. Nonconstant growth stock s companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the kpected growth rate to increase or decrease, thereby affecting the valuation model. For companies in such situations, you would refer to the variable nonconstant, growth model for the valuation of the company's stock. onsider the case of Portman Industries: ortman Industries just paid a dividend of $2.88 per share. The company expects the coming year to be very profitable, and its dividend is expected grow by 20.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate of 4.00% per year. ssuming that the market is in equilibrium, use the information just given to complete the table. Term Value Dividends one year from now (D1) $3.46 Horizon value (P¡) $29.32 Intrinsic value of Portman's stock $29.34 ▼ e risk-free rate (rRF) is 5.00%, the market risk premium (RPM) is 6.00%, and Portman's beta is 1.80. hat is the expected dividend yield for Portman's stock today? 13.13% 9.43% O 11.79% 11.34%

. Nonconstant growth stock s companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the kpected growth rate to increase or decrease, thereby affecting the valuation model. For companies in such situations, you would refer to the variable nonconstant, growth model for the valuation of the company's stock. onsider the case of Portman Industries: ortman Industries just paid a dividend of $2.88 per share. The company expects the coming year to be very profitable, and its dividend is expected grow by 20.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate of 4.00% per year. ssuming that the market is in equilibrium, use the information just given to complete the table. Term Value Dividends one year from now (D1) $3.46 Horizon value (P¡) $29.32 Intrinsic value of Portman's stock $29.34 ▼ e risk-free rate (rRF) is 5.00%, the market risk premium (RPM) is 6.00%, and Portman's beta is 1.80. hat is the expected dividend yield for Portman's stock today? 13.13% 9.43% O 11.79% 11.34%

Chapter15: Harvesting The Business Venture Investment

Section: Chapter Questions

Problem 6EP

Related questions

Question

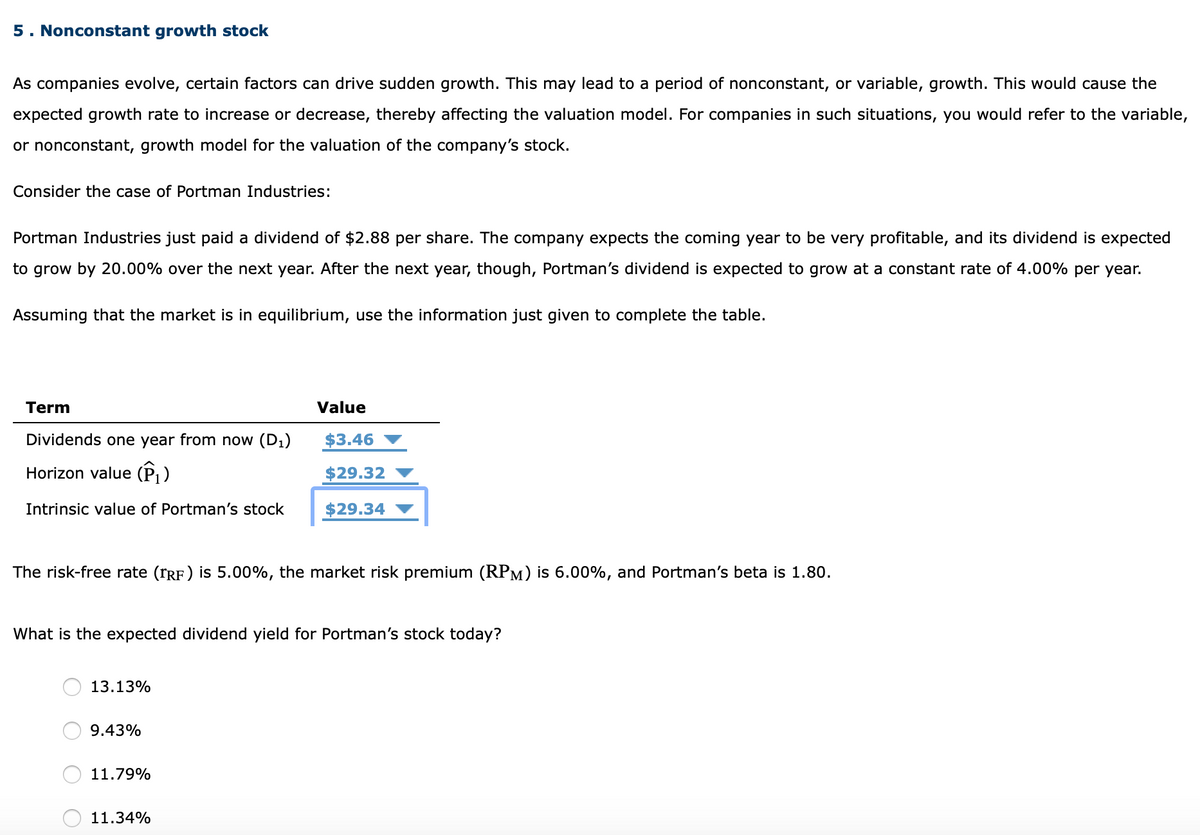

Transcribed Image Text:5. Nonconstant growth stock

As companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the

expected growth rate to increase or decrease, thereby affecting the valuation model. For companies in such situations, you would refer to the variable,

or nonconstant, growth model for the valuation of the company's stock.

Consider the case of Portman Industries:

Portman Industries just paid a dividend of $2.88 per share. The company expects the coming year to be very profitable, and its dividend is expected

to grow by 20.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate of 4.00% per year.

Assuming that the market is in equilibrium, use the information just given to complete the table.

Term

Value

Dividends one year from now (D1)

$3.46

Horizon value (P)

$29.32

Intrinsic value of Portman's stock

$29.34 ▼

The risk-free rate (rRF) is 5.00%, the market risk premium (RPM) is 6.00%, and Portman's beta is 1.80.

What is the expected dividend yield for Portman's stock today?

13.13%

9.43%

11.79%

11.34%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning