Your friend Carra is interested in investing in Spark common stocks. She knows that you are taking finance and have learned about stock valuation using historical dividends information. Carra has collected the following dividends data on Spark and asked for your help to calculate the stock price of this company. Use the Constant Growth Dividend model you learned to perform stock valuation for this company. Use the past dividends data to estimate the constant growth rate (it is assumed that the dividends will grow at its historical average growth rate from now onwards) for the dividends. Under the assumption that Spark will continue this dividend pattern forever and Carra wants to earn an annual rate of return of 11% on this investment, what price would Carra be willing to pay for the stock price of this company? What happens to the stock price that Carra would be willing to pay if her required rate of return is 15% (which is greater than 10%)? Briefly interpret your answers. Clearly show all formulae, steps and calculations

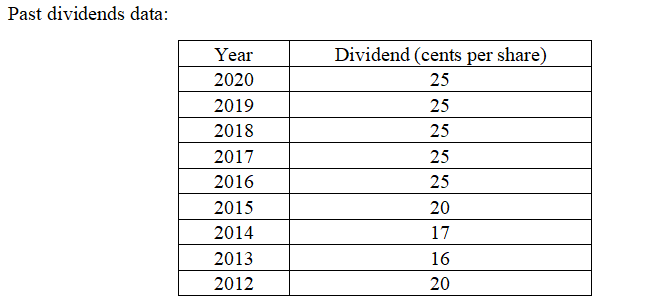

Your friend Carra is interested in investing in Spark common stocks. She knows that you are taking finance and have learned about stock valuation using historical dividends information. Carra has collected the following dividends data on Spark and asked for your help to calculate the stock price of this company.

Use the Constant Growth Dividend model you learned to perform stock valuation for this company. Use the past dividends data to estimate the constant growth rate (it is assumed that the dividends will grow at its historical average growth rate from now onwards) for the dividends. Under the assumption that Spark will continue this dividend pattern forever and Carra wants to earn an annual

Step by step

Solved in 4 steps with 2 images