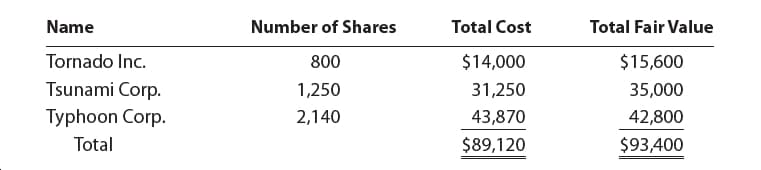

Name Number of Shares Total Cost Total Fair Value Tornado Inc. $14,000 $15,600 800 Tsunami Corp. 1,250 31,250 35,000 42,800 Typhoon Corp. 2,140 43,870 Total $89,120 $93,400

Hurricane Inc. purchased a portfolio of available-for-sale securities in Year 1, its first year of operations. The cost and fair value of this portfolio on December 31, Year 1, was as follows:

Please see the attachment for details:

On June 12, Year 2, Hurricane purchased 1,450 shares of Rogue Wave Inc. at $45 per share plus a $100 brokerage commission.

a. Provide the

1. The adjustment of the available-for-sale security portfolio to fair value on December 31, Year 1.

2. The June 12, Year 2, purchase of Rogue Wave Inc. stock.

b. How are unrealized gains and losses treated differently for available-for-sale securities than for trading securities?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images