1. On January 2, 2017, Greenwood Company purchased and placed in operation a machine estimated to have a 10-year life and no salvage value. The machine cost P600,000 and was depreciated on a straight-line basis. On December 27, 2020, a P60,000 device that incroased the machine's output by one fourth was added to the machine. The new device made no change in the rnachine's estimated life and salvage value. During the first week of January, 2024 the machine was completely overhauled at a cost of P180,000. The overhaul added three additional years to the machine's estimated life but did not change its salvage value. Prepare entries in general form to record: a) the purchase of the machine b) the 2017 depreciation c) the addition of the new device d) the 2021 depreciation e) overhauling of the machine n the 2024 depreciation

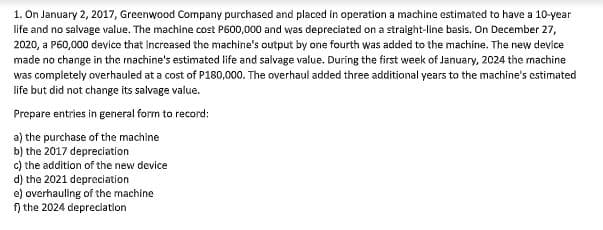

1. On January 2, 2017, Greenwood Company purchased and placed in operation a machine estimated to have a 10-year life and no salvage value. The machine cost P600,000 and was depreciated on a straight-line basis. On December 27, 2020, a P60,000 device that incroased the machine's output by one fourth was added to the machine. The new device made no change in the rnachine's estimated life and salvage value. During the first week of January, 2024 the machine was completely overhauled at a cost of P180,000. The overhaul added three additional years to the machine's estimated life but did not change its salvage value. Prepare entries in general form to record: a) the purchase of the machine b) the 2017 depreciation c) the addition of the new device d) the 2021 depreciation e) overhauling of the machine n the 2024 depreciation

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.5E: Change in Estimate Assume that Bloomer Company purchased a new machine on January 1, 2016, for...

Related questions

Topic Video

Question

100%

Please answer all the letters from a to f. Please provide your solutions in good accounting form. Thank you so much. Please complete your answers with the requirements asked in the problem.

Transcribed Image Text:1. On January 2, 2017, Greenwood Company purchased and placed in operation a machine estimated to have a 10-year

life and no salvage value. The machine cost P600,000 and was depreciated on a straight-line basis. On December 27,

2020, a P60,000 device that increased the machine's output by one fourth was added to the machine. The new device

made no change in the rnachine's estimated life and salvage value. During the first week of January, 2024 the rnachine

was completely overhauled at a cost of P180,000. The overhaul added three additional years to the machine's estimated

life but did not change its salvage value.

Prepare entries in general form to record:

a) the purchase of the machine

b) the 2017 depreciation

c) the addition of the new device

d) the 2021 depreciation

e) overhauling of the machine

n the 2024 depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning