BEP, ROE, AND ROIC Broward Manufacturing recently reported the following information: Net income $615,000 ROA 10% Interest expense $202,950 Accounts payable and accruals $950,000 Broward’s tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC).

BEP, ROE, AND ROIC Broward Manufacturing recently reported the following information: Net income $615,000 ROA 10% Interest expense $202,950 Accounts payable and accruals $950,000 Broward’s tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC).

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter14: Valuation: Market-based Approach

Section: Chapter Questions

Problem 19PC

Related questions

Question

BEP, ROE, AND ROIC Broward Manufacturing recently reported the following information: Net income $615,000

Transcribed Image Text:Show Notebook

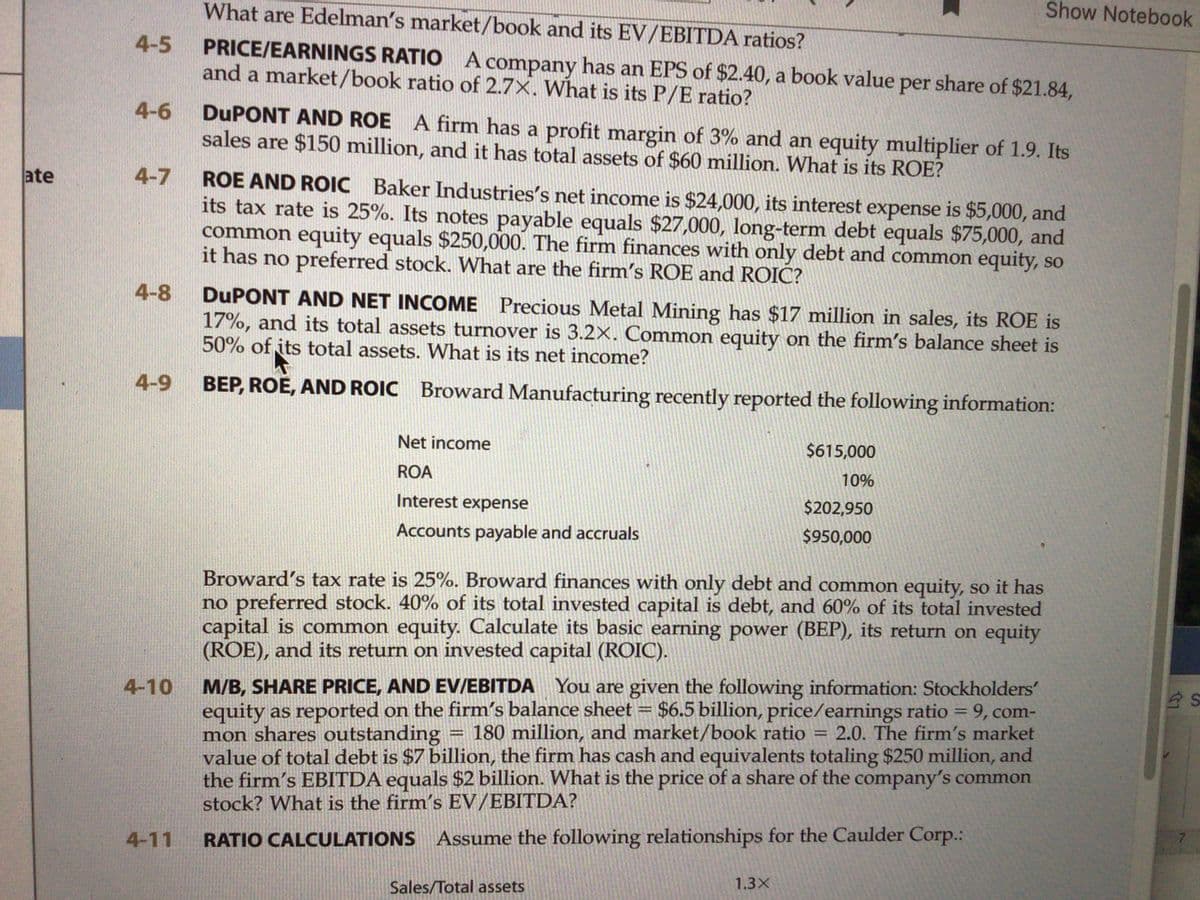

What are Edelman's market/book and its EV/EBITDA ratios?

PRICE/EARNINGS RATIO A company has an EPS of $2.40, a book value per share of $21.84,

and a market/book ratio of 2.7X. What is its P/E ratio?

4-5

DUPONT AND ROE A firm has a profit margin of 3% and an equity multiplier of 1.9. Its

sales are $150 million, and it has total assets of $60 million. What is its ROE?

4-6

ROE AND ROIC Baker Industries's net income is $24,000, its interest expense is $5,000, and

its tax rate is 25%. Its notes payable equals $27,000, long-term debt equals $75,000, and

common equity equals $250,000. The firm finances with only debt and common equity, so

it has no preferred stock. What are the firm's ROE and ROIC?

ate

4-7

DUPONT AND NET INCOME Precious Metal Mining has $17 million in sales, its ROE is

17%, and its total assets turnover is 3.2X. Common equity on the firm's balance sheet is

50% of its total assets. What is its net income?

4-8

4-9

BEP, ROE, AND ROIC Broward Manufacturing recently reported the following information:

Net income

$615,000

ROA

10%

Interest expense

$202,950

Accounts payable and accruals

$950,000

Broward's tax rate is 25%. Broward finances with only debt and common equity, so it has

no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested

capital is common equity. Calculate its basic earning power (BEP), its return on equity

(ROE), and its return on invested capital (ROIC).

M/B, SHARE PRICE, AND EV/EBITDA You are given the following information: Stockholders'

equity as reported on the firm's balance sheet

mon shares outstanding

value of totaldebt is $7 billion, the firm has cash and equivalents totaling $250 million, and

the firm's EBITDA equals $2 billion. What is the price of a share of the company's common

stock? What is the firm's EV/EBITDA?

4-10

$6.5 billion, price/earnings ratio = 9, com-

2.0. The firm's market

180 million, and market/book ratio

%3D

4-11

RATIO CALCULATIONS Assume the following relationships for the Caulder Corp.:

1.3X

Sales/Total assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning