1) What happens when a business is unable to generate enough cash? 2) What does the article have to say about accounts receivable, accounts payable, and inventories? 3) Is it bad for a company to have too much cash? Justify your

1) What happens when a business is unable to generate enough cash? 2) What does the article have to say about accounts receivable, accounts payable, and inventories? 3) Is it bad for a company to have too much cash? Justify your

Foundations of Business (MindTap Course List)

6th Edition

ISBN:9781337386920

Author:William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:William M. Pride, Robert J. Hughes, Jack R. Kapoor

Chapter16: Mastering Financial Management

Section: Chapter Questions

Problem 3DQ

Related questions

Question

pls see the photos

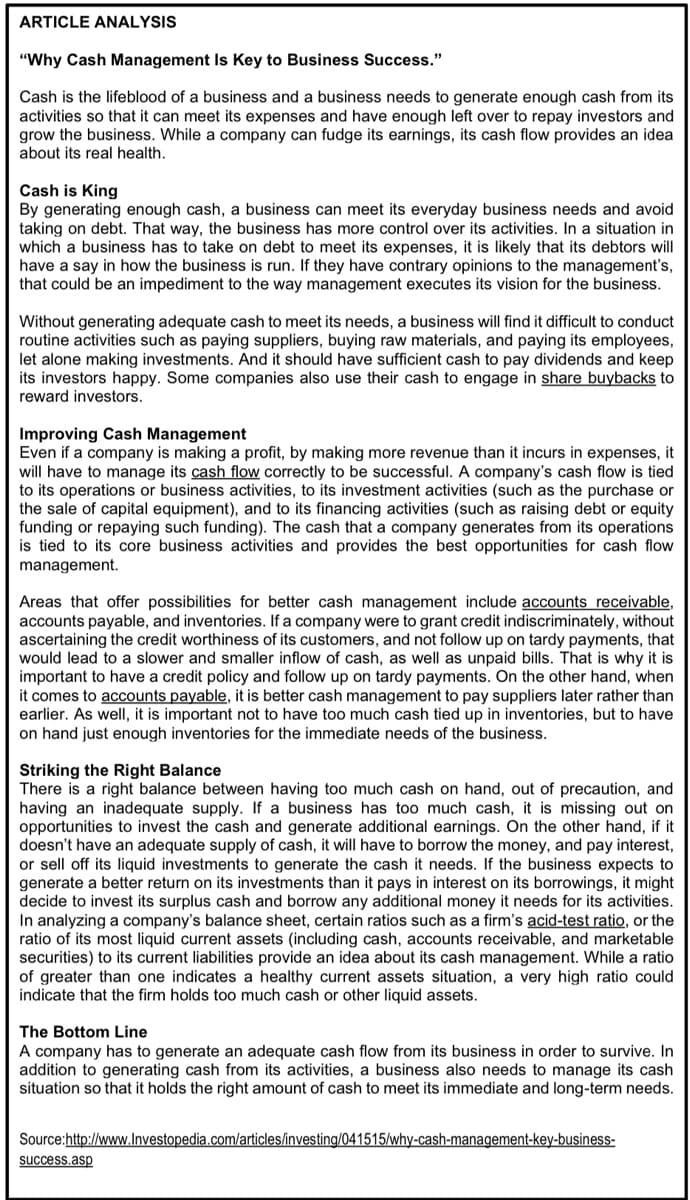

Transcribed Image Text:ARTICLE ANALYSIS

"Why Cash Management Is Key to Business Success."

Cash is the lifeblood of a business and a business needs to generate enough cash from its

activities so that it can meet its expenses and have enough left over to repay investors and

grow the business. While a company can fudge its earnings, its cash flow provides an idea

about its real health.

Cash is King

By generating enough cash, a business can meet its everyday business needs and avoid

taking on debt. That way, the business has more control over its activities. In a situation in

which a business has to take on debt to meet its expenses, it is likely that its debtors will

have a say in how the business is run. If they have contrary opinions to the management's,

that could be an impediment to the way management executes its vision for the business.

Without generating adequate cash to meet its needs, a business will find it difficult to conduct

routine activities such as paying suppliers, buying raw materials, and paying its employees,

let alone making investments. And it should have sufficient cash to pay dividends and keep

its investors happy. Some companies also use their cash to engage in share buybacks to

reward investors.

Improving Cash Management

Even if a company is making a profit, by making more revenue than it incurs in expenses, it

will have to manage its cash flow correctly to be successful. A company's cash flow is tied

to its operations or business activities, to its investment activities (such as the purchase or

the sale of capital equipment), and to its financing activities (such as raising debt or equity

funding or repaying such funding). The cash that a company generates from its operations

is tied to its core business activities and provides the best opportunities for cash flow

management.

Areas that offer possibilities for better cash management include accounts receivable,

accounts payable, and inventories. If a company were to grant credit indiscriminately, without

ascertaining the credit worthiness of its customers, and not follow up on tardy payments, that

would lead to a slower and smaller inflow of cash, as well as unpaid bills. That is why it is

important to have a credit policy and follow up on tardy payments. On the other hand, when

it comes to accounts payable, it is better cash management to pay suppliers later rather than

earlier. As well, it is important not to have too much cash tied up in inventories, but to have

on hand just enough inventories for the immediate needs of the business.

Striking the Right Balance

There is a right balance between having too much cash on hand, out of precaution, and

having an inadequate supply. If a business has too much cash, it is missing out on

opportunities to invest the cash and generate additional earnings. On the other hand, if it

doesn't have an adequate supply of cash, it will have to borrow the money, and pay interest,

or sell off its liquid investments to generate the cash it needs. If the business expects to

generate a better return on its investments than it pays in interest on its borrowings, it might

decide to invest its surplus cash and borrow any additional money it needs for its activities.

In analyzing a company's balance sheet, certain ratios such as a firm's acid-test ratio, or the

ratio of its most liquid current assets (including cash, accounts receivable, and marketable

securities) to its current liabilities provide an idea about its cash management. While a ratio

of greater than one indicates a healthy current assets situation, a very high ratio could

indicate that the firm holds too much cash or other liquid assets.

The Bottom Line

A company has to generate an adequate cash flow from its business in order to survive. In

addition to generating cash from its activities, a business also needs to manage its cash

situation so that it holds the right amount of cash to meet its immediate and long-term needs.

Source:http://www.Investopedia.com/articles/investing/041515/why-cash-management-key-business-

success.asp

Transcribed Image Text:Read the article “Why Cash Management Is Key to Business

Success" After reading, answer the following questions:

1) What happens when a business is unable to generate enough

cash?

2) What does the article have to say about accounts receivable,

accounts payable, and inventories?

3) Is it bad for a company to have too much cash? Justify your

answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Foundations of Business (MindTap Course List)

Marketing

ISBN:

9781337386920

Author:

William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:

Cengage Learning

Foundations of Business - Standalone book (MindTa…

Marketing

ISBN:

9781285193946

Author:

William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:

Cengage Learning

Foundations of Business (MindTap Course List)

Marketing

ISBN:

9781337386920

Author:

William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:

Cengage Learning

Foundations of Business - Standalone book (MindTa…

Marketing

ISBN:

9781285193946

Author:

William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:

Cengage Learning