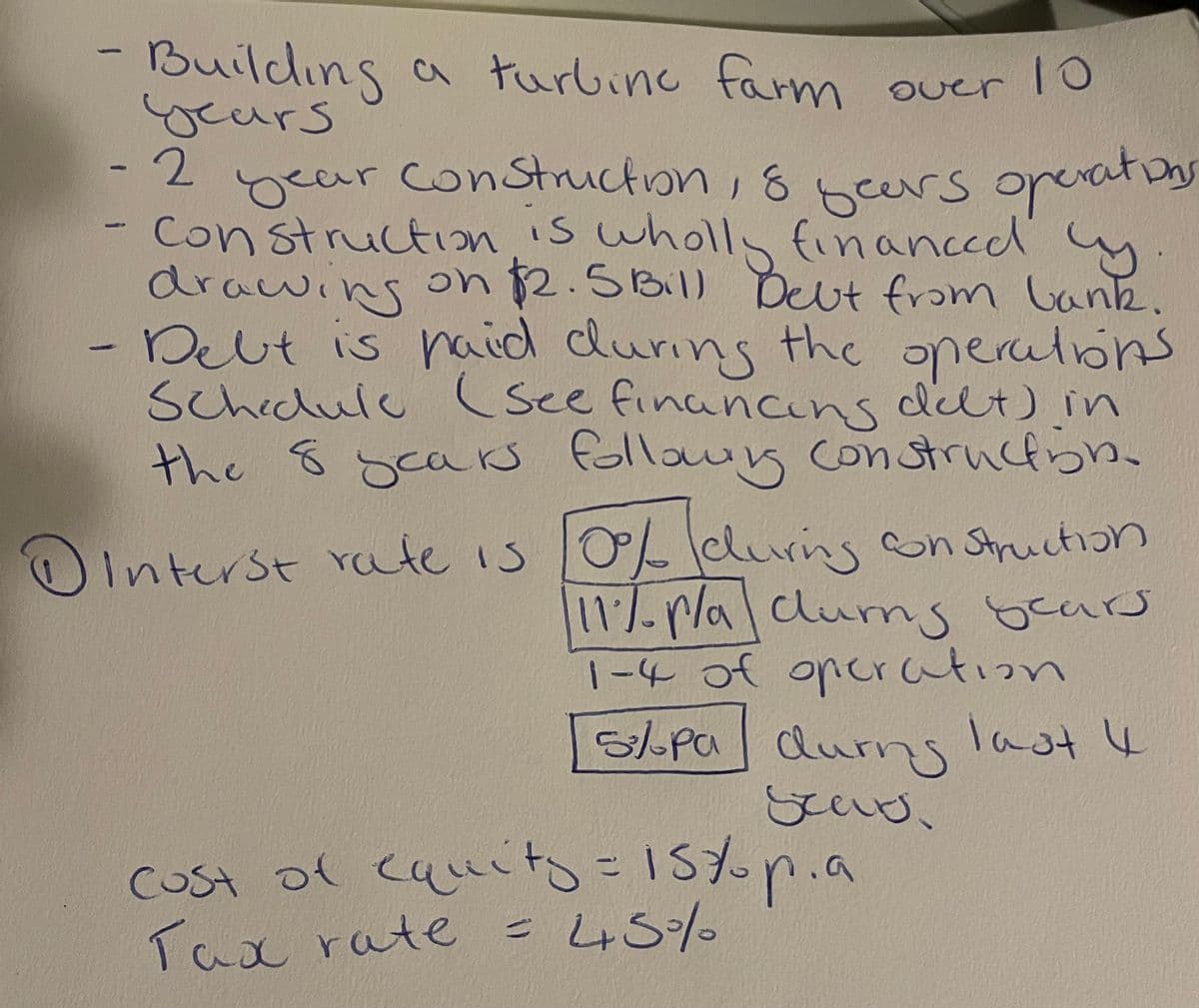

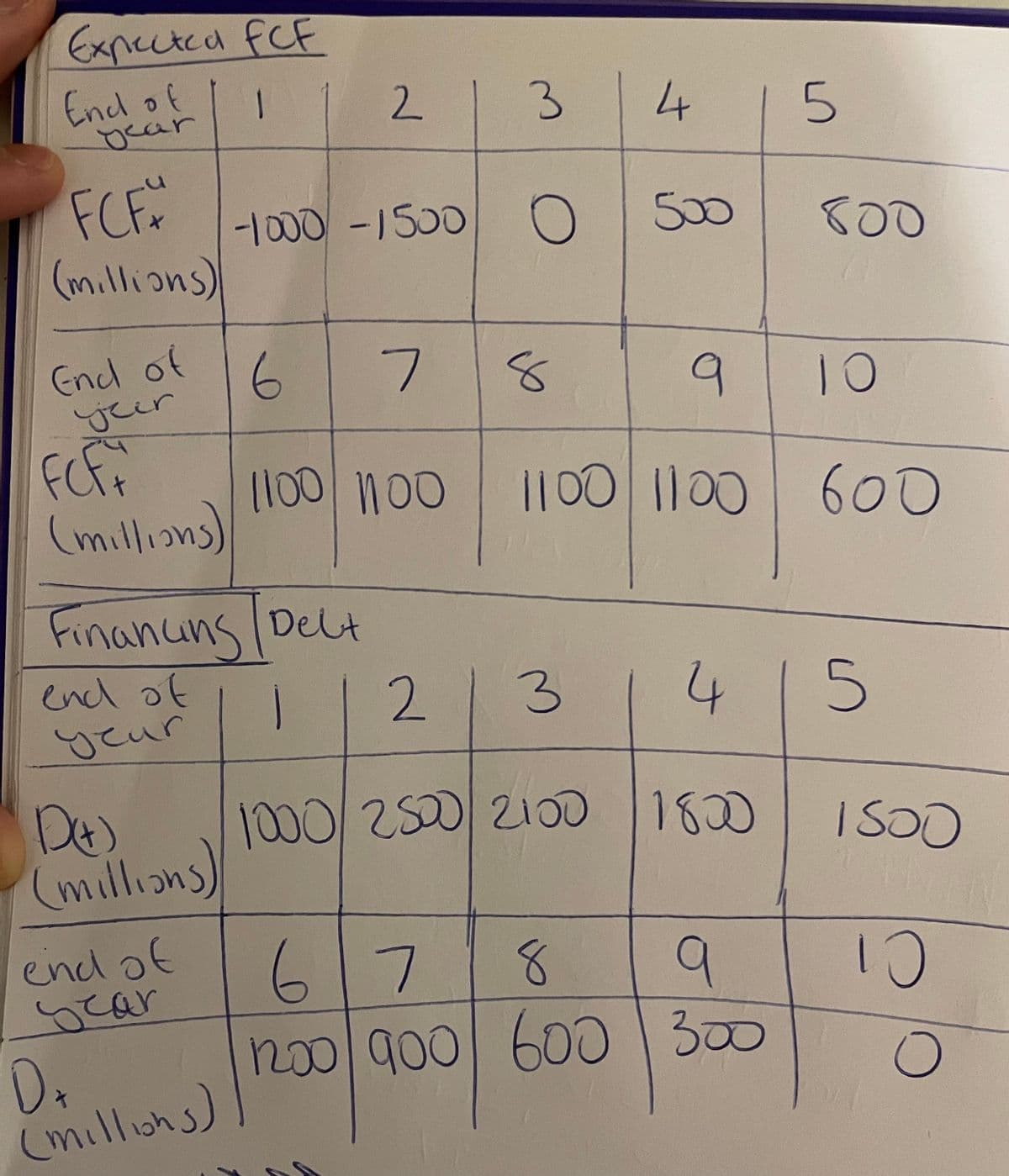

1 Building a turbine farm years over 10 2 year construction, 8 years operation Construction is wholly financed by. drawing on $2.5 Bill Debt from lank. - Delt is paid during the operations Schedule (see financing delt) in the 8 years following construction. Interst rate is [0% during construction 11%. P/a durns years 1-4 of operation - 5/pa during last 4 stad. cost of equity = 1570p.a = 45% Tax rate

Q: A furniture company is offering a choice of deals. You can receive $500 cash back on the purchase,…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: On Friday 26th January 2018, the UK government held its weekly auction of government Treasury bills.…

A: Discount rates refers to the interest rate at minimum level while lending finance to the other…

Q: What company's in the stock market was affected by the coronavirus pandemic. What stocks weren't…

A: The coronavirus pandemic has had a profound impact on the global economy, including the stock…

Q: Shortly after the invasion of Ukraine, sanctions impeded the ability of the Russian central bank to…

A: Shortly after the invasion of Ukraine, sanctions impeded the ability of the Russian central bank to…

Q: Calculate the total required rate of return - in nominal terms – for the investment. Calculate the…

A: In this scenario, Terry White is tasked with creating an asset allocation plan for an institutional…

Q: Suppose that a party wanted to enter an FRA that expires in 121 days and is based on 55-day LIBOR.…

A: It is a case of a party taking a short position in the forward contract agreement. Here, the party…

Q: What is the IRR for a $980 investment that returns $205 at the end of 6 years?

A: Internal rate of return: IRR of a project is the discount rate which makes net present value of the…

Q: Don Draper has signed a contract that will pay him $50,000 at the end of each year for the next 10…

A: Present value is the current value of a future sum of money, discounted at an appropriate rate of…

Q: One-year Treasury securities yield 3.25%. The market anticipates that 1-year from now, 1-year…

A: Arithmetic average return is calculated by adding the returns for all sub periods and then dividing…

Q: Benton Corporation is planning to buy a machine that may add $6000 to the pre-tax earnings of the…

A:

Q: A corporation creates a sinking fund in order to have $640,000 to replace some machinery in 8 years.…

A: It is a case of calculating the future value of a quarterly annuity. Here, the future value is…

Q: QUESTION 1 The minimum downside projection from a head and shoulders top pattern is derived A.…

A: The answer to the question are given below :

Q: You find a bond with 28 years until maturity that has a coupon rate of 7 percent and a yield to…

A: A bond indicates a debt instrument that obligates its issuer to repay the par value along with a…

Q: Two mutually exclusive projects are under consideration: Year 0 1 3,000 2 3,500 3 4,000 4 4,500 5…

A: Pay Back period is that under which investor will return his invested amount without any income.…

Q: The management of Deitrich Inc., a civil engineering design company, is considering an investment in…

A: “Since you have asked multiple questions, we will solve the first complete question for you. If you…

Q: Parker & Stone, Incorporated, is looking at setting up a new manufacturing plant in South Park to…

A: Initial Investment: Cash flow at Initial investment signifies the cost of the investment that is…

Q: Assume a stock has dividends that grow at a constant rate forever. If you value the stock using the…

A: The constant dividend growth model is: P = D / (r - g) where, P is the current stock price, D is…

Q: A bond pays 9% yearly interest in semi-annual payments for 6 years. The current yield on similar…

A: Companies issue bonds to raise debt capital. The issuing company pays periodic interest to the bond…

Q: Myca Corporation has a project with the following cash flows. What is the value of the cash flows…

A: Net Present Value, which is a financial metric used to determine the value of an investment by…

Q: You have two stocks. Stock A has a beta of 0.2, stock B has a beta of 0.7. If you want to form a…

A: Let the portfolio weight of stock A be a. Portfolio beta =Weight of stock A×Beta of stock A +…

Q: An analyst gathered the following information for a stock and market parameters: • stock beta =…

A: The Capital Asset Pricing Model (CAPM), which takes into account ongoing testing and research, is a…

Q: Calculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using…

A: It is important for borrowers to carefully review the terms and conditions of any credit or loan…

Q: Answer ALL parts of this question. The data below describes a three-stock financial market that…

A: Stock market refers to a market where the trading of stock between buyers and sellers has been…

Q: average annual return. If Dina reduces her portfolio's exposure to risk by opting for a smaller…

A: There are two asset classes, i.e., riskfree asset (bonds) and diversified stocks. Combination A…

Q: Professors Narishimhan Jegadeesh and Sheridan Titman, demonstrated how stocks with high returns over…

A: The paper by Jegadeesh and Titman in year 1993 highlighted the momentum effect. Under this effect,…

Q: A store owner borrowed 33,000 at 10% from a bank to buy more inventory. Given that the loan is for…

A: Compound interest is a concept that refers to the interest earned on both the initial principal…

Q: In 2020, Caterpillar Incorporated had about 540 million shares outstanding. Their book value was…

A: Number of shares outstanding = 540 million Book value of equity per share = $25.36 Market value of…

Q: Whispering Winds Company is considering a long-term investment project called ZIP ZIP will require…

A: The concepts of capital budgeting will be used and applied here. Capital budgeting tools are used to…

Q: Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely…

A: Soution 1: Computation of NPV - Holston Company Particulars Period Amount PV factor at…

Q: You owe $1,032.56 on a credit card with an 11.25% APR. The minimum due is $150.00. What is the…

A: Interest amount refers to the minimum cost to be charged over the investment made by the investors…

Q: You bought a call option with a strike price of $40. What is your total payoff on this option…

A: strike price = $40 Selling price = $42.70

Q: operating cash flows of a project: includes tax. none of the others is correct are equal…

A: Operating cash flow are cash flow related to normal operations of Business. so these are the cash…

Q: Which of the following statements are correct for a well-diversified portfolio (e.g., containing 100…

A: In a single index model, the R - squared determines the relationship of the portfolio with the…

Q: Questions asked in the personal interview 1. Why were you selected out of all the…

A: Introduction: I am honored and humbled to have been selected out of all the applicants for the role…

Q: Suppose your firm issues a €100,000,000 5-year bond with a coupon rate of 8% per annum (assume…

A: Bonds are instruments issued by companies to raise debt from investors in place of traditional…

Q: 8.0

A: Here the borrowed amount =$100 million, Semiannual payment for 10 years = 10*2= 20, interest = 8%…

Q: Assets Reserves $ Securities Loans Your bank has the following balance sheet:< 50 million 50 million…

A: Data given: Checkable deposits =$200 million Unexpected deposit outflow=$60 million Required reserve…

Q: first

A: Given the principal after some period of time becomes 177000, the given rate of interest =6.2%

Q: Total assets of $2.5 million and net plant and equipment equals $2 million. Notes payable of $150k…

A: A Balance sheet is a statement that shows the financial position of the company at a given point of…

Q: Find the interest on a loan of $3300 at 7% if I borrow on April 7 and repay on June 2 using the…

A: Exact Time measures 365 days in a yearOrdinary Time measures 360 days in a yearBanker's rule…

Q: A bond has a semi-annual coupon payment of $16.6 . What is the coupon RATE? Convert to a percent.…

A: Coupon Rate: It represents the rate of interest paid to the bondholders by the issuer. Thus, it is…

Q: 2R Code to answer the riddle. 3. 24 is what percent of 30 ?

A: A percentage is a fraction of an entire value represented as a value between zero and 100.…

Q: 2. A payment of £30 will be made in 10 years. The annual effective interest rate is 7 % p.a. Compute…

A: payment = p = £30 Time = t = 10 years Interest rate = r = 7%

Q: Suppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the…

A: According to the unbiased expectations theory, forward rates are an unbiased predictor of future…

Q: 2. * The effective interest rate is 5% p.a. for five years. Then, it jumps to a different value and…

A: Since you have asked multiple question , we will solve the first question for you. If you want any…

Q: A company had $16 of sales per share for the year that just ended. You expect the company to grow…

A: The free cash flow to equity model is one of the ways to value a stock and is based on the idea that…

Q: Stock A B C D Expected Return 10% 4% 8% 7% Standard Deviation 4% 2% 6% 8% For a rational risk-averse…

A: The standard deviation are said to be the major of variation of data from mean average or dispersion…

Q: Question 27 Which of the following is NOT a potential use of Free Cash Flow to the Firm (FCFF)? Pay…

A: The concept of Free Cash Flow to the Firm (FCFF) is an important financial metric that measures the…

Q: A 4% semi-annual govt bond is maturing March 10, 2024. Accrued interest on this bond uses the 30/360…

A: All the characteristics of the bond are known. The bond is to be settled between two coupon dates.…

Q: A firm could have issued straight debt at a 15% interest rate. However, with warrants attached, the…

A: A bond is a kind of debt security issued by the government and private companies for raising funds…

Using the FCFE Model, Calculate the current equity value of this project. Show detailed workings

Step by step

Solved in 4 steps with 2 images

- Libby Company purchased equipment by paying $5,600 cash on the purchase date and agreed to pay $5,600 every six months during the next four years. The first payment is due six months after the purchase date. Libby's incremental borrowing rate is 8%. The equipment reported on the balance sheet as of the purchase date is closest to: (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided.)ABC, Inc. purchased an equipment at time=0 for $135,077. The shipping and installation costs were $35,367. The equipment is classified as a 7-year MACRS property. The investment in net working capital at time=0 was $15,451 which would be recouped at the end of the project. The project life is four years. At the end of the fourth year, the company will sell the equipment for $35,727. The annual cash flows are $69,318. What is the cash flow of the project in Year 4? That is solve for CF4. Assume that the tax rate is 15% The MACRS allowance percentages are as follows, starting with Year 1: 14.29, 24.49, 17.49, 12.49, 8.93, 8.92, 8.93, and 4.46 percent.Zahir company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $900,000 on March 1, $600,000 on June 1, and $1,500,000 on December 31. Zahir company borrowed $500,000 on March 1 on a 5-year, 12% note to finance the construction of building. In addition, the company had outstanding all year a 10%, 5-year $1,000000 note payable and an 11%, 4-year, $1,750,000 note payable. Compute the following:(a) Weighted-average accumulated expenditure.(b) Capitalization rate used for interest capitalization purpose.(c) Avoidable interest

- Sheffield Corp. is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were $6470000 on March 1, $5340000 on June 1, and $7950000 on December 31. Sheffield Corp. borrowed $3250000 on January 1 on a 5-year, 10% note to help finance construction of the building. In addition, the company had outstanding all year a 8%, 3-year, $6450000 note payable and an 9%, 4-year, $12350000 note payable. What is the weighted-average interest rate used for interest capitalization purposesABC, Inc. purchased an equipment at time=0 for $84,362. The shipping and installation costs were $28,520. The equipment is classified as a 5-year MACRS property. The investment in net working capital at time=0 was $12,792 which would be recouped at the end of the project. The project life is three years. At the end of the third year, the company will sell the equipment for $25,478. The annual cash flows are $25,453. What is the cash flow of the project in Year 3? That is, solve for CF3. Assume that the tax rate is 13% The MACRS allowance percentages are as follows, starting with Year 1: 20.00, 32.00, 19.20, 11.52, 11.52, and 5.76 percent. Note: In the last year of the project, the Total Cash Flow = Operating Cash Flow + Terminal Cash Flow Enter your answer rounded off to two decimal points. Do not enter $ or comma in the answer box.On 01-01-15, G purchased a machine for $10,000,000. Installation costs incurred and paid for on 01-01-15 were $50,000. G started using the machine on 01-01-15. G estimates it will use the machine for 3 years. At the end of the 3rd year, G will have to dispose of the machine at an estimated cost of $435,000. Assume as of 01-01-15 the interest rate on US Treasury securities was 1.75% and G’s credit standing required a 2% risk premium. G uses a straight-line depreciation method and assumes no salvage value. What amount should G report on its balance sheet as a fixed asset (machine) as of 12-31-15? Prepare an excel spreadsheet that clearly identifies and clearly labels G’s ARO obligation balance as of 12-31 for every year from 2015 to 2017 AND G’s accretion expense for every year for 2015 to 2017. Prepare the entries G should make related to the equipment and its ARO for the year ended 12-31-16 AND 12-31-17? On 01-01-18, G paid a vendor $420,000 to dispose of the machine in accordance…

- As during eighth year, Clark Company spent $2,400,000 on equipment for its own use. The project took a whole year to complete, and all expenditures were spread out evenly over the year. Clark was able to borrow $1,500,000 at 6% interest at the start of the term for the procurement of materials and the fabrication of the equipment. On December 31, year 8, the whole debt, including interest, was redeemed and replaced with a long-term loan. Clark Company has an extra debt of $1,000,000 in year 8, with a weighted average interest rate of 7%. What will Clark Corporation report as interest cost in year 8 if it capitalises the maximum amount of interest allowed under GAAP? AsapAs during eighth year, Clark Company spent $2,400,000 on equipment for its own use. The project took a whole year to complete, and all expenditures were spread out evenly over the year. Clark was able to borrow $1,500,000 at 6% interest at the start of the term for the procurement of materials and the fabrication of the equipment. On December 31, year 8, the whole debt, including interest, was redeemed and replaced with a long-term loan. Clark Company has an extra debt of $1,000,000 in year 8, with a weighted average interest rate of 7%. What will Clark Corporation report as interest cost in year 8 if it capitalises the maximum amount of interest allowed under GAAP?The all-equity firm invests $90 today in a machine which will be depreciated down to $0 over three years of the project’s life. Hurdle is 10% and tax rate is 0%. Annual business plan detail follows. What is the project’s IRR? Revenues $180 -Operating Expenses 150 EBIT 30 Interest 0 EBT 30 Tax 0 Net Income $ 20

- Entity A has the following loan finance in place during the year: $2,560,000 of 7.50% loan finance $3,550,000 of 9.50% loan finance Entity A constructed a new factory which cost $5,655,000 and this was funded out of the existing loan finance. The factory took 9 months to complete within the same reporting year. REQUIRED: Measure the borrowing costs should be capitalised. The borrowing costs should be capitalised is _________?Bonita Industries is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were $6440000 on March 1, $5260000 on June 1, and $8850000 on December 31. Bonita Industries borrowed $3190000 on January 1 on a 5-year, 11% note to help finance construction of the building. In addition, the company had outstanding all year a 9%, 3-year, $6440000 note payable and an 10%, 4-year, $12650000 note payable.What are the weighted-average accumulated expenditures? $9860000 $20550000 $8435000 $11700000Valley Produce received $50,000 in vendor financing at 7.8% compounded semiannually for the purchase of harvesting machinery. Equal annual payments of $9,587.89 will repay the debt in seven years, including $17,115.26 in interest. Suppose the loan permits an additional prepayment of principal on any scheduled payment date. Prepare the amortization schedule that reflects a prepayment of $10,000 with the second scheduled payment. How much interest is saved as a result of the prepayment?