Zions Bank lends Teton Company $150,000 on August 1. Teton Company signs a $150,000, 6%, 8-month note. entry made by Teton Company at the maturity of the note includes: (Round final calculations to the nearest dola a credit to Interest Payable of $3,750. a credit to Notes, Payable of $150,000. a debit to Interest Expense of $2,250 a credit to Cash of $150,000

Zions Bank lends Teton Company $150,000 on August 1. Teton Company signs a $150,000, 6%, 8-month note. entry made by Teton Company at the maturity of the note includes: (Round final calculations to the nearest dola a credit to Interest Payable of $3,750. a credit to Notes, Payable of $150,000. a debit to Interest Expense of $2,250 a credit to Cash of $150,000

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.6BE: Journalizing installment notes On the first day of the fiscal year, a company issues 45,000, 8%,...

Related questions

Question

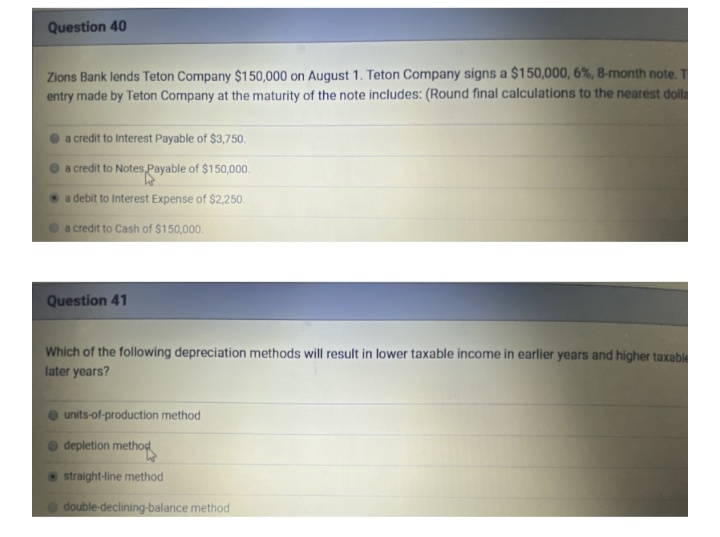

Transcribed Image Text:Question 40

Zions Bank lends Teton Company $150,000 on August 1. Teton Company signs a $150,000, 6%, 8-month note.

entry made by Teton Company at the maturity of the note includes: (Round final calculations to the nearest dolla

O a credit to Interest Payable of $3,750.

a credit to Notes,Payable of $150,000.

a debit to Interest Expense of $2,250.

a credit to Cash of $150,000.

Question 41

Which of the following depreciation methods will result in lower taxable income in earlier years and higher taxabl

later years?

units-of-production method

depletion method

straight-line method

double-declining-balance method

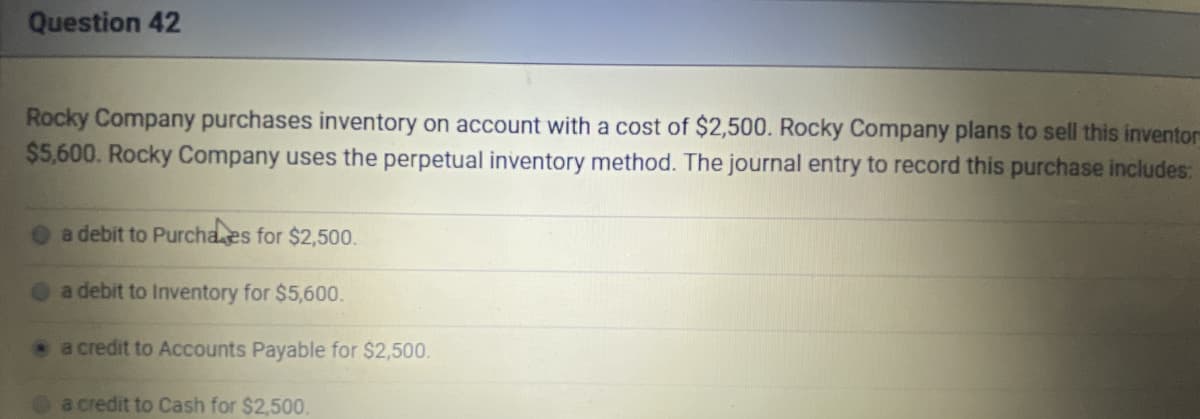

Transcribed Image Text:Question 42

Rocky Company purchases inventory on account with a cost of $2,500. Rocky Company plans to sell this inventors

$5,600. Rocky Company uses the perpetual inventory method. The journal entry to record this purchase includes:

a debit to Purchaes for $2,500.

a debit to Inventory for $5,600.

a credit to Accounts Payable for $2,500.

a credit to Cash for $2,500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning