1 Purchased $90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, a amount plus accrued interest of $375. The bonds are a held-to-maturity investment. 7 Sold, at $38 per share, 2,600 shares of treasury common stock purchased on Jun. 8. 4 Received interest of $6,000 from the Solstice Corp. investment on Jun. 1.

1 Purchased $90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, a amount plus accrued interest of $375. The bonds are a held-to-maturity investment. 7 Sold, at $38 per share, 2,600 shares of treasury common stock purchased on Jun. 8. 4 Received interest of $6,000 from the Solstice Corp. investment on Jun. 1.

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 2TP: Below is select information from two, independent companies. Additional information includes: On...

Related questions

Question

Transcribed Image Text:Comprehensive Problem 4 (Part A)

Instructions

Chart of Accounts

Journal

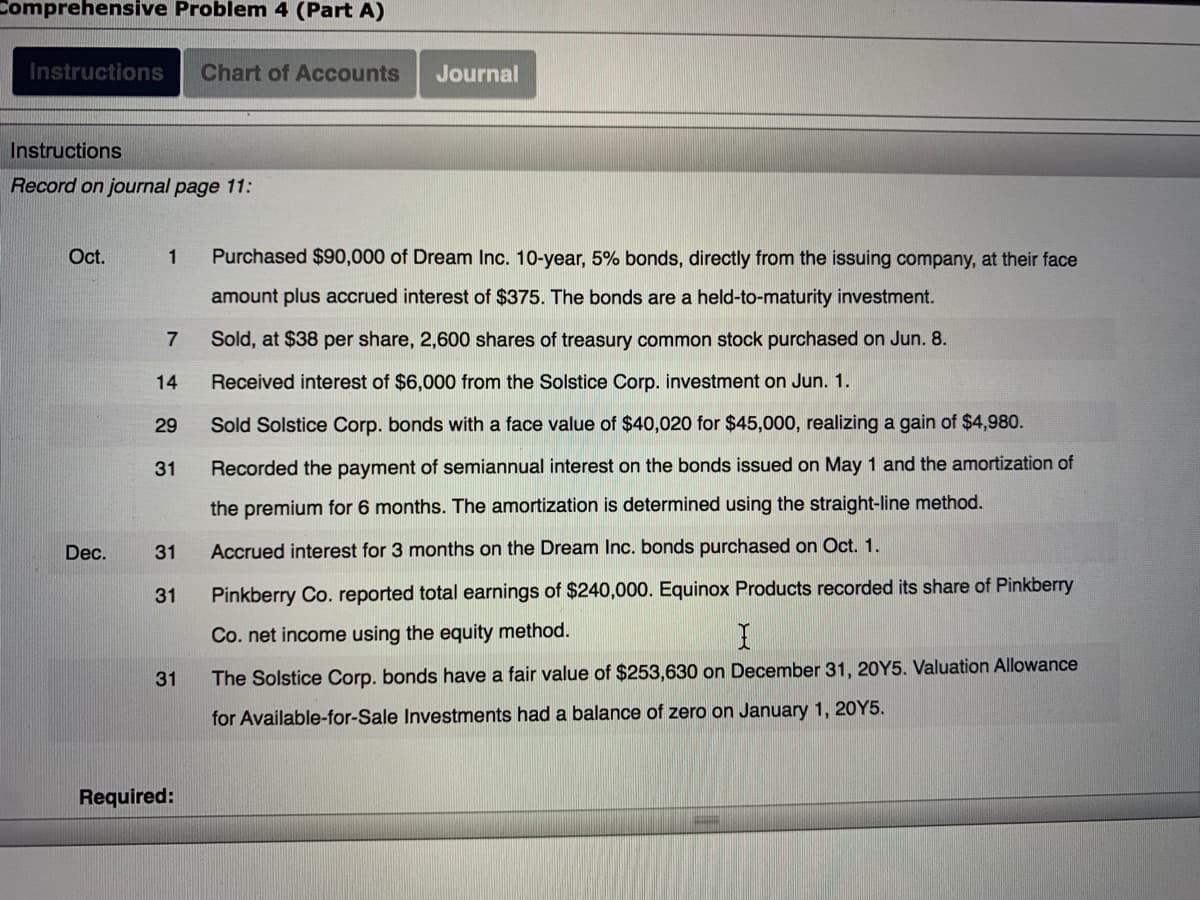

Instructions

Record on journal page 11:

Oct.

1

Purchased $90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face

amount plus accrued interest of $375. The bonds are a held-to-maturity investment.

Sold, at $38 per share, 2,600 shares of treasury common stock purchased on Jun. 8.

14

Received interest of $6,000 from the Solstice Corp. investment on Jun. 1.

29

Sold Solstice Corp. bonds with a face value of $40,020 for $45,000, realizing a gain of $4,980.

31

Recorded the payment of semiannual interest on the bonds issued on May 1 and the amortization of

the premium for 6 months. The amortization is determined using the straight-line method.

Dec.

31

Accrued interest for 3 months on the Dream Inc. bonds purchased on Oct. 1.

31

Pinkberry Co. reported total earnings of $240,000. Equinox Products recorded its share of Pinkberry

Co. net income using the equity method.

31

The Solstice Corp. bonds have a fair value of $253,630 on December 31, 20Y5. Valuation Allowance

for Available-for-Sale Investments had a balance of zero on January 1, 20Y5.

Required:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning