDB, SL, or 0 if neither applies below) D., (enter either the number with no decimals, or 0 if blank) B., (enter either the number with no decimals, or 0 if blank)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PB: Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and...

Related questions

Question

Transcribed Image Text:Your company purchases a patent for $46,000 to attempt to compete in a usually restricted market. This patent does not have a salvage value at the end of its 5-year useful life. You are tasked with computing the depreciation schedule and book value for

the patent using double declining balance with a switch to SL method (if necessary).

Question 1 Part B: Complete the following table to show the depreciation schedule.

If it is necessary to switch from DDB to SL depreciation, when the switch occurs, only enter the value of the SL depreciation and enter 0 for the DDB depreciation (eg. when/if the switch occurs, DDB: 0 and SL: X).

Enter your answers in the form 1234 (enter 0 for blank table cells).

NO DECIMALS

Year

B-1 (enter either the number with DDB (enter either the number

no decimals, or 0 if blank)

with no decimals, or 0 if blank)

SL (enter either the number with

no decimals, or O if blank)

DDB or SL? (enter DDB, SL, or 0 if neither

applies below!

D., (enter either the number with B, (enter either the number with

no decimals, or 0 if blank)

no decimals, or 0 if blank)

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning