1 Calculate the Marginal Cost of Capital. 2 Common Stock Price 3 Preferred Stock Price 4 Price per Bond ($1000 par) 5 Common Stock Shares 6 Preferred Stock Shares 7 Bonds Outstanding 8 Bond Coupon Rate 9 Time Until Maturity 10 Tax Rate 11 Par Value Preferred

1 Calculate the Marginal Cost of Capital. 2 Common Stock Price 3 Preferred Stock Price 4 Price per Bond ($1000 par) 5 Common Stock Shares 6 Preferred Stock Shares 7 Bonds Outstanding 8 Bond Coupon Rate 9 Time Until Maturity 10 Tax Rate 11 Par Value Preferred

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 18P

Related questions

Question

The first picture is the question and the second picture is what I need help on.

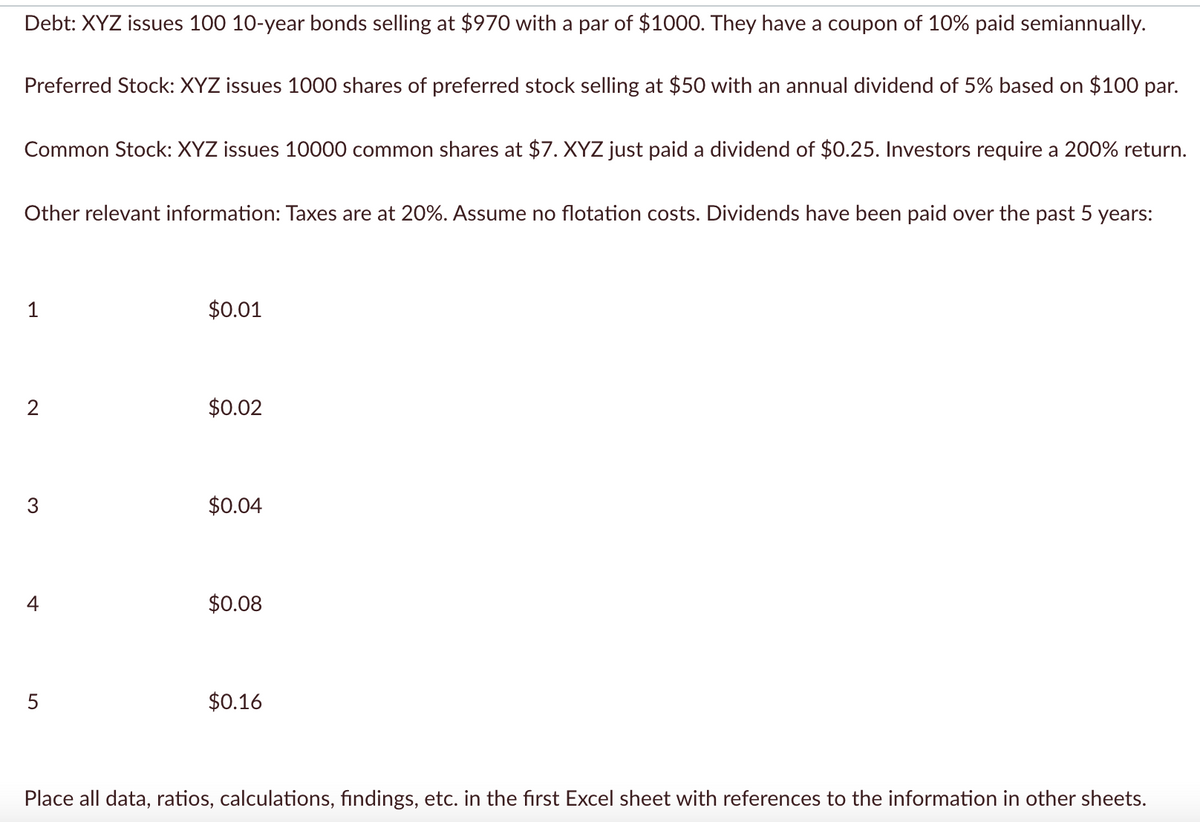

Transcribed Image Text:Debt: XYZ issues 100 10-year bonds selling at $970 with a par of $1000. They have a coupon of 10% paid semiannually.

Preferred Stock: XYZ issues 1000 shares of preferred stock selling at $50 with an annual dividend of 5% based on $100 par.

Common Stock: XYZ issues 10000 common shares at $7. XYZ just paid a dividend of $0.25. Investors require a 200% return.

Other relevant information: Taxes are at 20%. Assume no flotation costs. Dividends have been paid over the past 5 years:

1

$0.01

$0.02

3

$0.04

4

$0.08

$0.16

Place all data, ratios, calculations, findings, etc. in the first Excel sheet with references to the information in other sheets.

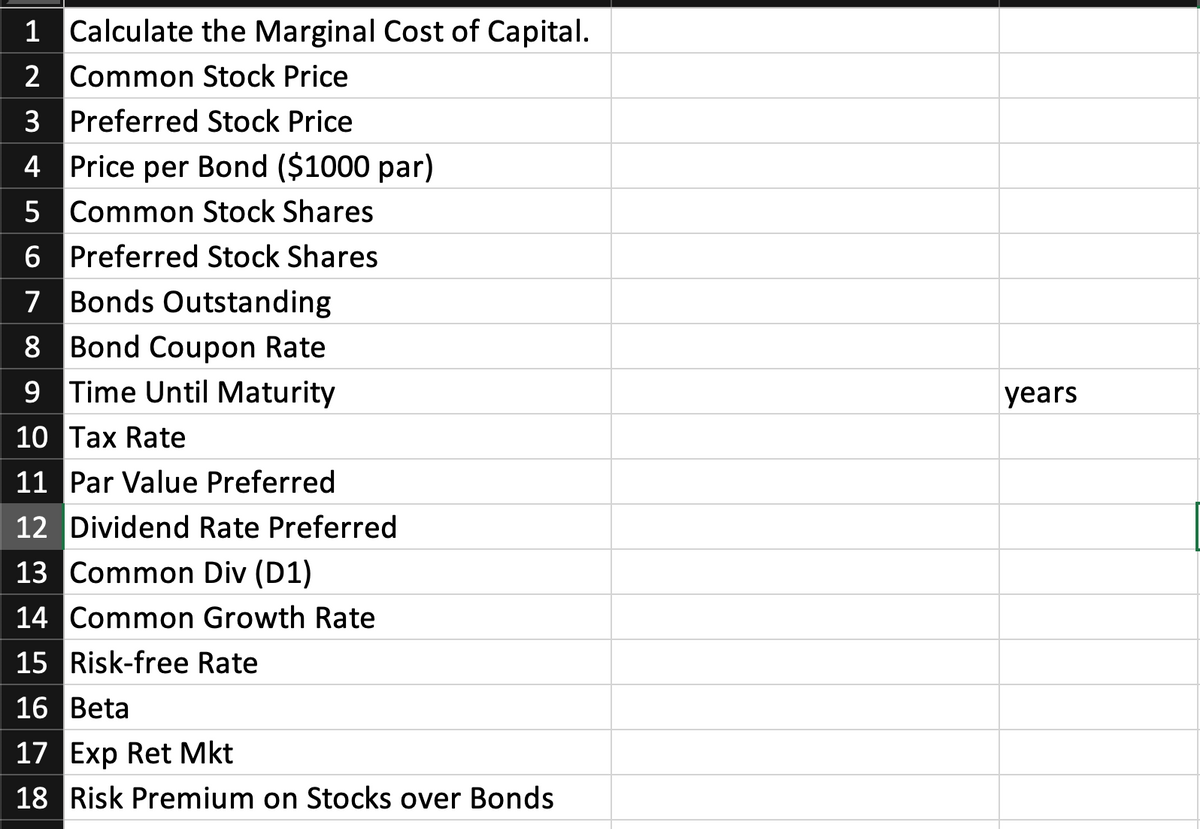

Transcribed Image Text:1 Calculate the Marginal Cost of Capital.

2 Common Stock Price

3 Preferred Stock Price

4 Price per Bond ($1000 par)

5 Common Stock Shares

6 Preferred Stock Shares

7 Bonds Outstanding

8 Bond Coupon Rate

9 Time Until Maturity

years

10 Tax Rate

11 Par Value Preferred

12 Dividend Rate Preferred

13 Common Div (D1)

14 Common Growth Rate

15 Risk-free Rate

16 Beta

17 Exp Ret Mkt

18 Risk Premium on Stocks over Bonds

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning