(10 Ma (05 Ma What are the functions of Management Accounting? Explain. 'Cost Accounting is an aid to Management Accounting" Discuss. Explain the difference between Cost Accounting and Management Accounting. (05

(10 Ma (05 Ma What are the functions of Management Accounting? Explain. 'Cost Accounting is an aid to Management Accounting" Discuss. Explain the difference between Cost Accounting and Management Accounting. (05

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

100%

Transcribed Image Text:(1)

i.

ii.

iii.

(2) i.

ii.

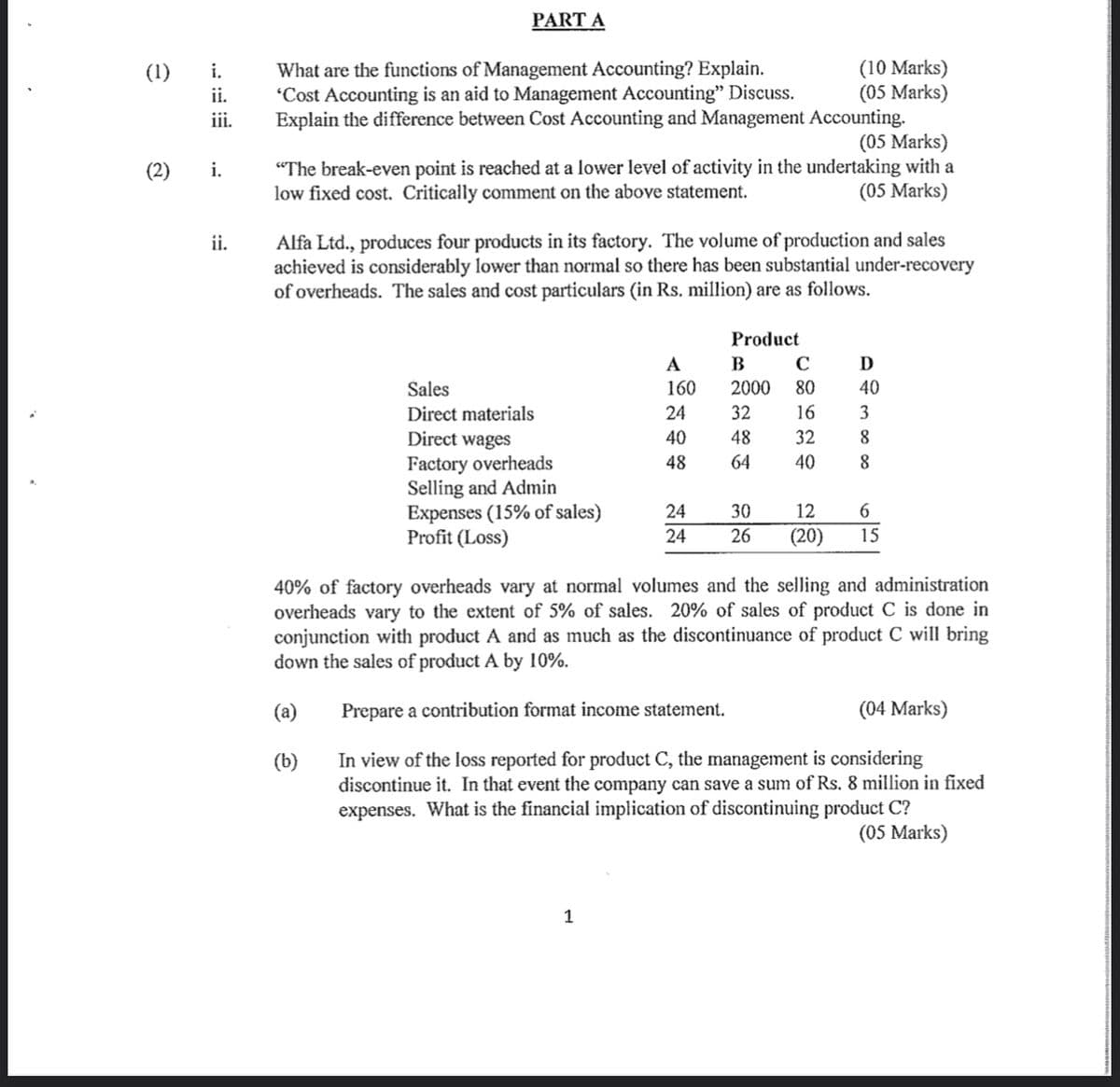

PART A

What are the functions of Management Accounting? Explain.

'Cost Accounting is an aid to Management Accounting" Discuss.

Explain the difference between Cost Accounting and Management

(05 Marks)

"The break-even point is reached at a lower level of activity in the undertaking with a

low fixed cost. Critically comment on the above statement.

(05 Marks)

Sales

Direct materials

Direct wages

Factory overheads

Selling and Admin

Expenses (15% of sales)

Profit (Loss)

Alfa Ltd., produces four products in its factory. The volume of production and sales

achieved is considerably lower than normal so there has been substantial under-recovery

of overheads. The sales and cost particulars (in Rs. million) are as follows.

A

160

24

40

48

1

Accounting.

24

24

(10 Marks)

(05 Marks)

Product

B

C

2000 80

D

40

16

3

32 8

8

32

48

64 40

30

6

12

26 (20) 15

40% of factory overheads vary at normal volumes and the selling and administration

overheads vary to the extent of 5% of sales. 20% of sales of product C is done in

conjunction with product A and as much as the discontinuance of product C will bring

down the sales of product A by 10%.

(a)

Prepare a contribution format income statement.

(04 Marks)

(b)

In view of the loss reported for product C, the management is considering

discontinue it. In that event the company can save a sum of Rs. 8 million in fixed

expenses. What is the financial implication of discontinuing product C?

(05 Marks)

Transcribed Image Text:(3)

iii.

(5)

(i)

(ii)

(4) (i)

(ii)

(ii)

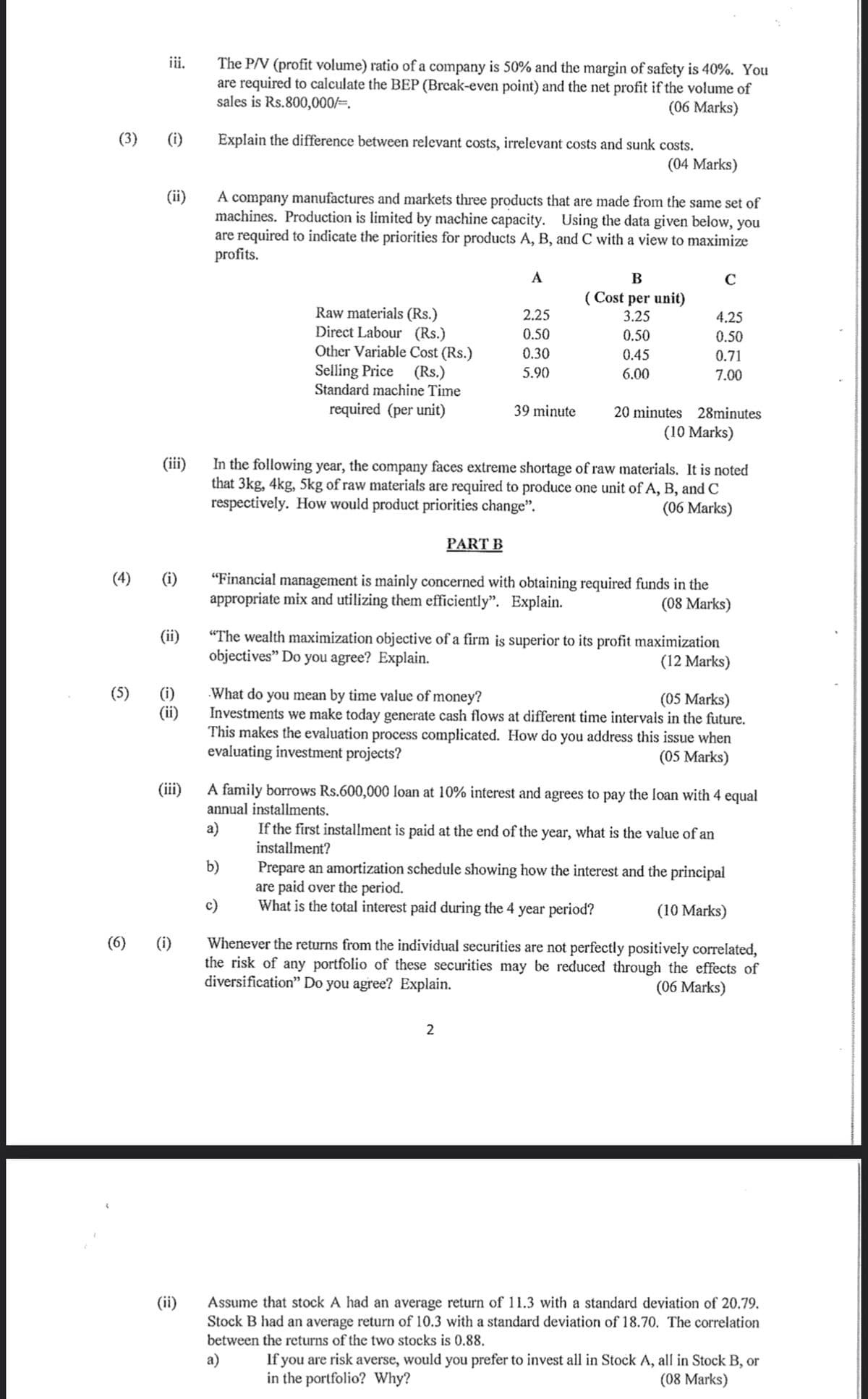

The P/V (profit volume) ratio of a company is 50% and the margin of safety is 40%. You

are required to calculate the BEP (Break-even point) and the net profit if the volume of

sales is Rs.800,000/=.

(06 Marks)

(6) (i)

Explain the difference between relevant costs, irrelevant costs and sunk costs.

(04 Marks)

(ii)

A company manufactures and markets three products that are made from the same set of

machines. Production is limited by machine capacity. Using the data given below, you

are required to indicate the priorities for products A, B, and C with a view to maximize

profits.

Raw materials (Rs.)

Direct Labour (Rs.)

Other Variable Cost (Rs.)

Selling Price (Rs.)

Standard machine Time

required (per unit)

A

(iii)

In the following year, the company faces extreme shortage of raw materials. It is noted

that 3kg, 4kg, 5kg of raw materials are required to produce one unit of A, B, and C

respectively. How would product priorities change".

(06 Marks)

PART B

2.25

0.50

0.30

5.90

39 minute

b)

B

(Cost per unit)

3.25

0.50

0.45

6.00

2

C

4.25

0.50

0.71

7.00

20 minutes 28minutes

(10 Marks)

"Financial management is mainly concerned with obtaining required funds in the

appropriate mix and utilizing them efficiently". Explain.

(08 Marks)

"The wealth maximization objective of a firm is superior to its profit maximization

objectives" Do you agree? Explain.

(12 Marks)

(iii)

A family borrows Rs.600,000 loan at 10% interest and agrees to pay the loan with 4 equal

annual installments.

a)

If the first installment is paid at the end of the year, what is the value of an

installment?

What do you mean by time value of money?

(05 Marks)

Investments we make today generate cash flows at different time intervals in the future.

This makes the evaluation process complicated. How do you address this issue when

evaluating investment projects?

(05 Marks)

Prepare an amortization schedule showing how the interest and the principal

are paid over the period.

What is the total interest paid during the 4 year period?

(10 Marks)

Whenever the returns from the individual securities are not perfectly positively correlated,

the risk of any portfolio of these securities may be reduced through the effects of

diversification" Do you agree? Explain.

(06 Marks)

Assume that stock A had an average return of 11.3 with a standard deviation of 20.79.

Stock B had an average return of 10.3 with a standard deviation of 18.70. The correlation

between the returns of the two stocks is 0.88.

a)

If you are risk averse, would you prefer to invest all in Stock A, all in Stock B, or

in the portfolio? Why?

(08 Marks)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON