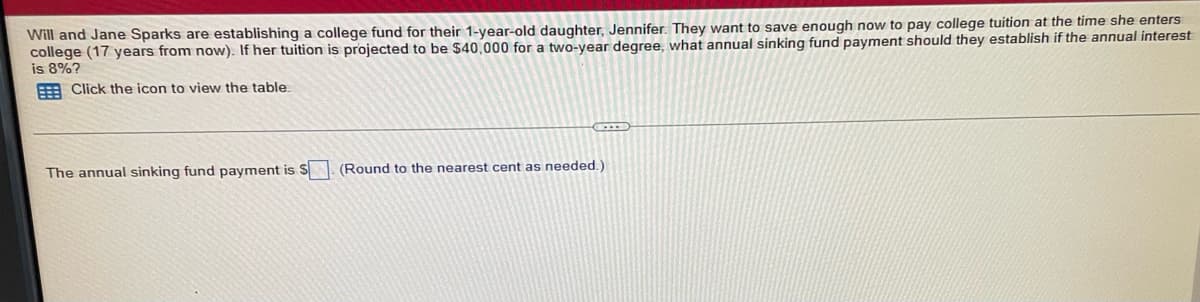

Will and Jane Sparks are establishing a college fund for their 1-year-old daughter, Jennifer. They want to save enough now to pay college tuition at the time she enters college (17 years from now). If her tuition is projected to be $40,000 for a two-year degree, what annual sinking fund payment should they establish if the annual interes is 8%? Click the icon to view the table. The annual sinking fund payment is S (Round to the nearest cent as needed.)

Will and Jane Sparks are establishing a college fund for their 1-year-old daughter, Jennifer. They want to save enough now to pay college tuition at the time she enters college (17 years from now). If her tuition is projected to be $40,000 for a two-year degree, what annual sinking fund payment should they establish if the annual interes is 8%? Click the icon to view the table. The annual sinking fund payment is S (Round to the nearest cent as needed.)

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 33P

Related questions

Question

Transcribed Image Text:enters

Will and Jane Sparks are establishing a college fund for their 1-year-old daughter, Jennifer. They want to save enough now to pay college tuition at the time she

college (17 years from now). If her tuition is projected to be $40,000 for a two-year degree, what annual sinking fund payment should they establish if the annual interest

is 8%?

Click the icon to view the table.

The annual sinking fund payment is S. (Round to the nearest cent as needed.)

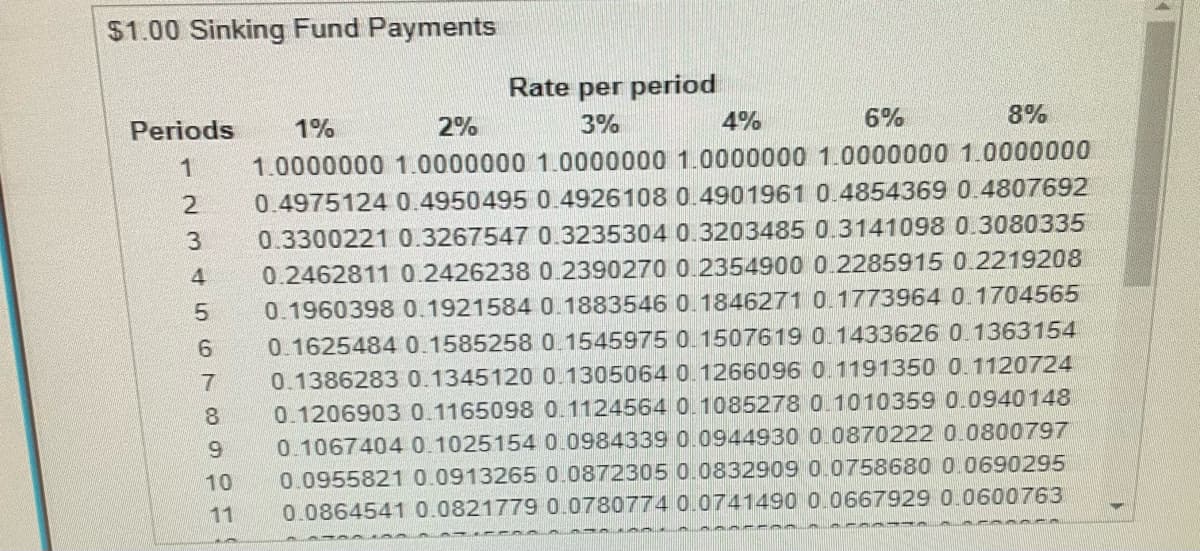

Transcribed Image Text:$1.00 Sinking Fund Payments

Periods

1

4%

6%

8%

2%

1%

2

1.0000000 1.0000000 1.0000000 1.0000000 1.0000000 1.0000000

0.4975124 0.4950495 0.4926108 0.4901961 0.4854369 0.4807692

3 0.3300221 0.3267547 0.3235304 0.3203485 0.3141098 0.3080335

0.2462811 0.2426238 0.2390270 0.2354900 0.2285915 0.2219208

0.1960398 0.1921584 0.1883546 0.1846271 0.1773964 0.1704565

0.1625484 0.1585258 0.1545975 0.1507619 0.1433626 0.1363154

0.1386283 0.1345120 0.1305064 0.1266096 0.1191350 0.1120724

0.1206903 0.1165098 0.1124564 0.1085278 0.1010359 0.0940148

0.1067404 0.1025154 0.0984339 0.0944930 0.0870222 0.0800797

0.0955821 0.0913265 0.0872305 0.0832909 0.0758680 0.0690295

0.0864541 0.0821779 0.0780774 0.0741490 0.0667929 0.0600763

456

7

8

Rate per period

3%

9

10

11

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning