the following stateme ) In general, money today is worth more than money in one year. ) We define the risk-free interest rate (rf) for a given period as the interest rate at w honey can be borrowed or lent without risk over that period. ) We refer to (1-r) as the interest rate factor for risk-free cash flows. ) For most financial decisions, costs and benefits occur at different points in time. time value of

the following stateme ) In general, money today is worth more than money in one year. ) We define the risk-free interest rate (rf) for a given period as the interest rate at w honey can be borrowed or lent without risk over that period. ) We refer to (1-r) as the interest rate factor for risk-free cash flows. ) For most financial decisions, costs and benefits occur at different points in time. time value of

Chapter4: Time Value Of Money

Section4.12: Uneven, Or Irregular, Cash Flows

Problem 3ST

Related questions

Question

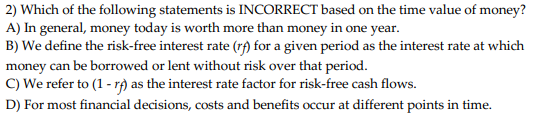

Transcribed Image Text:2) Which of the following statements is INCORRECT based on the time value of money?

A) In general, money today is worth more than money in one year.

B) We define the risk-free interest rate (rf) for a given period as the interest rate at which

money can be borrowed or lent without risk over that period.

C) We refer to (1-r) as the interest rate factor for risk-free cash flows.

D) For most financial decisions, costs and benefits occur at different points in time.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning