Based on the above and the result of you 1. Collections from customers in 2018 2. Gross sales, accrual basis in 2018 3. Payments for merchandise purchases in 2018 in 2018

Based on the above and the result of you 1. Collections from customers in 2018 2. Gross sales, accrual basis in 2018 3. Payments for merchandise purchases in 2018 in 2018

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 5.1P

Related questions

Question

please answer the following. thanks

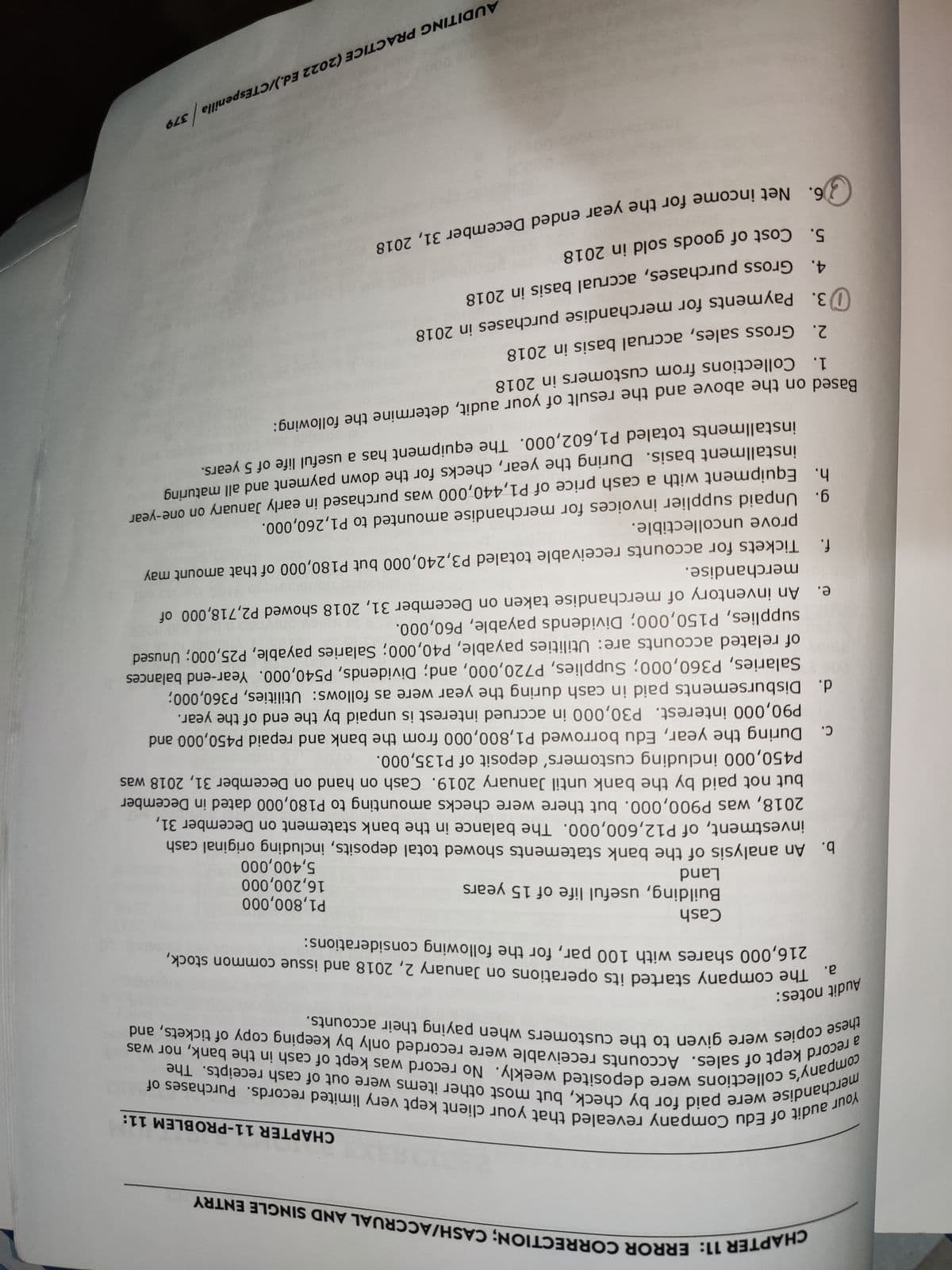

Transcribed Image Text:CHAPTER 11: ERROR CORRECTION; CASH/ACCRUAL AND SINGLE ENTRY

Your audit of Edu Company revealed that your client kept very limited records. Purchases of

merchandise were paid for by check, but most other items were out of cash receipts. The

company's collections were deposited weekly. No record was kept of cash in the bank, nor was

these copies were given to the customers when paying their accounts.

a record kept of sales. Accounts receivable were recorded only by keeping copy of tickets, and

Audit notes:

a. The company started its operations on January 2, 2018 and issue common stock,

216,000 shares with 100 par, for the following considerations:

c.

d.

CHAPTER 11-PROBLEM 11:

Cash

Building, useful life of 15 years

Land

b. An analysis of the bank statements showed total deposits, including original cash

investment, of P12,600,000. The balance in the bank statement on December 31,

P1,800,000

16,200,000

5,400,000

2018, was P900,000. but there were checks amounting to P180,000 dated in December

but not paid by the bank until January 2019. Cash on hand on December 31, 2018 was

P450,000 including customers' deposit of P135,000.

During the year, Edu borrowed P1,800,000 from the bank and repaid P450,000 and

P90,000 interest. P30,000 in accrued interest is unpaid by the end of the year.

Disbursements paid in cash during the year were as follows: Utilities, P360,000;

Salaries, P360,000; Supplies, P720,000, and; Dividends, P540,000. Year-end balances

of related accounts are: Utilities payable, P40,000; Salaries payable, P25,000; Unused

supplies, P150,000; Dividends payable, P60,000.

e.

An inventory of merchandise taken on December 31, 2018 showed P2,718,000 of

merchandise.

f. Tickets for accounts receivable totaled P3,240,000 but P180,000 of that amount may

prove uncollectible.

9. Unpaid supplier invoices for merchandise amounted to P1,260,000.

h. Equipment with a cash price of P1,440,000 was purchased in early January on one-year

installment basis. During the year, checks for the down payment and all maturing

installments totaled P1,602,000. The equipment has a useful life of 5 years.

2. Gross sales, accrual basis in 2018

3. Payments for merchandise purchases in 2018

Based on the above and the result of your audit, determine the following:

1. Collections from customers in 2018

4. Gross purchases, accrual basis in 2018

5. Cost of goods sold in 2018

6. Net income for the year ended December 31, 2018

AUDITING PRACTICE (2022 Ed.)/CTEspenilla 379

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage