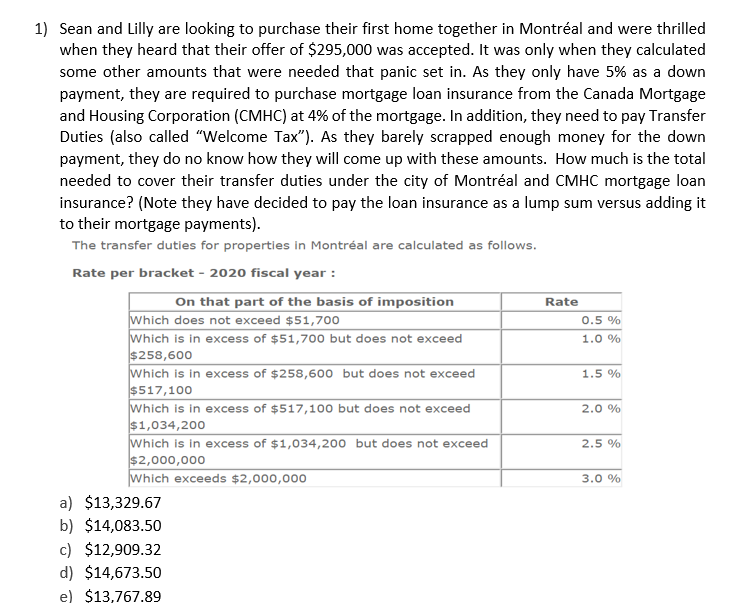

1) Sean and Lilly are looking to purchase their first home together in Montréal and were thrilled when they heard that their offer of $295,000 was accepted. It was only when they calculated some other amounts that were needed that panic set in. As they only have 5% as a down payment, they are required to purchase mortgage loan insurance from the Canada Mortgage and Housing Corporation (CMHC) at 4% of the mortgage. In addition, they need to pay Transfer Duties (also called "Welcome Tax"). As they barely scrapped enough money for the down payment, they do no know how they will come up with these amounts. How much is the total needed to cover their transfer duties under the city of Montréal and CMHC mortgage loan insurance? (Note they have decided to pay the loan insurance as a lump sum versus adding it to their mortgage payments). The transfer duties for properties in Montréal are calculated as follows. Rate per bracket - 2020 fiscal year : On that part of the basis of imposition Which does not exceed $51,700 Which is in excess of $51,700 but does not exceed $258,600 Which is in excess of $258,600 but does not exceed $517,100 Which is in excess of $517,100 but does not exceed $1,034,200 Which is in excess of $1,034,200 but does not exceed $2,000,000 Which exceeds $2,000,000 Rate 0.5 % 1.0 % 1.5 % 2.0 % 2.5 % 3.0 % a) $13,329.67 b) $14,083.50 c) $12,909.32 d) $14,673.50 e) $13,767.89

1) Sean and Lilly are looking to purchase their first home together in Montréal and were thrilled when they heard that their offer of $295,000 was accepted. It was only when they calculated some other amounts that were needed that panic set in. As they only have 5% as a down payment, they are required to purchase mortgage loan insurance from the Canada Mortgage and Housing Corporation (CMHC) at 4% of the mortgage. In addition, they need to pay Transfer Duties (also called "Welcome Tax"). As they barely scrapped enough money for the down payment, they do no know how they will come up with these amounts. How much is the total needed to cover their transfer duties under the city of Montréal and CMHC mortgage loan insurance? (Note they have decided to pay the loan insurance as a lump sum versus adding it to their mortgage payments). The transfer duties for properties in Montréal are calculated as follows. Rate per bracket - 2020 fiscal year : On that part of the basis of imposition Which does not exceed $51,700 Which is in excess of $51,700 but does not exceed $258,600 Which is in excess of $258,600 but does not exceed $517,100 Which is in excess of $517,100 but does not exceed $1,034,200 Which is in excess of $1,034,200 but does not exceed $2,000,000 Which exceeds $2,000,000 Rate 0.5 % 1.0 % 1.5 % 2.0 % 2.5 % 3.0 % a) $13,329.67 b) $14,083.50 c) $12,909.32 d) $14,673.50 e) $13,767.89

Chapter9: Obtaining Affordable Housing

Section: Chapter Questions

Problem 1FPC

Related questions

Question

Transcribed Image Text:1) Sean and Lilly are looking to purchase their first home together in Montréal and were thrilled

when they heard that their offer of $295,000 was accepted. It was only when they calculated

some other amounts that were needed that panic set in. As they only have 5% as a down

payment, they are required to purchase mortgage loan insurance from the Canada Mortgage

and Housing Corporation (CMHC) at 4% of the mortgage. In addition, they need to pay Transfer

Duties (also called "Welcome Tax"). As they barely scrapped enough money for the down

payment, they do no know how they will come up with these amounts. How much is the total

needed to cover their transfer duties under the city of Montréal and CMHC mortgage loan

insurance? (Note they have decided to pay the loan insurance as a lump sum versus adding it

to their mortgage payments).

The transfer duties for properties in Montréal are calculated as follows.

Rate per bracket - 2020 fiscal year :

On that part of the basis of imposition

Rate

0.5 %

Which does not exceed $51,700

Which is in excess of $51,700 but does not exceed

$258,600

Which is in excess of $258,600 but does not exceed

$517,100

Which is in excess of $517,100 but does not exceed

$1,034,200

Which is in excess of $1,034,200 but does not exceed

$2,000,000

Which exceeds $2,000,000

1.0 %

1.5 %

2.0 %

2.5 %

3.0 %

a) $13,329.67

b) $14,083.50

c) $12,909.32

d) $14,673.50

e) $13,767.89

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you