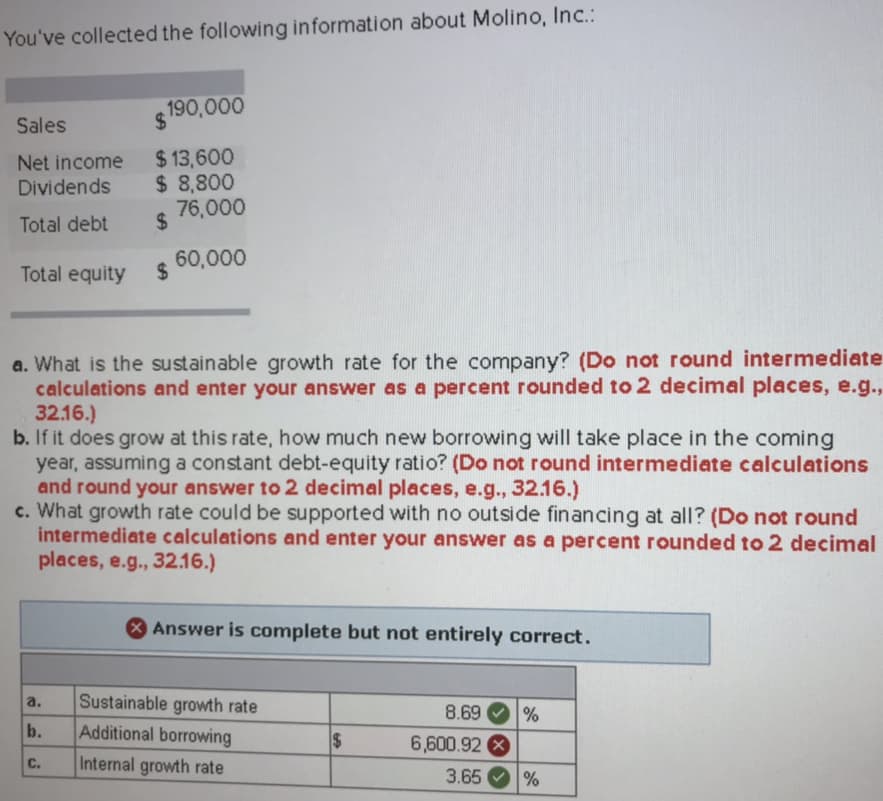

You've collected the following information about Molino, Inc. 190,000 Sales Net income $13,600 Dividends 8,800 bt $ 76,000 60,000 Total equity a. What is the sustainable growth rate for the company? (Do not round intermediate b. If it does grow at this rate, how much new borrowing will take place in the coming c. What growth rate could be supported with no outside financing at all? (Do not round calculations and enter your answer as a percent rounded to 2 decimal places, e.g, 3216.) year, assuming a constant debt-equity ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. a. Sustainable growth rate b. Additional borrowing c. Internal growth rate 8.69 )% 6,600.92 3.65 196

You've collected the following information about Molino, Inc. 190,000 Sales Net income $13,600 Dividends 8,800 bt $ 76,000 60,000 Total equity a. What is the sustainable growth rate for the company? (Do not round intermediate b. If it does grow at this rate, how much new borrowing will take place in the coming c. What growth rate could be supported with no outside financing at all? (Do not round calculations and enter your answer as a percent rounded to 2 decimal places, e.g, 3216.) year, assuming a constant debt-equity ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. a. Sustainable growth rate b. Additional borrowing c. Internal growth rate 8.69 )% 6,600.92 3.65 196

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter17: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 3P

Related questions

Question

100%

Practice Pack

Transcribed Image Text:You've collected the following information about Molino, Inc.

190,000

Sales

Net income $13,600

Dividends 8,800

bt $ 76,000

60,000

Total equity

a. What is the sustainable growth rate for the company? (Do not round intermediate

b. If it does grow at this rate, how much new borrowing will take place in the coming

c. What growth rate could be supported with no outside financing at all? (Do not round

calculations and enter your answer as a percent rounded to 2 decimal places, e.g,

3216.)

year, assuming a constant debt-equity ratio? (Do not round intermediate calculations

and round your answer to 2 decimal places, e.g., 32.16.)

intermediate calculations and enter your answer as a percent rounded to 2 decimal

places, e.g., 32.16.)

Answer is complete but not entirely correct.

a. Sustainable growth rate

b. Additional borrowing

c. Internal growth rate

8.69 )%

6,600.92

3.65 196

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 7 steps with 6 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT