. (Replicating strategy for pricing) To price a derivative, we can use risk-neutral pricing. As an alternative yet equivalent method, we can construct price the derivative using replicating strategies. Consider a 1-period binomial model, where we have three nodes No,0, N1,0, N1,1. We have a cash account with fixed interest rate r = 0.01 - that is, if we have at No,o cash account with D dollars, we expect (1 + r)D at either N1,0 or N1,1. We also have a stock with price S0,0 = 10 at No,0, S1,0 = 8 at N1,0 and $1,1 = 15 at N₁,1. Now consider an European call option at time t = 1 with strike K = 12. Can you price the option at No,o using a replicating strategy, and what is the price? Please submit your answer rounded to only one decimal digit - for example if your answer is 1.28, then submit 1.3. If your answer is 1.12, submit 1.1.

. (Replicating strategy for pricing) To price a derivative, we can use risk-neutral pricing. As an alternative yet equivalent method, we can construct price the derivative using replicating strategies. Consider a 1-period binomial model, where we have three nodes No,0, N1,0, N1,1. We have a cash account with fixed interest rate r = 0.01 - that is, if we have at No,o cash account with D dollars, we expect (1 + r)D at either N1,0 or N1,1. We also have a stock with price S0,0 = 10 at No,0, S1,0 = 8 at N1,0 and $1,1 = 15 at N₁,1. Now consider an European call option at time t = 1 with strike K = 12. Can you price the option at No,o using a replicating strategy, and what is the price? Please submit your answer rounded to only one decimal digit - for example if your answer is 1.28, then submit 1.3. If your answer is 1.12, submit 1.1.

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 32QA

Related questions

Question

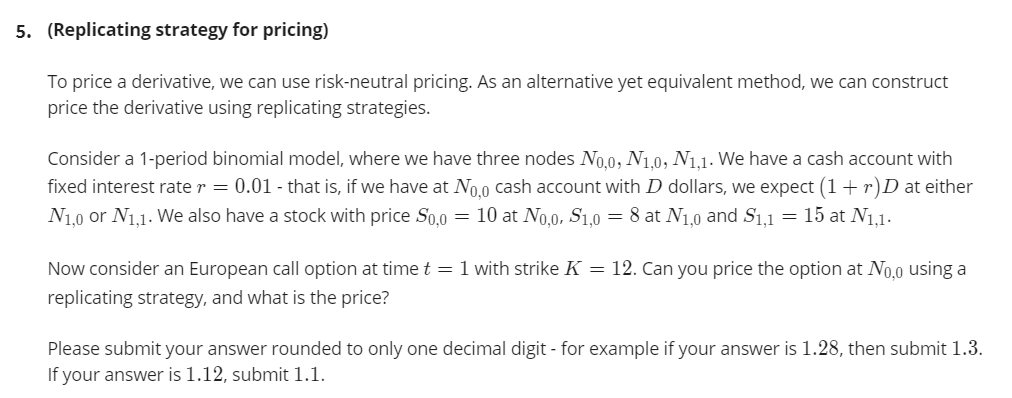

Transcribed Image Text:5. (Replicating strategy for pricing)

To price a derivative, we can use risk-neutral pricing. As an alternative yet equivalent method, we can construct

price the derivative using replicating strategies.

Consider a 1-period binomial model, where we have three nodes No.0, N1.0, N1.1. We have a cash account with

fixed interest rate r = 0.01 - that is, if we have at No.0 cash account with D dollars, we expect (1+ r)D at either

N1.0 or N1.1. We also have a stock with price S0.0

10 at No,0, S1,0 = 8 at N1,0 and S1,1

= 15 at N1,1.

Now consider an European call option at time t = 1 with strike K = 12. Can you price the option at No.0 using a

replicating strategy, and what is the price?

Please submit your answer rounded to only one decimal digit - for example if your answer is 1.28, then submit 1.3.

If your answer is 1.12, submit 1.1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you