Determining missing items in return and residual income computations Data for Uberto Company are presented in the following table of rates of return on investment and residual incomes: Invested Assets Income from Operations Return on Investment Minimum Return Minimum Acceptable Income from Operations Residual Income $980,000 $225,400 (a) 13% (b) (c) $600,000 (d) (e) (f) $72,000 $24,000 $320,000 (g) 14% (h) $35,200 (i) $240,000 $45,600 (j) 11% (k) (l) Determine the missing values, identified by the letters above. For all amounts, round to the nearest whole number.

Determining missing items in return and residual income computations Data for Uberto Company are presented in the following table of rates of return on investment and residual incomes: Invested Assets Income from Operations Return on Investment Minimum Return Minimum Acceptable Income from Operations Residual Income $980,000 $225,400 (a) 13% (b) (c) $600,000 (d) (e) (f) $72,000 $24,000 $320,000 (g) 14% (h) $35,200 (i) $240,000 $45,600 (j) 11% (k) (l) Determine the missing values, identified by the letters above. For all amounts, round to the nearest whole number.

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 1.25EX: Financial statements We-Sell Realty, organized August 1, 2016, is owned and operated by Omar Farah....

Related questions

Question

Determining missing items in return and residual income computations

Data for Uberto Company are presented in the following table of

Invested Assets |

Income from Operations |

Return on Investment |

Minimum Return | Minimum Acceptable Income from Operations | Residual Income |

||||||

| $980,000 | $225,400 | (a) | 13% | (b) | (c) | ||||||

| $600,000 | (d) | (e) | (f) | $72,000 | $24,000 | ||||||

| $320,000 | (g) | 14% | (h) | $35,200 | (i) | ||||||

| $240,000 | $45,600 | (j) | 11% | (k) | (l) |

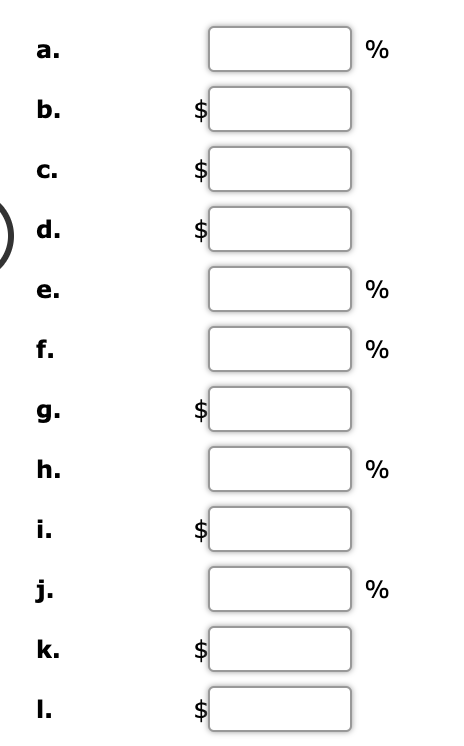

Determine the missing values, identified by the letters above. For all amounts, round to the nearest whole number.

Transcribed Image Text:а.

%

b.

C.

d.

е.

%

f.

%

g.

h.

%

i.

j.

%

k.

I.

%24

%24

%24

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning