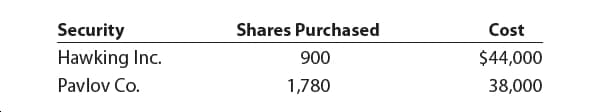

Security Shares Purchased Cost Hawking Inc. $44,000 900 Pavlov Co. 1,780 38,000

During Year 1, its first year of operations, Galileo Company purchased two available-forsale investments as follows:

Please see the attachment for details:

Assume that as of December 31, Year 1, the Hawking Inc. stock had a market value of $50 per share and the Pavlov Co. stock had a market value of $24 per share. Galileo Company had net income of $300,000 and paid no dividends for the year ended December 31, Year 1. All of the available-for-sale investments are classified as current assets.

a. Prepare the Current Assets section of the balance sheet presentation for the availablefor-sale investments.

b. Prepare the

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images