The following formula is used in determining its optimal level of cash. Assume that the fixed cost of selling marketable securities is P10 per transaction and the interest rate on marketable securities is 6% per year. The company estimates that it will make cash payments of P12,000 over a 1-month period. What is the average cash balance (rounded to the nearest peso)? (check the attached photo) choose the letter of the correct answer a. P1,732.00 b. P3,464.00 c. P6,928.00 d. P8,660.00 e. P15,588.00

The following formula is used in determining its optimal level of cash. Assume that the fixed cost of selling marketable securities is P10 per transaction and the interest rate on marketable securities is 6% per year. The company estimates that it will make cash payments of P12,000 over a 1-month period. What is the average cash balance (rounded to the nearest peso)? (check the attached photo) choose the letter of the correct answer a. P1,732.00 b. P3,464.00 c. P6,928.00 d. P8,660.00 e. P15,588.00

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 13MC: Which of the following discounts future cash flows to their present value at the expected rate of...

Related questions

Question

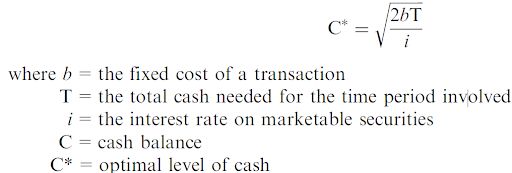

The following formula is used in determining its optimal level of cash. Assume that the fixed cost of selling marketable securities is P10 per transaction and the interest rate on marketable securities is 6% per year. The company estimates that it will make cash payments of P12,000 over a 1-month period. What is the average cash balance (rounded to the nearest peso)?

(check the attached photo)

choose the letter of the correct answer

a. P1,732.00

b. P3,464.00

c. P6,928.00

d. P8,660.00

e. P15,588.00

Transcribed Image Text:26T

C* =

!

where b = the fixed cost of a transaction

T = the total cash needed for the time period involved

i = the interest rate on marketable securities

C = cash balance

C* = optimal level of cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College