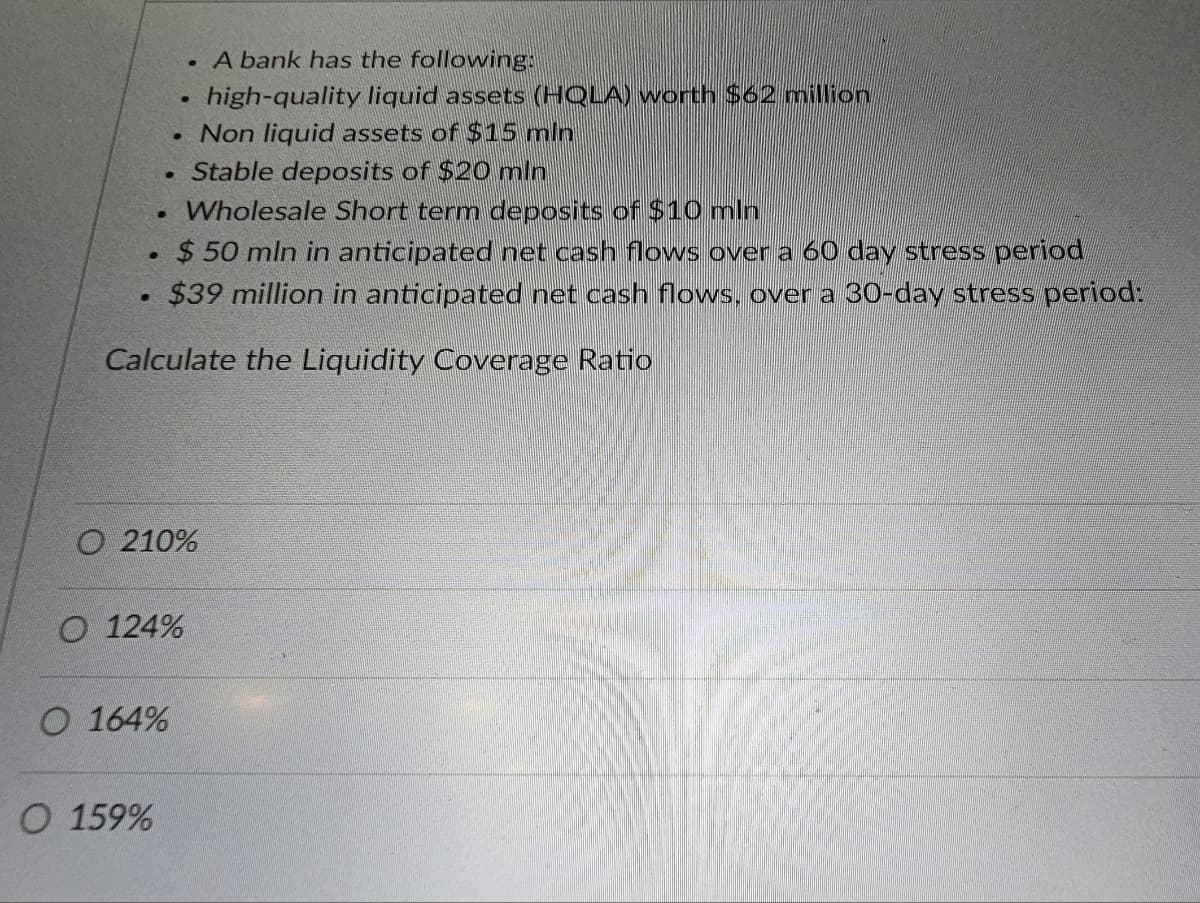

. A bank has the following: high-quality liquid assets (HQLA) worth $62 million . Non liquid assets of $15 mln . • • • Stable deposits of $20 min Wholesale Short term deposits of $10 mln $ 50 mln in anticipated net cash flows over a 60 day stress period $39 million in anticipated net cash flows, over a 30-day stress period: Calculate the Liquidity Coverage Ratio O 210% O 124% O 164% O 159%

Q: Union Local School District has a bond outstanding with a coupon rate of 2.9 percent paid…

A: Face value or maturity value = Z = $10,000Semiannual coupon amount = C = $145 (i.e. $10,000 * 0.029…

Q: Treasury bills are currently paying 6 percent and the inflation rate is 3.30 percent. What is the…

A: Nominal rate = 6%Inflation rate = 3.30%Approximate real rate = ?The real interest rate is the annual…

Q: 1a. Compute the average rate of return for each investment. If required, round your answer to one…

A: Capital budgeting is the process of allocating funds for large purchases that will increase your…

Q: How much will you owe at the end of 10 years and a month, if you decide to pay your yearly bonus at…

A: Here, Loan Amount$355,000.00Time Period in years15APR5.50%Compounding Period (Weekly)52Yearly Bonus…

Q: Lights, Camera, and More sells filmmaking equipment. The company offers three purchase options: (1)…

A: Payment todayPayment in one yearTotal paymentsOption 1$130,000.00$130,000.00Option…

Q: Ashley has a large and growing collection of animated movies. She wants to replace her old…

A: To solve this problem, we'll use the formula for the future value of an ordinary annuity: \[ FV = P…

Q: Maddox, a division of Stanley Enterprises, currently performs computer services for various…

A: Irrelevant costs are expenses that do not have any impact on the decision-making process. They do…

Q: Phoebe owns 200 shares in Optus Inc. Optus has 50 million shares outstanding that are trading at $3…

A: The objective of the question is to calculate the loss incurred by Phoebe due to the private…

Q: A game of chance offers the following odds and payoffs. Each play of the game costs $125, so the net…

A: When returns is determined without accounting for the cost of investment, it will be considered as…

Q: George is looking for a fully amortizing 30 year Fixed Rate Mortgage with monthly payments for $4,…

A: Term of loan = 30 yearsMonthly payment = $4500Interest rate = 2.13%Repaid in 5 years.To find:…

Q: At an output level of 76,000 units, you calculate that the degree of operating leverage is 3.3. The…

A: To calculate the percentage change in operating cash flow, we can use the formula: \[…

Q: Find the effective rate for a payday loan which charges $37.78 for a two week loan of $280. The…

A: The Effective Annual Rate (EAR) is the interest rate that is adjusted for compounding over a given…

Q: Clark Industries has a defined benefit pension plan that specifies annual, year-end retirement…

A: A defined benefit pension plan is a retirement arrangement where an employer commits to providing a…

Q: The index model has been estimated from the excess returns for stock A with the following results:…

A: RA12.00%+1.55Rm+eAσM24.00%σ(eA)18.50%

Q: Blooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a…

A: Equivalent Annual Cost (EAC) is a financial metric used to compare different investment or financing…

Q: you purchase a bond with an invoice price of $1025. the bond has a coupon rate of 5.51 percent, it…

A: A bond is an instrument of debt on which coupons are paid by the issuer. Coupons may be paid in…

Q: Year 0 1 2 3 Project A -$50,000 $24,200 $16,800 $46,500 Project B -$45,000 $39,000 $18,000 $18,000…

A: Capital budgeting refers to the process of analyzing, evaluating, and selecting the potentially…

Q: The common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past…

A: Time = 6 monthsCurrent price of stock = $120Exercise price of the call option = $120Premium of the…

Q: A 9-year project is expected to generate annual sales of 8,700 units at a price of $74 per unit and…

A: Operating cash flow represents the cash utilized by a company's core business activities,…

Q: Consider a three-year project with the following information: Initial fixed asset Investment =…

A: The sensitivity of Operating Cash Flow (OCF) refers to the degree to which OCF changes in response…

Q: 10. Assume a $50,000 investment and the following cash flows for two alternatives: Page 456 Year…

A: Payback period tracks how long it takes for an investment to recoup its initial cost, while NPV…

Q: Eric wants to invest in government securities that promise to pay $1,000 at maturity. The…

A: The objective of the question is to determine which of the two investment options, one that matures…

Q: A-Winery produces bottled wines for the hospitality industry in a four-stage process -Pumping,…

A: Solved Explanation:Step 1: Step 2: Step 3: Step 4:

Q: Consider a project to supply Detroit with 27,000 tons of machine screws annually for automobile…

A: To calculate the accounting, cash, and financial break-even quantities, we need to analyze the…

Q: What value would be placed on a stock that currently pays no dividend but is expected to start…

A: Year 5 dividend (D5) = $1Growth rate (g) = 0.05Discount rate (r) = 0.12Stock price at year 4 (P4) =…

Q: how to use texas instrument TI-30XIIs calculator to find the savings plan balance? ex: Find the…

A: Compound = Monthly = 12Time = t = 3 * 12 = 36Interest Rate = r = 3 / 12 = 0.25%Monthly Payment = p =…

Q: Two years ago, you purchased 203 shares of IBM stock for $147 a share. Today, you sold your IBM…

A: Profit per share is the difference between the sale price per share and the purchase price per…

Q: Suppose an investment has an initial capital cost of $1100, an ongoing cost of $6.50 per year and an…

A: The Internal rate of return is the discount rate at which the net present value of all cash flows…

Q: Strip Mining Incorporated can develop a new mine at an initial cost of $16 million. The mine will…

A: Cost in year 0 = $16 millionCash inflow in year 1 = $42 millionCost in year 2 = $27 millionTo find:…

Q: United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make…

A: Net present value refers to the method of capital budgeting used for evaluating the viability of the…

Q: Project CO C1 C2 IRR Alpha -400,000 241,000 293,000 21 21 Beta -200,000 131,000 172,000 31

A: To determine which project to choose between Alpha and Beta using the IRR (Internal Rate of Return)…

Q: Abuela Pastries operates a chain of bakeries and is considering the sprinkle cookie project, which…

A:

Q: Gary wants to save $555,000 in 5 years, he currently has $225,000 in an investment. Due to financial…

A: To find out the interest rate Gary needs to earn to achieve his goal, we can use the formula for…

Q: Emmons Corporation has a 0.0 probability of a return of 0.49, a 0.4 probability of a rate of return…

A: Expected Return is computed asRemaining probability = 1- (0.0 + 0.4) = 0.6Expected Return = (0.0 *…

Q: Duo Corporation is evaluating a project with the following cash flows: Year Cash Flow 0 -$ 15,200 1…

A: Cash flow in year 0 = -$15,200Cash flow in year 1 = $6300Cash flow in year 2 = $7500Cash flow in…

Q: Commercial banks are the principal providers of loan finance to the household sector. Identify five…

A: The question is asking to identify and explain five different types of loan finance that a bank…

Q: You are planning your retirement in 10 years. You currently have $161,000 in a bond account and…

A: The problem case focuses on calculating the annual withdrawal amount during the retirement period of…

Q: A loan is being repaid with level payments at the end of each year for 20 years. The principal…

A: Amortization is the systematic process of repaying a loan through a series of regular payments,…

Q: Data table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download…

A: The question provides a data table of the Modified Accelerated Cost Recovery System (MACRS) Fixed…

Q: 6. (14pts) When purchasing a $210,000 house, a borrower is comparing two loan alternatives. The…

A: The objective of the question is to calculate the incremental cost of borrowing extra money between…

Q: Metallica Bearings, Incorporated, is a young start-up company. No dividends will be paid on the…

A: Expected Dividend 10 years from today (D10) = $12Constant growth rate after 10 years (g) = 6% or…

Q: PLS HELP ASAP

A: “Since you have posted multiple questions, we will provide the solution only to the first question…

Q: You own a portfolio equally invested in a risk-free asset and two stocks. If one of the stocks has a…

A: The beta for the other stock is 1.59. Solution is provided in the explanation section. Hope this…

Q: Baker Corp. has a value of $60 million. Tucci is otherwise identical to Baker Corp., but has $24…

A: As per the MM theory the market value of the unlevered firm and levered firm remains same. In other…

Q: A couple is planning to finance its three-year-old son's university education. Money can be…

A: $166.22Explanation:Use the formula for the future value of a series of periodic deposits:FV = PMT ×…

Q: Suppose a stock had an initial price of $80 per share, paid a dividend of $.60 per share during the…

A: Return on stock % = 10.75%Explanation:Step 1:Total return on stock investmentReturns on stock…

Q: Suppose that Backwoods Chemical's book balance sheet is: Backwoods Chemical Company (Book Values)…

A: .The market price that investors would be prepared to pay for a company's debt is known as the…

Q: PLS HELP ASAP

A: Defined Benefit Pension Plans are retirement plans wherein the employer commits to providing…

Q: Finance, or financial management, requires the knowledge and precise use of the language of the…

A: The time value of money is the core valuation concept that accounts for the effects of compounding…

Q: Suppose the current spot rate for the Norwegian krone is NKr5.9433, while the expected inflation…

A: Spot rate for Norway (S) = 5.9433Expected inflation rate in Norway = 3.1%Expected inflation rate in…

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

- What is the PRESENT VALUE of a ₱20,000 single payment with annual rate of 12% to be compounded annually that will be received after 5 years? A. ₱11,348.54 B. ₱22,400.00 C. ₱32,000.00 D. ₱35,246.83 Which of the following is an operating cash inflow activities? A. Receipt of loan from bank B. Proceed from sale of fixed assets C. Collection of accounts receivables D. Issued shares of stocks Which part of financial planning is meeting with the heads of other department and get information from them pertaining to the tactics that might be able to develop? A. develop a plan B. gather the relevant data C. establish the objective D. implement the plan Statement 1: Long-term financial planning focuses on big picture, such as capital structure and capital budgeting. Statement 2: Short-term financial planning focuses on ensuring that business has enough cash to pay all its liabilities.…mekmek Corporation uses the Baumol Cash Model to determine its optimal cash balance. For the coming year, the expected cash disbursement total to P432,000. The interest rate on marketable securities is P8 per transaction. Using 5% carrying cost rate, what is the optimal cash balance of the company? A. 1,175.76 B. 5,878.78 C. 11,757.55 D. 142,000Calculate the amount of liquidity a bank can generate from selling its AFS portfolio using the following information:USTs held in AFS = $92,053,000Securities held in HTM = $13,500,000Loans = $69,680,000Settlement occurs on T+2Maturing on T+1 = $16,000,000Haircut = 5%USTs in AFS used as collateral for RP liabilities (i.e./ "encumbered") = $19,740,000 $56,313,000 $53,497,350 $52,697,350 $51,710,350

- 1. Makmak Corporation uses the Baumol Cash Management Model to determine its optimal cash balance. For the coming year, the expected cash disbursement total P432,000. The interest rate on marketable securities is 5% and P8 is the cost per transaction. What is the optimal Cash Balance of the company? 2. If Hot Tubs Inc. had annual credit sales of P2,027,773 and its days sales outstanding was equal to 35 days, what was its average A/R outstanding? (Use a 365-day year.)The following formula is used in determining its optimal level of cash. Assume that the fixed cost of selling marketable securities is P10 per transaction and the interest rate on marketable securities is 6% per year. The company estimates that it will make cash payments of P12,000 over a 1-month period. What is the average cash balance (rounded to the nearest peso)? (check the attached photo) choose the letter of the correct answer a. P1,732.00b. P3,464.00c. P6,928.00d. P8,660.00e. P15,588.00(a) Assume JPM has a Liquidity Coverage Ratio of 112%. Assume JPM's High Quality Liquid Assets total $750 billion, what is JPM's 30-day net cash outflow? What is JPM's 30-day net cash outflow? (b) At year - end, 2022, JPM total assets $3, 665,743, 000, 000 ($3.665 trillion). What fraction of total assets are risk - weighted?

- Njenge Bank has the following balance sheet (in millions) with the risk weights in parentheses. Assets Liabilities and Equity Cash (0%) K20 Deposits K175 OECD Interbank deposits (20%) K25 Subordinated debt (2.5 years) K3 Mortgage loans (50%) K70 Cumulative preferred stock K5 Consumer loans (100%) K70 Equity K2 Total Assets K185 Total Liabilities & Equity K185 In addition, the bank has K30 million in performance-related standby letters of credit (SLCs), and K300 million in six-year interest rate swaps. Credit conversion factors follow: Performance-related standby LCs 50%…Njenge Bank has the following balance sheet (in millions) with the risk weights in parentheses: Assets Liabilities and Equity Cash (0%) K20 Deposits K175 OECD Interbank deposits (20%) K25 Subordinated debt (2.5 years) K3 Mortgage loans (50%) K70 Cumulative preferred stock K5 Consumer loans (100%) K70 Equity K2 Total Assets K185 Total Liabilities & Equity K185 In addition, the bank has K30 million in performance-related standby letters of credit (SLCs), and K300 million in six-year interest rate swaps.…Njenge Bank has the following balance sheet (in millions) with the risk weights in parentheses. Assets Liabilities and Equity Cash (0%) K20 Deposits K175 OECD Interbank deposits (20%) K25 Subordinated debt (2.5 years) K3 Mortgage loans (50%) K70 Cumulative preferred stock K5 Consumer loans (100%) K70 Equity K2 Total Assets K185 Total Liabilities & Equity K185 In addition, the bank has K30 million in performance-related standby letters of credit (SLCs), and K300 million in six-year interest rate swaps. Credit conversion factors follow: Performance-related standby LCs 50%…

- Green Corporation anticipates a cash requirement of P1,500 over a 1- month period. It is expected that cash will be paid uniformly. The annual interest rate is 24 percent. The transaction cost of each borrowing or withdrawal is P30. (a) What is the optimal cash balance? (b) What is the average cash balance? CHOOSE THE CORRECT ANSWER FOR A AND B(A) P1,432.05 and (B) P566.03(A) P2,121.32 and (B) P8060.66(A) P1,121.32 and (B) P1060.66(A) P2,121.32 and (B) P1060.66(A) P1,732.05 and (B) P866.03V company's evaluation of its cash outlay required indicates that it needs P50,000 for the year. The marketable securities earn an annual rate of 2%. The company incurs P5 to convert marketable securities to cash. V company maintains buffer cash of 5,000 all throughout the year. 1. How much is the annual holding cost as a result of keeping cash in bank? 2. How much is the total annual cost of cash?A bank has an average asset duration of 5 years and an average liability duration of 3 years.This bank has total assets of $500 million and total liabilities of $250 million. Currently,market interest rates are 10 percent. If interest rates fall by 2 percent (to 8 percent), what isthis bank's change in net worth?6A. Net worth will decrease by $31.81 million.B. Net worth will increase by $31.81 million.C. Net worth will increase by $27.27 million.D. Net worth will decrease by $27.27 million.