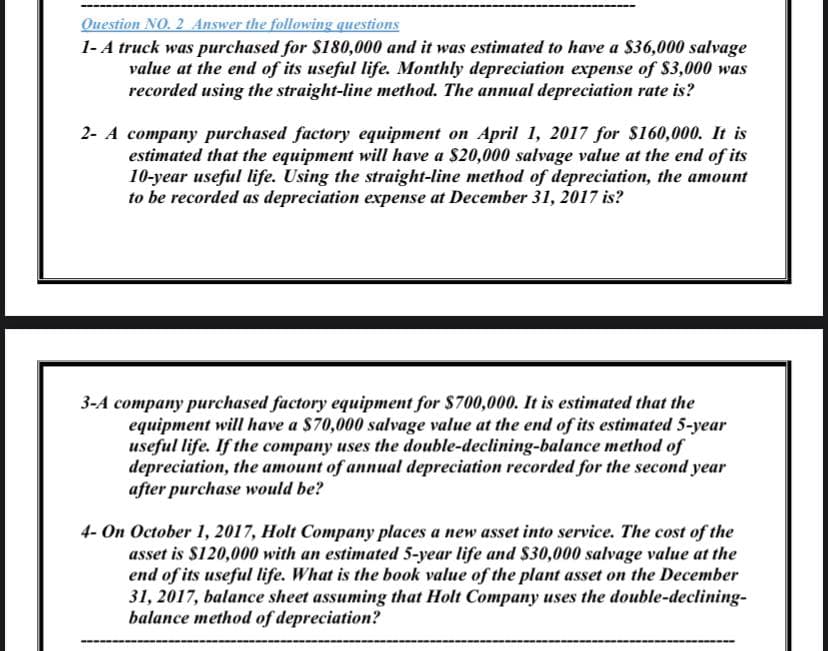

1-A truck was purchased for $180,000 and it was estimated to have a $36,000 salvage value at the end of its useful life. Monthly depreciation expense of $3,000 was recorded using the straight-line method. The annual depreciation rate is? 2- A company purchased factory equipment on April 1, 2017 for $160,000. It is estimated that the equipment will have a $20,000 salvage value at the end of its 10-year useful life. Using the straight-line method of depreciation, the amount to be recorded as depreciation expense at December 31, 2017 is? 3-A company purchased factory equipment for $700,000. It is estimated that the equipment will have a $70,000 salvage value at the end of its estimated 5-year useful life. If the company uses the double-declining-balance method of depreciation, the amount of annual depreciation recorded for the second year after purchase would be?

1-A truck was purchased for $180,000 and it was estimated to have a $36,000 salvage value at the end of its useful life. Monthly depreciation expense of $3,000 was recorded using the straight-line method. The annual depreciation rate is? 2- A company purchased factory equipment on April 1, 2017 for $160,000. It is estimated that the equipment will have a $20,000 salvage value at the end of its 10-year useful life. Using the straight-line method of depreciation, the amount to be recorded as depreciation expense at December 31, 2017 is? 3-A company purchased factory equipment for $700,000. It is estimated that the equipment will have a $70,000 salvage value at the end of its estimated 5-year useful life. If the company uses the double-declining-balance method of depreciation, the amount of annual depreciation recorded for the second year after purchase would be?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.5E: Change in Estimate Assume that Bloomer Company purchased a new machine on January 1, 2016, for...

Related questions

Question

the question in the attached file

thanks

Transcribed Image Text:Ouestion NO. 2 Answer the following questions

1-A truck was purchased for $180,000 and it was estimated to have a $36,000 salvage

value at the end of its useful life. Monthly depreciation expense of $3,000 was

recorded using the straight-line method. The annual depreciation rate is?

2- A company purchased factory equipment on April 1, 2017 for S160,000. It is

estimated that the equipment will have a $20,000 salvage value at the end of its

10-year useful life. Using the straight-line method of depreciation, the amount

to be recorded as depreciation expense at December 31, 2017 is?

3-A company purchased factory equipment for $700,000. It is estimated that the

equipment will have a $70,000 salvage value at the end of its estimated 5-year

useful life. If the company uses the double-declining-balance method of

depreciation, the amount of annual depreciation recorded for the second year

after purchase would be?

4- On October 1, 2017, Holt Company places a new asset into service. The cost of the

asset is S120,000 with an estimated 5-year life and $30,000 salvage value at the

end of its useful life. What is the book value of the plant asset on the December

31, 2017, balance sheet assuming that Holt Company uses the double-declining-

balance method of depreciation?

-------

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,