. All revenues shall be remitted to the BTr and included in the Special Fund, unless another law specifically requires otherwise. 2. Payments to government entities in the form of checks are not allowed. 3. Revenues of a government entity arise from exchange transactions only. 4 According to the GAM for NGAS, revenue from exchange transactions are measured at the amount of cash received. 5. When cash flows are deferred, the fair value of the consideration receivable is its present value. 6. The constructive remittance of taxes withheld through the TRA gives rise to the recognition of revenue. 7. According to the GAM for NGAS, the receipt of concessionary loans by government entities may give rise to revenue recognition.

. All revenues shall be remitted to the BTr and included in the Special Fund, unless another law specifically requires otherwise. 2. Payments to government entities in the form of checks are not allowed. 3. Revenues of a government entity arise from exchange transactions only. 4 According to the GAM for NGAS, revenue from exchange transactions are measured at the amount of cash received. 5. When cash flows are deferred, the fair value of the consideration receivable is its present value. 6. The constructive remittance of taxes withheld through the TRA gives rise to the recognition of revenue. 7. According to the GAM for NGAS, the receipt of concessionary loans by government entities may give rise to revenue recognition.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please help me to answer 1-10. thank you

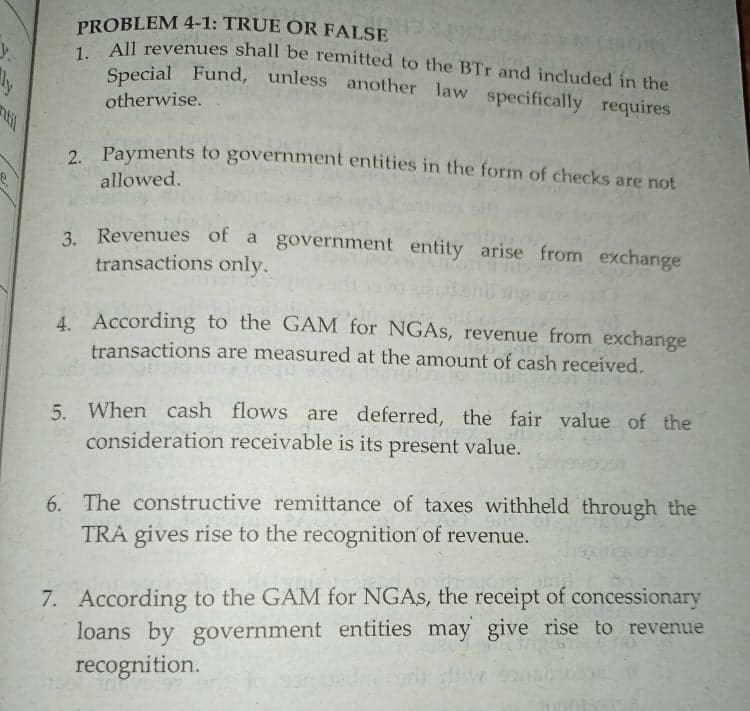

Transcribed Image Text:PROBLEM 4-1: TRUE OR FALSE

AIl revenues shall be remitted to the BTr and included in the

Special Fund, unless another law specifically requires

otherwise.

til

2. Payments to government entities in the form of checks are not

allowed.

3. Revenues of a government entity arise from exchange

transactions only.

4. According to the GAM for NGAS, revenue from exchange

transactions are measured at the amount of cash received.

5. When cash flows are deferred, the fair value of the

consideration receivable is its present value.

6. The constructive remittance of taxes withheld through the

TRA gives rise to the recognition of revenue.

7. According to the GAM for NGAS, the receipt of concessionary

loans by government entities may give rise to revenue

recognition.

Transcribed Image Text:Chapter

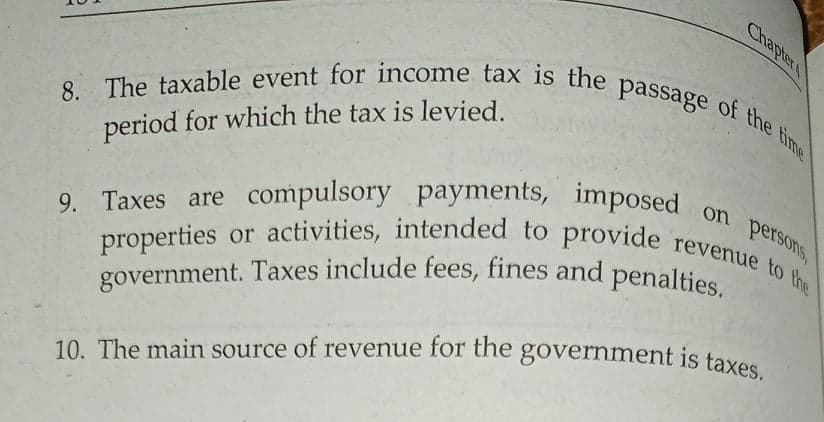

10. The main source of revenue for the government is taxes.

government. Taxes include fees, fines and penalties.

9. Taxes are compulsory payments, imposed on perSoNs,

8. The taxable event for income tax is the passage of the time

properties or activities, intended to provide revenue to the

period for which the tax is levied.

9. Taxes are compulsory payments, imposed

10. The main source of revenue for the government is taxes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education