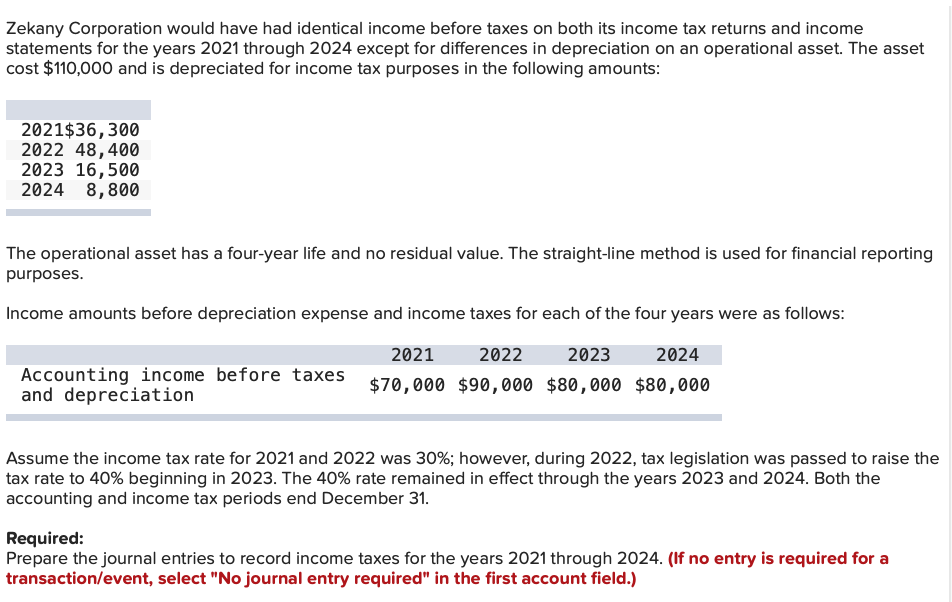

Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2021 through 2024 except for differences in depreciation on an operational asset. The asset cost $110,000 and is depreciated for income tax purposes in the following amounts: 2021$36,300 2022 48,400 2023 16,500 2024 8,800 The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting purposes. Income amounts before depreciation expense and income taxes for each of the four years were as follows: 2021 2022 2023 2024 Accounting income before taxes $70,000 $90,000 $80,000 $80,000 and depreciation Assume the income tax rate for 2021 and 2022 was 30%; however, during 2022, tax legislation was passed to raise the tax rate to 40% beginning in 2023. The 40% rate remained in effect through the years 2023 and 2024. Both the accounting and income tax periods end December 31. Required: Prepare the journal entries to record income taxes for the years 2021 through 2024. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2021 through 2024 except for differences in depreciation on an operational asset. The asset cost $110,000 and is depreciated for income tax purposes in the following amounts: 2021$36,300 2022 48,400 2023 16,500 2024 8,800 The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting purposes. Income amounts before depreciation expense and income taxes for each of the four years were as follows: 2021 2022 2023 2024 Accounting income before taxes $70,000 $90,000 $80,000 $80,000 and depreciation Assume the income tax rate for 2021 and 2022 was 30%; however, during 2022, tax legislation was passed to raise the tax rate to 40% beginning in 2023. The 40% rate remained in effect through the years 2023 and 2024. Both the accounting and income tax periods end December 31. Required: Prepare the journal entries to record income taxes for the years 2021 through 2024. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 5MC: At the beginning of 2019, Conley Company purchased an asset at a cost of 10,000. For financial...

Related questions

Question

Transcribed Image Text:Zekany Corporation would have had identical income before taxes on both its income tax returns and income

statements for the years 2021 through 2024 except for differences in depreciation on an operational asset. The asset

cost $110,000 and is depreciated for income tax purposes in the following amounts:

2021$36,300

2022 48,400

2023 16,500

2024 8,800

The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting

purposes.

Income amounts before depreciation expense and income taxes for each of the four years were as follows:

2021

2022

2023

2024

Accounting income before taxes

and depreciation

$70,000 $90,000 $80,000 $80,000

Assume the income tax rate for 2021 and 2022 was 30%; however, during 2022, tax legislation was passed to raise the

tax rate to 40% beginning in 2023. The 40% rate remained in effect through the years 2023 and 2024. Both the

accounting and income tax periods end December 31.

Required:

Prepare the journal entries to record income taxes for the years 2021 through 2024. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field.)

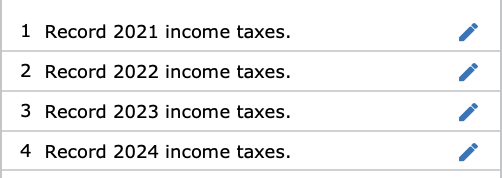

Transcribed Image Text:1 Record 2021 income taxes.

2 Record 2022 income taxes.

3 Record 2023 income taxes.

4 Record 2024 income taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning