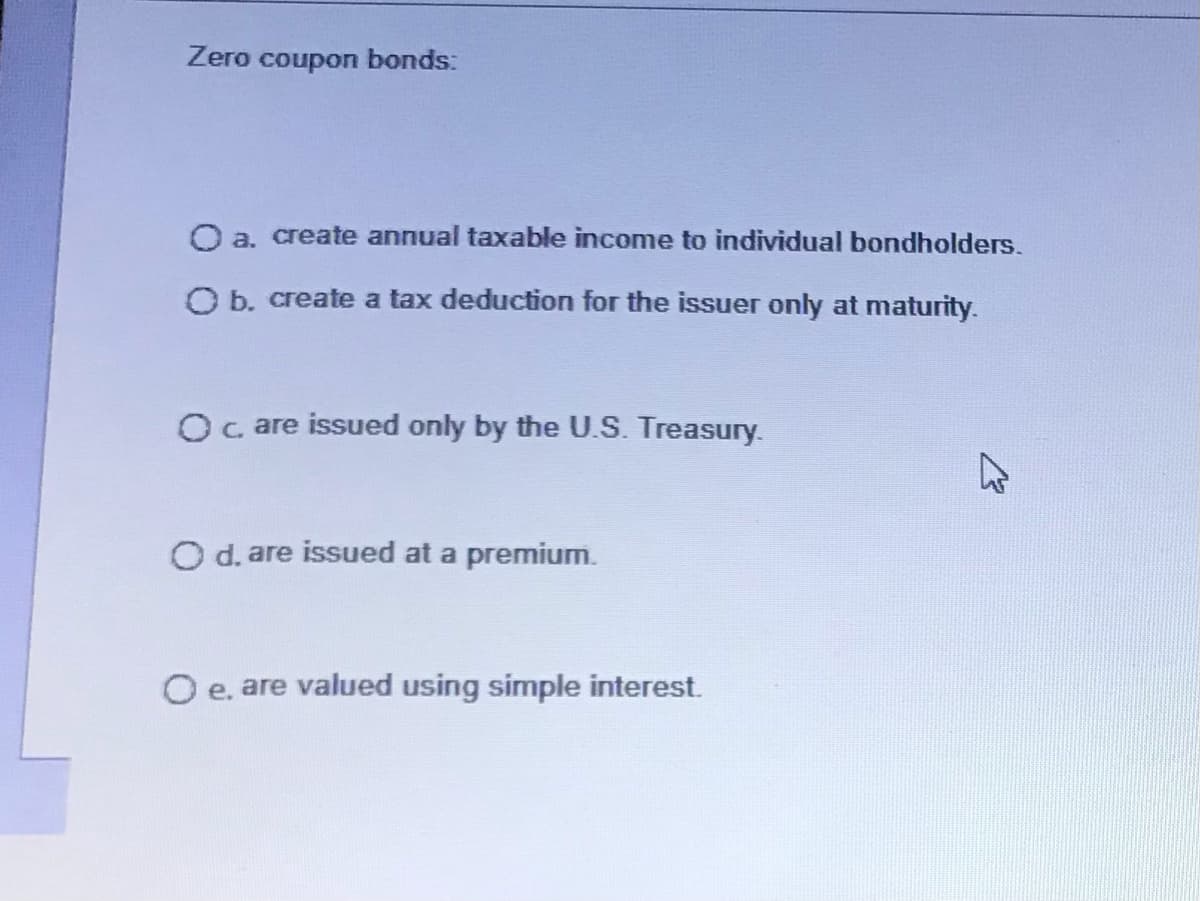

Zero coupon bonds: O a. create annual taxable income to individual bondholders. O b. create a tax deduction for the issuer only at maturity. O c. are issued only by the U.S. Treasury. O d. are issued at a premium. O e. are valued using simple interest. K

Q: You can buy a piece of land today that you expect will be worth $500,000 in 9 years. Assuming you…

A: Data given: FV= $500,000 n=9 years r=rate=13% Required:: Amount willing to pay for the…

Q: Calculate the value of a bond that matures in 15 years and has $1,000 par value the annual interest…

A: Bonds are considered a long-term financial liability. This is one of the methods of raising funds…

Q: The Building and Personal Property Coverage Form cover all of the following EXCEPT: a. Building…

A: Fixed assets or non-current assets are those assets that help long-term benefits to the company.…

Q: 10: Beasley Enterprises stock has an expected return of 8.86 percent. The stock is expected to…

A: The expected rate of return is the overall rate of return that a company provides in a neutral…

Q: Course: Finance As a great investor, you are interested in 3 assets to invest: A, B and C. A…

A: Sharp ratio It is calculated as shown below. Sharp ratio=Expected return-risk free rateStandard…

Q: Problem 3. Humble Manufacturing is interested in measuring its overall cost of capital. The firm is…

A: Financing is referred to as the process of providing finance or funds to the business through…

Q: Q4) You have $10,000 in your bank account today and you wish to start saving for your first car,…

A: To calculate the interest rate we will use the below formula Interest rate = (FV/PV)1/n-1 Where FV…

Q: Suppose you are buying shares of a discount bond that currently cost $10 each. You have $100 of…

A: Leverage means increase that is for accomplishing some purpose, It tells us how capital comes in the…

Q: ou fund and

A: NPV= Present value of cashinflows - Present value of cashoutflows.

Q: 3. A corporation plans a capital expansion program that requires the following estimated…

A: Calculations are done in excel, so there is no intermediate rounding. Present Value of Capital…

Q: Assume you have USD $100,000 of cash to buy the following stock at week 1 price. What is the weekly…

A: The stock is the part of the ownership of the company given in return for the capital paid.

Q: 2. PhysisPharm plc. is a UK-based pharmaceutical company using natural ingredients in most of their…

A: The R&D Department of PP has 5 projects and only £1,50,000 to invest NPV ( net present value )…

Q: The cost of equipment is PHP 50857 and the cost of installation is PHP 35878. If the salvage value…

A: Sinking fund method of depreciation In case of sinking fund method of depreciation, a fixed…

Q: -Cropiva manufactures agricultural equipment, and they are planning on introducing a new product…

A: The question is based on the concept of investment appraisal for the long term. The net present…

Q: 8,290

A: The total amount an investment now owns, including the money invested and the interest generated to…

Q: Calculate the total deferred payment price.

A: Total Deferred Payment Price: It refers to the total amount paid on the loan borrowed by the…

Q: Q23 Selected data from Box Division's accounting records revealed the following: Sales $…

A: Ratio Analysis is the method of checking the company's operational efficiency, liquidity, and…

Q: Five years ago, $12, 000 was deposited into a savings account that provides an interest of 6.5%…

A: A savings account is a deposit account opened with banks and other financial institutions. The…

Q: that produces batik and other traditional clothing. The company's financial data is as follows.…

A: When a corporation raises funds by issuing debt instruments to investors, this is referred to as…

Q: Just in preparation for his retirement, a man intended to invest today into a bank with an interest…

A: Annuity: An annuity is the series of payments which is received or paid for a certain period of…

Q: onesia is one of the most prestigious companies providing holiday travel packages to tourism…

A: When comparing different projects or in instances where determining a discount rate is problematic,…

Q: According to the CAPM, what is the required rate of return for a stock with a beta of 0.7, when the…

A: To calculate the required rate of return we use the below formula Required rate of return = Risk…

Q: Calculate the future value of an ordinary annuity consisting of monthly payments of $450 for five…

A: An ordinary annuity is an annuity where the periodic payment occurs at the end of the period.

Q: What is the present value of a perpetual stream of cash flows that pays $ 7,500 at the end of…

A: Year one cash flow = $7500 Growth rate = 0.02 Discount rate = 0.09 Discount rate = 0.07 Present…

Q: The XYZ-Delivery Company has two options for its delivery truck. The first option is to purchase a…

A: Before investing in new projects or assets, profitability of the project is evaluated by using…

Q: The tax rate is 20% Calculate the operating cash flow for the repair shop using the three methods…

A: Operating Cash Flow: It is the amount of cash generated by the firm from its normal business…

Q: ature in six years, and interest is paid semi-annually on June 30 and December 31. The bonds were…

A: The bond will mature on the maturity date, and the issuing company would pay the debt holder the…

Q: 5. What principal (present value) invested for 3 years at total future value of P4,000? How much is…

A: Present value is the equivalent value of money today considering the time period and interest rate…

Q: ear amortizing bond has a coupon rate of 4% and pays its coupons semi- annually. Coupon payments are…

A: The bond's susceptibility to interest rate fluctuations is measured by its duration. The…

Q: urity, and the market's required yield to maturity for similar rated debt was 7.5%. ed on the…

A: Price of bond is present value of coupon payment and present value of par value of bond based on…

Q: Present value calculation Without referring to the Financial calculator, use the basic formula for…

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: For a bank that funds its fixed-rate loans with floating rate deposits whose cost varies with a the…

A: LIBOR: LIBOR is a benchmark that has traditionally been calculated using data provided by a group…

Q: Suppose you took out a 25 year mortgage at 2.32% to purchase a home, making monthly payments of…

A: When the existing loan is financed again it is known as refinancing. Before refinancing its benefits…

Q: write a short report on Y Combinator, on its business model and the amount and sources of capital it…

A: A business model is a firm's primary strategy for operating financially. Models often include…

Q: A company has a capital employed of P 200,000. It has a cost of capital of 12% per year. Its…

A: Return on investment is the ratio that shows the percentage return earned on the investment made by…

Q: P5-19 Future value of an annuity For each case in the accompanying table, answer the questions that…

A: "Hi, Thanks for the Question. Since, you asked multiple question, we will answer first question for…

Q: A 15-year bond with 7.5% coupons paid semiannually will be redeemed at P1400. The bond is bought to…

A: Semiannual coupon rate = 0.0375 (i.e. 0.075 / 2) Semiannual yield (y) = 0.03 (i.e. 0.06 / 2)…

Q: a year. John's Workshop electric bills are Ș He wants to reduce them by using solar electricity, so…

A: The present worth method is a capital budgeting technique used to evaluate the best project or…

Q: At a discount rate of 6.00%, find the present value of a perpetual payment of $ 1,000 per…

A: Perpetual payment = $1000 Discount rate = 0.06 Discount rate = 0.03 Present value of the…

Q: Bond matures in 18 years and pay 14 percent interest annually. If the bond is purchased for $1,225…

A: Face value = $1000 Bond price = $1225 Coupon rate = 14% Annual coupon amount = Face value*Coupon…

Q: ack and Carlie each deposit $17,250 into accounts that earn 6% interest for 6.5 years. Jack's…

A: Interest is received on the deposit made for a time period. It involves the concept of the time…

Q: Given the following cash flow for a certain investment and a MARR of 12% per year: 0 1 2 3 4 5 6…

A: Here, Cash Flow in Year 0 is -P30,000 Cash Flow in Year 1 is -P 19,000 Cash Flow in Year 2, 3 and 4…

Q: How much do you have to deposit today so that exactly 10 years from now you can withdraw $10,000 a…

A: To calculate the deposit amount today, present value of 5 years of withdrawal amount need to be…

Q: A new drill press was purchased for $95,000 by trading in a similar machine that had a book value of…

A: Answer - Step 1 - Calculation of Unrecognized Loss - Particulars Amount Book value of…

Q: Assume Coleco pays an annual dividend of $1.90 and has a share price of $38.00. It announces that…

A: Existing dividend = $1.90 Existing stock price = $38.00 New dividend = $2.20

Q: Cash conversion cycle can be reduced by reducing the payables deferral period which will slow down…

A: The total number of days that a company takes to convert its resources into cash is known as the…

Q: Sandra has just purchased Insidia Ltd bonds.Using the following information at the time of the…

A: Nominal coupon rate: It is the stated interest rate on bond and is calculated by dividing sum of…

Q: Problem 1 if interest payments were made o tilbysemiannually? 3. Superior Cement Company has an 8…

A: The price of preferred stock is calculated with the help of following formula Price of preferred…

Q: The amount you will have at the end of 30 years will be $ (Round to the nearest dollar.)

A: Future Value of Annuity: It represents the future worth of the present annuity stream of cash flow.…

Q: The 14 year $1000 par bond pays 7 percent interest annually. Market price $945 What is the bond…

A: Par value = $1000 Coupon rate = 7% Coupon amount = 1000*0.07 = $70 Years to maturity = 14 Years Bond…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The coupon rate on a tax-exempt bond is 5.6%, and the rate on a taxable bond is 8%. Both bonds sell at par. At what tax bracket (marginal tax rate) would an investor be indifferent between the two bonds?Calculate the cost of capital of a bond selling to yeild 13% for the purchaser of the bond. The borrowing firm faces a tax rate of 34% a. 8.58% b. 10.58% c. 34% d. 13.58%7A-1. Which of the following statements is most correct?a. If interest rates increase, a 10-year zero coupon bond will drop inprice by a greater percentage than will a 10-year 8 percent couponbond.b. One nice thing about zero coupon bonds is that individual investorsdo not have to pay any taxes on a zero coupon bond until itmatures, even if they are not holding the bonds as part of a taxdeferred account.c. If a bond with a sinking fund provision has a yield to maturitygreater than its coupon rate, the issuing company would prefer tocomply with the sinking fund by calling the bonds in at par ratherthan buying the bonds back in the open market.d. Statements a and c are correct.e. All of the statements above are correct.

- Which of the following is true about “zeroes” (i.e. zero-coupon bonds)? (Group of answer choices) Zeroes sell at a premium compared to other bonds Zeroes pay more interest than a Treasury bill Zeroes are only issued by US corporations Zeroes only receive payment from price appreciation Zeroes have a shorter maturity than other bondsWhich of the following statements is right? Group of answer choices a)Ignoring the liquidity risk, the 10-treasry bond should have the same interest rate as the 10-year corporate bond. b)Ignoring the default risk, the 10-treasry bond should have the same interest rate as the 10-year corporate bond. c)The return of the 10-year treasury bond must be less than that of the 10-year corporate bond d)The return of the 10-year treasury bond must be greater than that of the 10-year corporate bond7A-1. Which of the following observations is the most accurate? a. As interest rates rise, the price of a 10-year zero coupon bond would fall by a larger amount than the price of a 10-year 8 percent coupon bond.b. One of the benefits of zero coupon bonds is that private borrowers do not have to pay taxes on them before they expire, particularly though they are not keeping them in a tax-deferred portfolio.c. Where the yield to maturity on a bond with a sinking fund clause is higher than the coupon rate, the borrowing party will have to comply with the sinking fund by calling the bonds in at par rather than purchasing them back on the open market.d. All a and c are valid statements.e. All of the above claims are true.

- A municipal bond has a yield to maturity of 3.8 percent. What corporate bond yield would make an investor in the 29 percent tax bracket indifferent between two bonds, all else the same?Municipal bonds are yielding 4.4 percent if they are insured and 4.7 percent if they are uninsured. Your marginal tax rate is 28 percent and the inflation rate is 1.645%. Your equivalent taxable yield on the insured bonds is _____ percent and on the uninsured bonds is _____ percent. How would your answers change if your marginal tax rate falls to 13.5% and the inflation rate increases to 2.0639%? What would happen to the YTM of the uninsured bond if negative news was announced resulting in a decline in its credit rating? What would happen to the YTM of the insured bond if it suddenly lost its insurance?Which of the following statements is not correct? a) The export value of the bond; the value the investor pays when buying bonds b) Nominal value of the bond; is the value written on the bond c) Another reason for the difference in bond market prices is the dividend paid to bonds. d) Periodic interest amounts on bonds are calculated at nominal value. e) Market value of a bond is equal to the present value of the interest to be paid by the bond and the principal amount to be paid at the end of maturity. ------------------ What is the market value of İdil Gıda's bond with a nominal value of 15000 USD, maturity of 3 years and 30% annual interest payment, assuming that the desired yield rate is 36%? a) 12500b) 13494c) 9000d) 5456e) 7594 ============ What is the market value of Beril Gıda A.Ş.'s bond with a nominal value of USD 12,000, maturity of 5 years and an annual interest payment of 25%, when the desired rate of return is 25%? a) 18000b) 15000c) 12000d) 16000e)…

- Consider the following information for a period of years: Long-term government bonds Long-term corporate bonds Inflation Arithmetic Mean 7.8% a. Long-term government bonds b. Long-term corporate bonds 7.9 3.5 a. What is the real return on long-term government bonds? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the real return on long-term corporate bonds? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. 4.25% %Corporate bonds issued by Johnson Corporation yield 8% interest at this time. Equal risk municipal bonds yield 6%. At what tax rate would an investor be indifferent to buying one or the other?Calculate the after-tax return of a(n) 5.625.62 percent, 20-year, A-rated corporate bond for an investor in the 1515 percent marginal tax bracket. Compare this yield to a(n) 3.683.68 percent, 20-year, A-rated, tax-exempt municipal bond, and explain which alternative is better. Repeat the calculations and comparison for an investor in the 3535 percent marginal tax bracket.