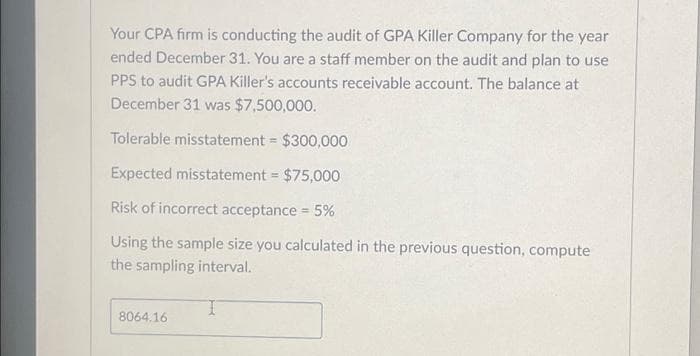

Your CPA firm is conducting the audit of GPA Killer Company for the year ended December 31. You are a staff member on the audit and plan to use PPS to audit GPA Killer's accounts receivable account. The balance at December 31 was $7,500,000. Tolerable misstatement = $300,000 Expected misstatement = $75,000 Risk of incorrect acceptance = 5% Using the sample size you calculated in the previous question, compute the sampling interval.

Q: Considering that the credit policy of Steward (Pty) Ltd is 90 days, which one of the following…

A: Debtor collection period is used to find average number of days taken to receive payment from…

Q: The ledger of Tamarisk, Inc. on July 31, 2022, includes the following selected accounts before…

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. These…

Q: You have decided to start saving money for your future. What is the future value of a 17-year…

A: Future value refers to the total value that an investment or a series of cash flows will accumulate…

Q: ing Inc. has the following cost and production data for the month of April. Units in beginning work…

A: The total cost of producing a product, including raw materials and operating costs, is detailed in a…

Q: A store uses the gross profit method to estimate inventory and cost of goods sold for interim…

A: The following formula used to calculate as follows under:-Cost of goods sold = Beginning inventory +…

Q: in a wide variety of applications. During the coming year, it expects to sell 190,000 units for…

A: The cost of goods sold include the cost of goods that are sold during the period. The gross margin…

Q: The markup on a ysed car was at least 30% ofnits current wholesale price. If the car was sold for…

A: Wholesale price refers to the cost at which goods or products are sold by a manufacturer or…

Q: Primare Corporation has provided the following data concerning last month's manufacturing…

A: The Cost of Goods Manufactured is the total manufacturing costs of goods that…

Q: Prepare the journal entries to record the following transactions on Carla Vista Company's books…

A: In a perpetual inventory system, inventory records are maintained up to date in order to reflect the…

Q: Analyse the system requirement for accounting software for the retail sector. Critically discuss the…

A: Accounting software plays a crucial role in the retail sector, aiding in the management of financial…

Q: Osborn Manufacturing uses a predetermined overhead rate of $19.20 per direct labor-hour. This…

A: Predetermined overhead = Estimated Manufacturing overhead/Estimated total units in allocation…

Q: Beginning Inventory Purchase 1 Purchase 2 Purchase 3 Units sold Units 26 45 20 50 113 Cost per unit…

A: The choice of inventory valuation method can have an impact on a company's FS. Different methods can…

Q: Brothern Corporation bases its predetermined overhead rate on the estimated machine-hours for the…

A: The overhead is applied to the production on the basis of the pre-determined overhead rate. The…

Q: Required Information Benchmark Assignment - Coca-Cola Co. & Pepsico Inc. You will need to use the…

A: Formulas:- 1. Working capital = Current assets - Current liabilities.2. Current ratio = Current…

Q: Instructions a. Create a general ledger account for each of the above accounts and enter the August…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Alyeski Tours operates day tours of coastal glaciers in Alaska on its tour boat the Blue Glacier.…

A: Net Operating Income (NOI) is a financial measure that represents the profitability of a company's…

Q: Required information [The following information applies to the questions displayed below] Shadee…

A: The income statement offers important insights into the profitability, cost control, and revenue…

Q: Data from the current year-end balance sheets Assets Cash Accounts receivable, net Merchandise…

A: Operating income is the difference between total revenue and total operating expense of the…

Q: Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources),…

A: Step method of allocating cost - is one of the methods in methods of cost allocation is based on the…

Q: Calculate the value of an real option value of an oil producing company which has the target of a…

A: To calculate the value of the real option using the Black-Scholes Option Pricing Model (BSOPM), we…

Q: tuline applies overhead on the basis of machine hours. Given the following data, compute overhead…

A: Predetermined overhead rate = Estimated overhead / Estimated machine hoursOverhead applied = Actual…

Q: Differential Analysis for a Discontinued Product The condensed product-line income statement for…

A: The decision making technique that helps the entity to analyze the benefits and costs of different…

Q: Brandon Technology makes two models of a specialized sensor the aerospace industry. The difference…

A: In case of scarce resources, the contribution is assessed in terms of scare resource and the…

Q: 2. If HHC has $1,650 cash, $500 of government Treasury bills purchased four months ago, $880 of cash…

A: Given in the question:Cash of HHC = $1,650Treasury bills purchased four months ago = $500The cash…

Q: Prepare general journal entries to record the transactions of Spade Company by using the following…

A: Journal entry is the primary reporting of the business transactions in the books of accounts. These…

Q: K Pisa Pizza, a seller of frozen pizza, is considering introducing a healthier version of its pizza…

A: Incremental analysis:It is the analysis which helps in decision making by comparing the cost and…

Q: Compute the standard overhead rate. Hint Standard allocation base at 80% capacity is 30,000 DLH,…

A: Standard costs are estimates of the actual costs in a company’s production processThen, the actual…

Q: Nick Smith, the sole owner of Nick's Cleaning Service has $5,000 in equity in his business and he…

A: Since you have posted multiple questions, we will provide the solution only to the first question as…

Q: Thalassines kataskeves, S.A., of Greece, makes marine equipment. The company has been experiencing…

A: Financial advantage (disadvantage) of discontinuing the product line = Net income on discontinuing…

Q: A partnership has gone through liquidation and now reports the following account balances: Cash Loan…

A: Lets understand the basics.Liquidation can be happened due to legal requirements or due to mutual…

Q: D. Determine the annual set-up cost. E. Determine the annual holding cost. F. What is the total…

A: Lets understand the basics.Economic order quantity is a quantity at which set up costs and holding…

Q: Assume that the risk-free rate, RF, is currently 9% and that the market return, rm, is…

A: COST OF EQUITY Cost of Capital is the minimum rate of return that must be earned on investments, in…

Q: At December 31, Magnum Auto Bodyshop owes an employee for four days of work that will not be paid…

A: The adjustment entries are prepared to adjust the revenue and expense of the current period. The…

Q: Long-term capital assets with a(n) _____ may not be depreciable. O finite life O indefinite life O…

A: All long term capital assets are depreciated because of usage and passage of time.

Q: X Corporation, a cash basis taxpayer, has taxable income of $500,000 for the current year. Tern…

A: Note:“Since you have asked multiple questions, we will solve the first question for you. If you want…

Q: Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs…

A: Under FIFO method the oldest products in inventory have been sold first.Under LIFO method the newest…

Q: Sunland Company purchases $47,000 of raw materials on account, and it incurs $56,400 of factory…

A: Lets understand the basics.Journal entry is required to make in order to record all the transaction…

Q: A company has purchased a new piece of machinery for $100,000. The estimate it will result in annual…

A: Capital budgeting is the process of evaluating and selecting long-term investments that will benefit…

Q: morman 1. The following figures are available: Sales Purchases Sales commission Wages ● 40% of all…

A: Cash BudgetWhich is very helpful to forecast future cash payments and help to make decisions about…

Q: Table 1 shows a balance sheet for a certain company. All quantities shown are in millions of…

A: Net working capital is that amount of capital which is being used in day to day normal operations in…

Q: f you had to amortize a lump sum payment of 100,000 into a uniform annuity stream with 20…

A: The question is based on the concept of Annuity.Annuities refers to the series of equal payments or…

Q: Management of Plascencia Corporation is considering whether to purchase a new model 370 machine…

A: Differential cost is that cost which is difference between two proposed alternatives. This cost is…

Q: Kingston Corporation's accumulated depreciation—equipment account increased by $4,300, while $2,800…

A: Cash flows from operating activities: It is a section of the Statement of cash flow that explains…

Q: Smiley Corporation's current sales and partial balance sheet are shown below. This year Sales $…

A: Balance sheet:A balance sheet is a statement of assets, liability, and equity. It is prepared after…

Q: Job 62 was recently completed and the following data is available on the job cost sheet for Job 62:…

A: Direct material cost is the cost of raw material produced or purchased for producing the final…

Q: There are four steps in the two-stage cost allocation process using ABC. Which of the following not…

A: Activity-Based costing system: Activity-based costing is a costing method that identifies activities…

Q: Blue Spruce Company has 2,030 kg of raw materials in its December 31, 2022, ending inventory.…

A: Direct Materials Purchases Budget :Direct Materials Purchases Budget is prepared on the base of the…

Q: Joanna received $67,800 compensation the value of her stock in ABC from her employer, company…

A: Gross income refers to the total income earned by an individual before any deductions or taxes are…

Q: Silvia is thinking about investing money into a bond to diversify her investments. Company X issued…

A: The maximum price of the bond is the price which is payable by the bond investor so that the…

Q: E6.3 (LO 1), AN Gato Inc. had the following inventory situations to consider at January 31, its…

A: FOB shipping point: Under FOB shipping point the possession of goods are with the seller until the…

ss.

Step by step

Solved in 3 steps

- McMullen and Milligan, CPAs, were conducting the audit of Cusick Machine Tool Company for the year ended December 31. Jim Sigmund, senior-in-charge of th audit, plans to use MUS to audit Cusick's invenotry account. Thee balance at December 31 was $9,000,000. Required: A) Based on the following information, compute the required MUS sample size: Tolerable misstatement = $360,000 Expected misstatement = $90,000 Risk of incorrect acceptance = 5% B) Nancy Van Pelt, staff accountant, used the sample items selected in part (a) and performed the audit procedures listed in the inventory audit program. She notes the following misstatements: Misstatement Number Book Value Audit Value 1 $10,000 $7,500 2 $9,000 $6,000 3 $60,000 0…McMullen and Milligan, CPAs, were conducting the audit of Cusick Machine Tool Company for the year ended December 31. Jim Sigmund, senior-in-charge of th audit, plans to use MUS to audit Cusick's invenotry account. Thee balance at December 31 was $9,000,000. Required: A) Based on the following information, compute the required MUS sample size: Tolerable misstatement = $360,000 Expected misstatement = $90,000 Risk of incorrect acceptance = 5% B) Nancy Van Pelt, staff accountant, used the sample items selected in part (a) and performed the audit procedures listed in the inventory audit program. She notes the following misstatements: Misstatement Number Book Value Audit Value 1 $10,000 $7,500 2 $9,000 $6,000 3 $60,000 0…A CPA company is conducting the audit of Finch Hardware Company for the year ended December 31. The senior-in-charge of the audit plans to use MUS to audit Finch’s inventory account. The balance at December 31 was $9,000,000, tolerable misstatement is $360,000, expected misstatement is $90,000, and the risk of incorrect acceptance is 5%. Compute the required MUS sample size and sampling interval using Table 8-5 in the textbook (round your interval answer to the nearest whole number).

- James Duffney, CPA, has randomly selected and audited a sample of 100 of Will-Mart’s accounts receivable. Will-Mart has 6,140 accounts receivable accounts with a total book value of $6,000,000. Duffney has determined that the account’s tolerable misstatement is $500,000. His sample results are as follows: Average audited value $962 Average book value 970 Required: Calculate the accounts receivable estimated audited value and projected misstatement using the: a. Mean-per-unit method. b. Ratio method. c. Difference method.Carson Allister is performing a PPS application in the audit of Bird Company’s accounts receivable. Based on the acceptable level of the risk of incorrect acceptance of 5 percent and a tolerable misstatement of $120,000, Allister has calculated a sample size of 75 items and a sampling interval of $25,000. After examining the sample items, the following misstatements were identified: (Use Exhibit F.A.2.) Item Recorded Balance Audited Value 1 $35,000 $28,000 2 10,000 8,000 3 6,000 3,000 Required: Calculate the upper limit on misstatements for Bird Company’s accounts receivable.An audit firm is conducting the audit of Diaz Construction Company for the fiscal year ended October 31. Rebecca Smith, the partner in charge of the audit, decides that MUS is the appropriate sampling technique to use in order to audit Diaz’s inventory account. The balance in the inventory at October 31 was $4,250,000. Rebecca has established the following: risk of incorrect acceptance = 5% (i.e., the desired confidence level of 95%), tolerable misstatement = $212,500, and expected misstatement = $63,750. Calculate the sample size and sampling interval using Table 8-5 in the textbook (round your interval answer to the nearest whole number).

- An external auditor of Roses Corporation sent out positive confirmation requests to 1,000 customers. Population size is 2,400 accounts, with a total recorded value of P400,000. Recorded value of samples selected is P159,960 and audited value of samples is P151,360. What is the estimated population audited value using ratio estimation? A. 400,000 B. 422,728 C. 378,480 Using the data provided in Roses Corporation, what is the projected misstatement using MPU estimation?A. 151,360 B. 20,640 C. 8,600The 1,000 accounts receivable of Gamco Company have a total book value of $20,000. Wilbur Schneitz, Certified Public Accountant (CPA), has selected and audited a sample of 50 accounts with a total book value of $900. Using nonstatistical variables sampling and the difference estimation technique, Smith has properly estimated a projected misstatement of an overstatement of $3,000 for the entire population. The total audited value of Schneitz’s sample is: 650 1000 750 900You are auditing the accounts receivable for Conor Company as of December 31, 2021. One of your procedures was to send positive confirmations to a sample of 50 accounts. Of those 50 confirmations, 40 have been positively confirmed without comments, 7 had minor differences that have been cleared satisfactorily. Two of the responses had the following comments: a. “We never received these goods.” b. “The balance of $1,000 was paid on December 15, 2021.” For each of these comments, identify the steps that you would take to clear (resolve) them.

- The 1,500 accounts receivable of DEF Company have a total book value of $30,000. Bob Smith, Certified Public Accountant (CPA), has selected and audited a sample of 50 accounts with a total book value of $1,050. Using the difference estimation technique, Smith has properly estimated a projected misstatement of an overstatement of $3,000 for the entire population. The total audited value of Smith's sample is: Multiple Choice $900 $1,150 $850 $950An external auditor of Roses Corporation sent out positive confirmation requests to 1,000 customers. Population size is 2,400 accounts, with a total recorded value of P400,000. Recorded value of samples selected is P159,960 and audited value of samples is P151,360. What is the estimated population audited value using ratio estimation? A. 400,000 B. 422,728 C. 378,480Consider the following audit work performed by two auditors, Suzy and Gary:(a) Suzy attended the client’s year-end stocktake and observed that the client followed the stocktake instructions. She selected numerous items for test counting from the client’s inventory sheets and all were found to be correct. Cut-off details were noted and subsequently checked and found to be correctly treated. Suzy concluded that inventory was fairly stated.(b) Maintenance expenses were material, although it was only 50% of last year’s balance. Gary selected a large sample of entries and agreed them to supporting documents. No errors were found. Gary concluded that maintenance expenses were reasonable. Required:Indicate whether sufficient appropriate audit evidence has been obtained to support the conclusions for the inventory and maintenance expenses accounts.Explain your answers.