You've observed the following returns on Pine Computer's stock over the past five years: 8 percent, -12 pe percent, 21 percent, and 16 percent. The average inflation rate over this period was 3.1 percent and the ave over the period was 4.1 percent. a. What was the average real return on the stock? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 de e.g., 32.16. b. What was the average nominal risk premium on the stock? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 d e.g., 32.16. a. Average real return b. Average nominal risk premium % %

You've observed the following returns on Pine Computer's stock over the past five years: 8 percent, -12 pe percent, 21 percent, and 16 percent. The average inflation rate over this period was 3.1 percent and the ave over the period was 4.1 percent. a. What was the average real return on the stock? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 de e.g., 32.16. b. What was the average nominal risk premium on the stock? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 d e.g., 32.16. a. Average real return b. Average nominal risk premium % %

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 18PROB

Related questions

Question

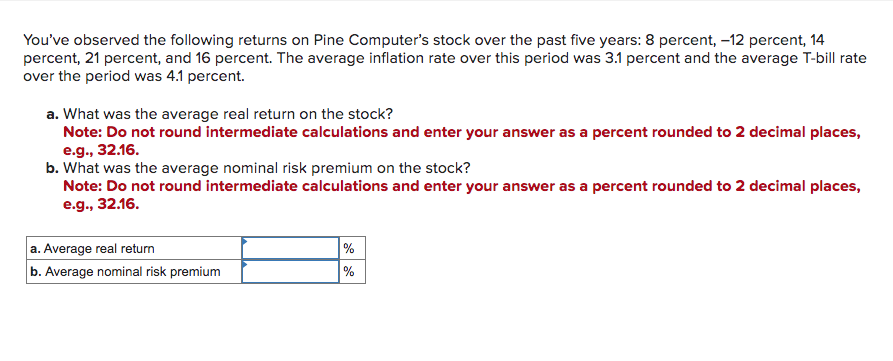

Transcribed Image Text:You've observed the following returns on Pine Computer's stock over the past five years: 8 percent, -12 percent, 14

percent, 21 percent, and 16 percent. The average inflation rate over this period was 3.1 percent and the average T-bill rate

over the period was 4.1 percent.

a. What was the average real return on the stock?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places,

e.g., 32.16.

b. What was the average nominal risk premium on the stock?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places,

e.g., 32.16.

a. Average real return

b. Average nominal risk premium

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning