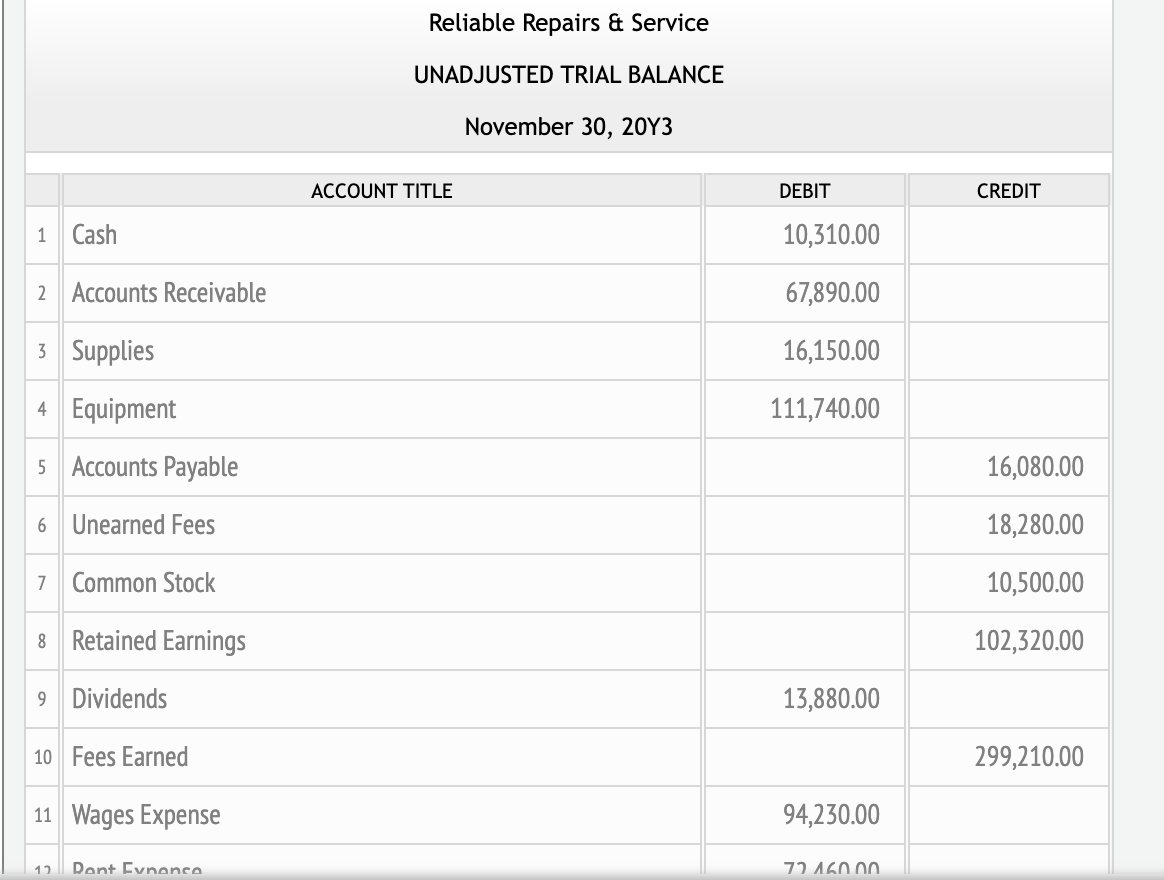

1 Cash 2 Accounts Receivable 3 Supplies 4 Equipment 5 Accounts Payable 6 Unearned Fees 7 Common Stock 8 Retained Earnings 9 Dividends 10 Fees Earned 11 Wages Expense 12 Pont Eynonco Reliable Repairs & Service UNADJUSTED TRIAL BALANCE November 30, 20Y3 ACCOUNT TITLE DEBIT 10,310.00 67,890.00 16,150.00 111,740.00 13,880.00 94,230.00 72 460.00 CREDIT 16,080.00 18,280.00 10,500.00 102,320.00 299,210.00

1 Cash 2 Accounts Receivable 3 Supplies 4 Equipment 5 Accounts Payable 6 Unearned Fees 7 Common Stock 8 Retained Earnings 9 Dividends 10 Fees Earned 11 Wages Expense 12 Pont Eynonco Reliable Repairs & Service UNADJUSTED TRIAL BALANCE November 30, 20Y3 ACCOUNT TITLE DEBIT 10,310.00 67,890.00 16,150.00 111,740.00 13,880.00 94,230.00 72 460.00 CREDIT 16,080.00 18,280.00 10,500.00 102,320.00 299,210.00

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 2PA: To demonstrate the difference between cash account activity and accrual basis profits (net income),...

Related questions

Question

JOURNAL

| DATE | DESCRIPTION | POST. REF. | DEBIT | CREDIT | ASSETS | LIABILITIES | EQUITY | |

|---|---|---|---|---|---|---|---|---|

|

1

|

|

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

3

|

|

|

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

|

|

|

8

|

|

|

|

|

|

|

|

|

|

9

|

|

|

|

|

|

|

|

|

|

10

|

|

|

|

|

|

|

|

|

|

11

|

|

|

|

|

|

|

|

|

Transcribed Image Text:1 Cash

2 Accounts Receivable

3 Supplies

4

Equipment

5 Accounts Payable

6 Unearned Fees

7 Common Stock

8 Retained Earnings

9 Dividends

10 Fees Earned

11 Wages Expense

12

Pont Eynonco

Reliable Repairs & Service

UNADJUSTED TRIAL BALANCE

November 30, 20Y3

ACCOUNT TITLE

DEBIT

10,310.00

67,890.00

16,150.00

111,740.00

13,880.00

94,230.00

72 460.00

CREDIT

16,080.00

18,280.00

10,500.00

102,320.00

299,210.00

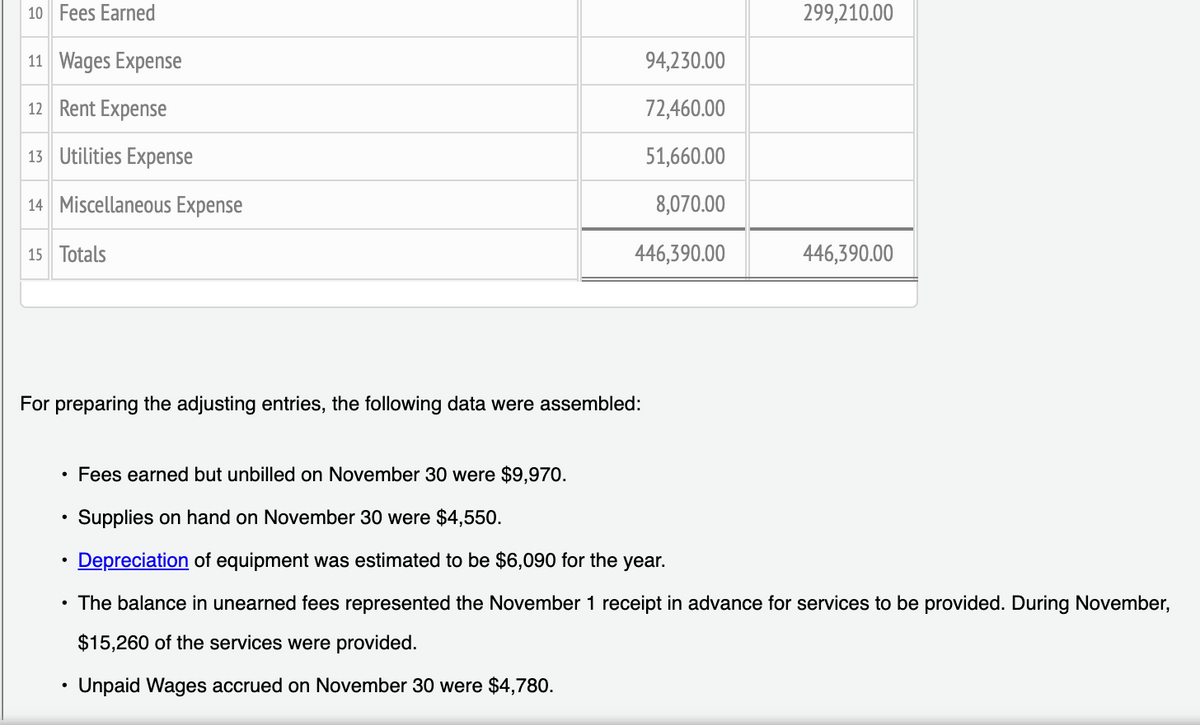

Transcribed Image Text:10 Fees Earned

11 Wages Expense

12 Rent Expense

13 Utilities Expense

14 Miscellaneous Expense

15 Totals

94,230.00

72,460.00

51,660.00

8,070.00

446,390.00

For preparing the adjusting entries, the following data were assembled:

●

299,210.00

446,390.00

Fees earned but unbilled on November 30 were $9,970.

Supplies on hand on November 30 were $4,550.

Depreciation of equipment was estimated to be $6,090 for the year.

The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November,

$15,260 of the services were provided.

Unpaid Wages accrued on November 30 were $4,780.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College