Job No. Product Quantity Date Amount $16,120 Jan. 2 1 TT 520 1,610 Jan. 15 22 20,125 Feb. 3 30 1,420 25,560 Mar. 7 670 15,075 41 TT Mar. 24 SLK 2,210 49 22,100 SLK 31,875 May 19 58 2,550 June 12 65 TT 620 10,540 Aug. 18 Sept. 2 78 SLK 3,110 48,205 82 SS 1,210 16,940 750 Nov. 14 92 TT 8,250 52,650 Dec. 12 98 SLK 2,700

Process Costing

Process costing is a sort of operation costing which is employed to determine the value of a product at each process or stage of producing process, applicable where goods produced from a series of continuous operations or procedure.

Job Costing

Job costing is adhesive costs of each and every job involved in the production processes. It is an accounting measure. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications. Job costing is possible only in businesses where the production is done as per the customer’s requirement. For example, some customers order to manufacture furniture as per their needs.

ABC Costing

Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

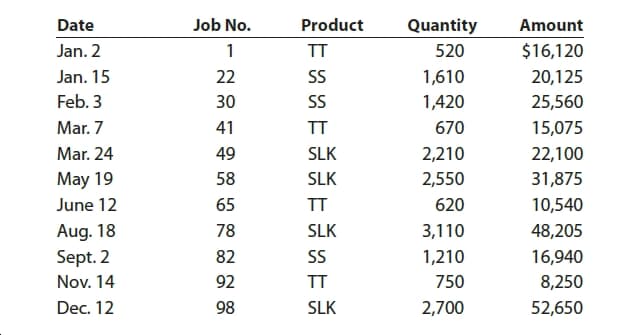

Alvarez Manufacturing Inc. is a job shop. The management of Alvarez Manufacturing Inc. uses the cost information from the job sheets to assess cost performance. Information on the total cost, product type, and quantity of items produced is as follows:

See Attachment

a. Develop a graph for each product (three graphs) with Job Number (in date order) on the horizontal axis and Unit Cost on the vertical axis. Use this information to determine Alvarez

b. What additional information would you require in order to investigate Alvarez Manufacturing Inc.’s cost performance more precisely?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images