Calculate the total required rate of return - in nominal terms – for the investment. Calculate the total required rate of return - in real terms – for the investment.

Calculate the total required rate of return - in nominal terms – for the investment. Calculate the total required rate of return - in real terms – for the investment.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 52P

Related questions

Question

Calculate the total required

Calculate the total required rate of return - in real terms – for the investment.

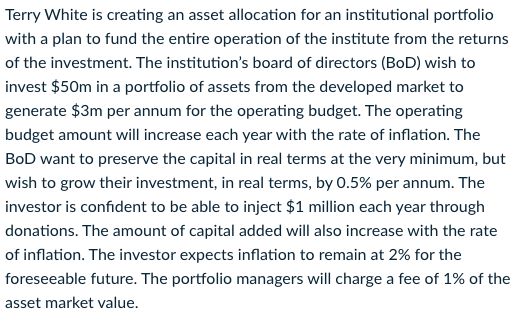

Transcribed Image Text:Terry White is creating an asset allocation for an institutional portfolio

with a plan to fund the entire operation of the institute from the returns

of the investment. The institution's board of directors (BoD) wish to

invest $50m in a portfolio of assets from the developed market to

generate $3m per annum for the operating budget. The operating

budget amount will increase each year with the rate of inflation. The

BoD want to preserve the capital in real terms at the very minimum, but

wish to grow their investment, in real terms, by 0.5% per annum. The

investor is confident to be able to inject $1 million each year through

donations. The amount of capital added will also increase with the rate

of inflation. The investor expects inflation to remain at 2% for the

foreseeable future. The portfolio managers will charge a fee of 1% of the

asset market value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,