1, 40,000 shares issued $ d share is converted into 2 common shares) ed number of shares authorized, ding at December 31, 2019 (assume this of 2000)

1, 40,000 shares issued $ d share is converted into 2 common shares) ed number of shares authorized, ding at December 31, 2019 (assume this of 2000)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 22E

Related questions

Question

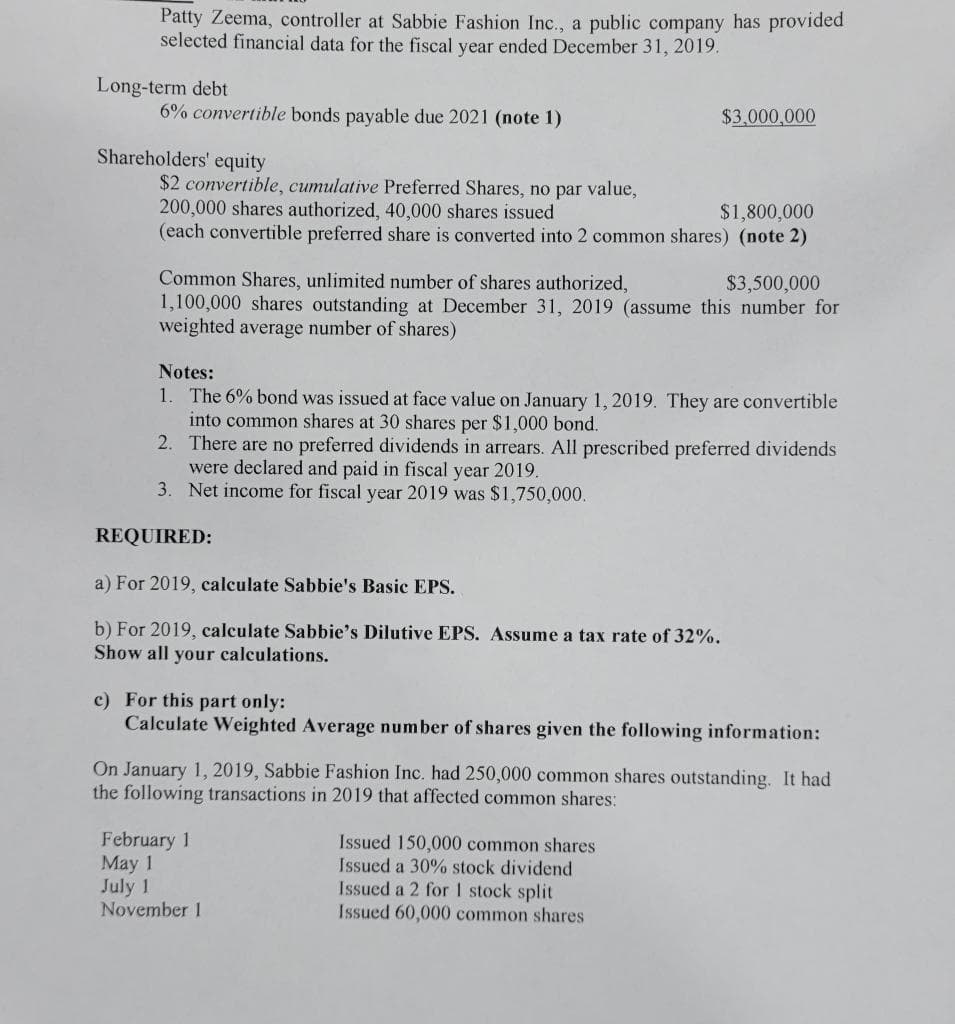

Transcribed Image Text:Patty Zeema, controller at Sabbie Fashion Inc., a public company has provided

selected financial data for the fiscal year ended December 31, 2019.

Long-term debt

6% convertible bonds payable due 2021 (note 1)

$3,000,000

Shareholders' equity

$2 convertible, cumulative Preferred Shares, no par value,

200,000 shares authorized, 40,000 shares issued

(each convertible preferred share is converted into 2 common shares) (note 2)

$1,800,000

Common Shares, unlimited number of shares authorized,

1,100,000 shares outstanding at December 31, 2019 (assume this number for

weighted average number of shares)

$3,500,000

Notes:

1. The 6% bond was issued at face value on January 1, 2019. They are convertible

into common shares at 30 shares per $1,000 bond.

2. There are no preferred dividends in arrears. All prescribed preferred dividends

were declared and paid in fiscal year 2019.

3. Net income for fiscal year 2019 was $1,750,000.

REQUIRED:

a) For 2019, calculate Sabbie's Basic EPS.

b) For 2019, calculate Sabbie's Dilutive EPS. Assume a tax rate of 32%.

Show all your calculations.

c) For this part only:

Calculate Weighted Average number of shares given the following information:

On January 1, 2019, Sabbie Fashion Inc. had 250,000 common shares outstanding. It had

the following transactions in 2019 that affected common shares:

February 1

May 1

July 1

November 1

Issued 150,000 common shares

Issued a 30% stock dividend

Issued a 2 for I stock split

Issued 60,000 common shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning