1-15. Tropical Tours is considering an expansion of its operations, which will require the company to issue new debt and equity. Tropical’s investment banker provided the following information about the cost of issuing new debt: If Tropical’s capital structure consists of 60 percent debt, what WACC break points are associated with issuing new debt? (LO 11-2)

Q: i. Derive the revenue function. ii. Derive a cost function. iii. What is the total cost of producing…

A: Revenue function gives an equation to determine the revenue generated from selling a good.This is…

Q: Phil Pittman is interested in a fixed-rate mortgage for $200,000. He is undecided whether to choose…

A: Given,

Q: Maturity (years) 1 1-year Forward rate (%) 0-years from now 1.25 1-year from now 1.75 2-years from…

A: Using the binomial model, we have to estimate the lower one year forward rate, one year from now.…

Q: A merchant puts in his P3,000.00 to a small business for a period of six years. With a given…

A: Information Provided: Present value = P 3,000.00 Period of investment = 6 years Interest rate = 20%…

Q: 7) A businessman wants to buy a truck. The dealer offers to sell the truck for either $120,000 now,…

A: The equipment are purchased on the loans from the dealers and these loans are paid by the equal…

Q: re correct except C. I typed the answer an

A: Dupont equation is used to calculate the relation between the net profit margin and sales and equity…

Q: What is your Excel RATE of an investment that earns 12% compounded quarterly? 1% 12%…

A: Quarter comprise of 3 months In a year they are 4 quarters

Q: Willie just bought a home and financed his purchase with a $1,000,000 6% 20- year mortgage. (a) What…

A: Mortgage A loan that helps to obtain funds to buy a long-term asset such as a house or real estate…

Q: In 2015, the UGBS embarked on a project. The project will receive annual inflows of GHC 30,000 from…

A: Net present value refers to the comparison of present values of all cashflows with its initial…

Q: Company Z has $ 720472 in annual fixed costs. The primary product generates $ 87.89 in revenue per…

A: We will use the concept of cost volume profit analysis here. This analysis is also known as CVP…

Q: (a) The bid and ask prices of physical platinum are currently trading at $1,050 / $1,060 per troy…

A: Given: Current price = $1,050/$1,060 Storage cost = $10 per toy Interest rate = 4.6% Periods = 12

Q: An asset used in a 4-year project falls in the 5-year MACRS class for tax purposes. The asset has an…

A: Original cost of asset = $9,300,000 Sale price of asset = $2,760,000 Tax rate = 0.22 or 22% Asset…

Q: the following stateme ) In general, money today is worth more than money in one year. ) We define…

A: Given: From the given statements whether the identified the time value of money.

Q: You invested $90,000 in a mutual fund at the beginning of the year when the NAV was $54.3. At the…

A: Mutual fund is created by accumulating funds from different small investors. Such collection is…

Q: Dahlia Corporation has a current accounts receivable balance of $337,800. Credit sales for the year…

A: Answer - Receivable Turnover - The accounts receivable turnover ratio determines how many times…

Q: Discuss the importance of financial statements in the strategic planning process of an…

A: Strategic planning refers to the process in which helps of the management decides the goals and…

Q: A rich donor gives a hospital $1,040,000 one year from today. Each year after that, the…

A: First donation (F) = $1,040,000 Growth rate (g) = 0.06 Interest rate (r) = 0.11 Period (n) = 10…

Q: Assume that in 20X2, sales increase by 10 percent and cost of goods sold increases by 20 percent.…

A: Data: Description Amount ($) Sales ($) 2800000 Revised sales after 10% increase in 20X2…

Q: The accumulation function for fund X is given by: ax(t) = 1 + 0.5t. The accumulation function for…

A: We have the accumulation function for two funds. At a given time T, they have the same force of…

Q: Calculate the annual interest (in $) and current yield (as a %) of the bond. (Round your percentage…

A: The coupon rate is the interest rate used to determine the interest payment on a bond. The coupon…

Q: Solve Problem 20.24 using Excel.

A: The NPV analysis is used to measure a project’s profitability by discounting future cash flows to…

Q: A BANK CHARGES 15% SIMPLE INTEREST ON A P500.00 LOAN. HOW MUCH WILL BE REPAID IF THE LOAN IS PAID…

A: Present Worth P 500.00 Interest Rate 15% Time Period (Months) 3

Q: An asset used in a 4-year project falls in the 5-year MACRS class for tax purposes. The asset has an…

A: Given Asset is 5 year class Cost of acquisition is 88L Carrying value at the end of project life is…

Q: Domenic is 20 years old and wishes to secure his future by saving $300 per week into an investment…

A: Savings per week is $300 Interest rate is 6.25% Compounded weekly Time deriod is 30 years To Find:…

Q: What is the payback period on each of the above projects? Given that you wish to use the payback…

A: As per Bartleby Honor Code, when a question with multiple sub-parts is asked, the expert is required…

Q: 3) How do you calculate (mathematically) the present value (PV) of a(n): (a) perpetuity (b) annuity…

A: The present value is the equivalent amount that is equivalent today considering the time and…

Q: Which of the following is not one of the three primary credit bureaus? Group of answer choices A.…

A: At the time of providing credit facilities to customers, credit bureaus play very important role.…

Q: Congratulations! You have just signed a contract to purchase your first home. Your purchase price is…

A: As per the given information; Purchase price - $300,000 Down payment - 20% To determine: a 15-year…

Q: What does the CF stand for?

A: Solution:- Mean, median and mode are measures of averages of data.

Q: Fernando invested money in a 3-yr CD (certificate of deposit) that returned the equivalent of 6.5%…

A: Investment in 30 m Cd is X - 3000 Let Investment in 3yr CD is. X Total interest earned is 1075 Then…

Q: In 1998, Hepler Company's sales were $26 million and its total assets were $10 million. Current…

A: A company is expecting growth in sales driven by additional assets. We have to find the amount of…

Q: The market value of the equity of Nina, Incorporated, is $594,000. The balance sheet shows $33,000…

A: Enterprise value (EV) is also known as firm value. Essentially it is a measure of a company’s total…

Q: Use up to 6 decimal places during solving for the answer. Write all numerical final answers round…

A:

Q: th 1. What single payment on the 6 year will settle debts of Php th 10,000due in 4 years, and Php…

A: Amount due in 4 years (P4) = Php10,000 Amount due in 8 years (P4) = Php15,000 Quarterly interest…

Q: You are investing $500 per month in an account where you expect a long term growth rate of 6%…

A: The concept of TVM states that money today is worth more than the same amount in the future because…

Q: Prove that it is feasible using 1. ANNUAL WORTH METHOD 2. PAYBACK METHOD Rate of interest = 10%

A: Cash flow diagram

Q: You are given the following information on three funds. The risk free rate is 6 %. Calculate the…

A: With the information given we can calculate 2 differential return measure:1. Sharpe Ratio2.…

Q: Select all the TRUE statements The goal of the corporate financial manager is to maximize the…

A: The Ask price of a stock is the minimum price at which the seller agrees to sell the stock. The Bid…

Q: The firm is considering increasing its debt by $900,000, using the proceeds to buy back 90,000…

A: There are many ways for a company to improve its financial health. One of the methods used by…

Q: * You are offered the choice between receiving X dollars light years from now or receiving $400.00…

A:

Q: I’m wanting to buy a call option. I have the prices of 13 calls and the strike prices & the…

A: Call options and the factors that affect them: Call options give their holders the right but, not…

Q: Sales Net income (after taxes) Assets Medical Supplies $ 20,400,000 2,190,000 8,590,000 Medical…

A: The return on sales is the measure of a company’s profitability as it shows how much of the revenue…

Q: (DuPont analysis) Triangular Chemicals has total assets of $103 million, a return on equity of 41…

A: In the above question we are given: Total assets=103 million Return on equity=41% Net profit…

Q: Suppose that Alex's benefit to the game is $128. Suppose further that Alex already bought a ticket…

A: In the given question A has two options i) Go to the work ii) Go to the game Benefit from the game…

Q: a. What is the times-interest-earned ratio? Note: Round your answer to 2 decimal places. Times…

A: In finance we use financial ratios often. This is done to determine the financial position and…

Q: Assume benefit is unchanged, how to manipulate the cost to have positive NPV (net present value)

A: Net Present Value is the difference between PV of all cash inflows (benefits) and PV of all cash…

Q: Jolie Foster Care Homes Incorporated shows the following data: Total Assets $ 2,330,000 2,050,000…

A: Answer - Return of Net Income to Total Assets - Return on assets is a financial ratio that depicts…

Q: A trader buys a call option on a share for K2. The stock price is K25 and the strike price is K20.…

A: Future contracts are those agreements or contracts which are entered today but these are for future…

Q: The maintenance for a bus, whose life is 10 years, is $1500 per year starting the fourth year,…

A: Present worth is the discounted value of all the future cash flows to the present using appropriate…

Q: A trader buys a call option on a share for K2. The stock price is K25 and the strike price is K20.…

A: Call option gives the holder the right but not the obligation to buy at the strike price. A call…

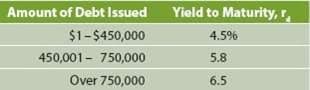

11-15. Tropical Tours is considering an expansion of its operations, which will require the company to issue new debt and equity. Tropical’s investment banker provided the following information about the cost of issuing new debt:

If Tropical’s capital structure consists of 60 percent debt, what WACC break points are associated with issuing new debt? (LO 11-2)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Klynveld Companys balance sheet shows total liabilities of 94,000,000, total stockholders equity of 75,000,000, and total assets of 169,000,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.Category Prior Year Current Year Accounts payable 3,123.00 5,969.00 Accounts receivable 6,987.00 8,940.00 Accruals 5,642.00 6,108.00 Additional paid in capital 19,885.00 13,325.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,986.00 18,120.00 Current portion long-term debt 500 500 Depreciation expense 1,035.00 988.00 Interest expense 1,290.00 1,167.00 Inventories 3,006.00 6,743.00 Long-term debt 16,856.00 22,001.00 Net fixed assets 75,521.00 74,000.00 Notes payable 4,072.00 6,540.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,244.00 34,874.00 Sales 46,360 45,055.00 Taxes 350 920 What is the firm's cash flow from financing?Category Prior Year Current Year Accounts payable 3,147.00 5,976.00 Accounts receivable 6,925.00 8,910.00 Accruals 5,635.00 6,187.00 Additional paid in capital 19,527.00 13,950.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,974.00 18,270.00 Current portion long-term debt 500 500 Depreciation expense 975.00 976.00 Interest expense 1,278.00 1,155.00 Inventories 3,048.00 6,717.00 Long-term debt 16,569.00 22,919.00 Net fixed assets 75,968.00 73,882.00 Notes payable 4,045.00 6,584.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,870.00 34,759.00 Sales 46,360 45,347.00 Taxes 350 920 What is the firm's cash flow from operations? What is the firm's dividend payment in the current year? What is the firm's net income in the current year?

- PROBLEM 8:Tomas Co. has the following balance sheet as of December 31, 2021.Current assets 180,000.00Fixed assets 120,000.00Total assets 300,000.00Accounts payable 40,000.00Accrued liabilities 20,000.00Notes payable 50,000.00Other Long-term debt 75,000.00Total Equity 115,000.00Total liabilities and equity 300,000.00 In 2021, Tomas Co. reported sales of P1,500,0000, net income of P30,000, and dividends of P18,000. The company expected its sales to increase by 20% by next year and its retention ratio will remain at 40%. Assume that Tomas Co. is operating at full capacity and it uses the AFN approach in determining the amount of external financing needed.How much is the sales for 2022? Using Problem 8, how much is the increase in retained earnings for the purpose of computing the AFN? Using Problem 8, how much external funds needed for the year 2022?Total Debt = 800,000; Income before Income Taxes and Interest Expense = 100,000; Total Assets = 1,000,000. How much is the Debt to Total Assets Ratio?BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 What is the firms ROE (Return on Equity)?Group of answer choices 9.45% 9.63% 9.84% 10.20%

- BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 Question 9 What is the firm's Debt Ratio? Group of answer choices 60.0% 65.0% 70.0% 75.0% Question 10 What is the firm's Inventory Turnover? 4.41 4.55 4.69 4.83 Question 11 What is the firm's DPS…BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 Question 5 What is the firm's EBITDA coverage? Group of answer choices 3.51 3.69 3.88 4.17 Question 6 What is the firms DSO (Days Sales Outstanding)? Group of answer choices 51.30 days 52.80 days 53.50…21. Kinsella Corporation's statement of financial position showed the following amounts: current liabilities, $75,000; total liabilities, $100,000; total assets, $200,000. What is the total long-term debt to total equity ratio? a.0.375 b.0.125 c.0.75 d.0.25

- Delta GMBH’s ROE is 8.9 percent. Sales are $2,956,000.00. Total debt ratio is 0.3743. Total debt is $964,000.00. Determine the return on assets (ROA).Category Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,139.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,349.00 Interest expense 40,500 41,741.00 Inventories 279,000 288,000 Long-term debt 337,728.00 398,725.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,280.00 Retained earnings 306,000 342,000 Sales 639,000 847,106.00 Taxes 24,750 48,618.00 What is the current year's return on assets (ROA)? (Round to 4 decimal places.)Particulars As on 31.3.2019(Rupees. In Lacs)As on 31.3.2020(Rupees. In Lacs)Investment in FinancialAssets- 100Equity Share Capital 150 160Long term Loans taken 100 200Dividend paid - 26Dividend received - 10Interest received - 15 Calculate the debt-equity ratio & comment