. Calculate the present value of the $580,000 future cash benefit. Assuming that the retirement benefit is the only consideration in making the retirement decision, should Ms. Trevino accept her employer’s offer? (Round your final answer to the nearest whole dollar value.)

. Calculate the present value of the $580,000 future cash benefit. Assuming that the retirement benefit is the only consideration in making the retirement decision, should Ms. Trevino accept her employer’s offer? (Round your final answer to the nearest whole dollar value.)

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter6: Losses And Loss Limitations

Section: Chapter Questions

Problem 3BD

Related questions

Question

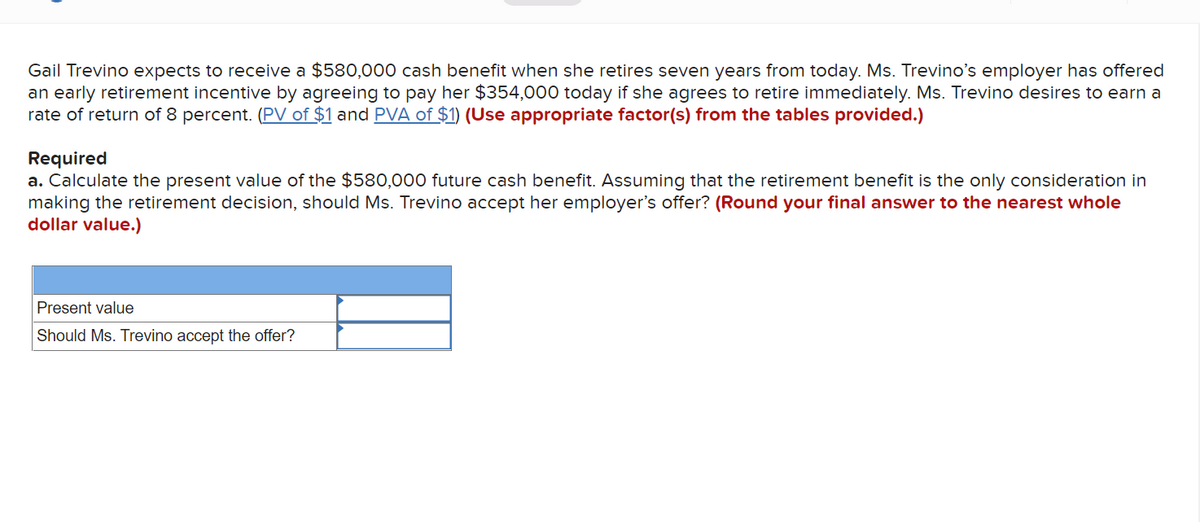

Gail Trevino expects to receive a $580,000 cash benefit when she retires seven years from today. Ms. Trevino’s employer has offered an early retirement incentive by agreeing to pay her $354,000 today if she agrees to retire immediately. Ms. Trevino desires to earn a

Required

a. Calculate the present value of the $580,000 future cash benefit. Assuming that the retirement benefit is the only consideration in making the retirement decision, should Ms. Trevino accept her employer’s offer? (Round your final answer to the nearest whole dollar value.)

Transcribed Image Text:Gail Trevino expects to receive a $580,000 cash benefit when she retires seven years from today. Ms. Trevino's employer has offered

an early retirement incentive by agreeing to pay her $354,000 today if she agrees to retire immediately. Ms. Trevino desires to earn a

rate of return of 8 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.)

Required

a. Calculate the present value of the $580,000 future cash benefit. Assuming that the retirement benefit is the only consideration in

making the retirement decision, should Ms. Trevino accept her employer's offer? (Round your final answer to the nearest whole

dollar value.)

Present value

Should Ms. Trevino accept the offer?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT