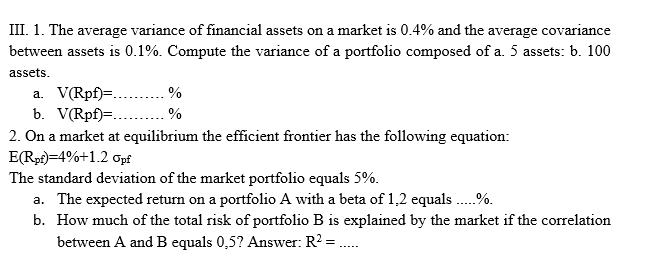

1. 1. The average variance of financial assets on a market is 0.4% and the average covariance tween assets is 0.1%. Compute the variance of a portfolio composed of a. 5 assets: b. 100 sets. a. V(Rpf)=........ %

Q: You are required to use a financial calculator or spreadsheet (Excel) to solve 10 problems related…

A: Here, Face value = $1,000 Time to maturity = 25 years Semiannual coupon rate = 7.5% Present value of…

Q: What is the amount of the periodic payment made at the beginning of every month into a fund that is…

A: Future value of money includes the amount deposited and compounded interest accumulated over the…

Q: is $40 per unit. The required financial break-even quantit

A: Cash break even quantity = fixed cost/(P –v) 6800 = $170,000/(P – $40) P -40= 170000/6800 P=65…

Q: A health insurance policy costs $275/month and pays $100,000 for a major illness. The probability…

A: The expected net profit is the difference between the amount received by the company and the amount…

Q: A U.S. parent firm has a subsidiary using euro. The manager of the parent firm should understand…

A: Here, US is a Parent Firm Euro is a Subsidiary Firm

Q: ou have the following information: the current exchange rate is SGD 0.40/ MYR. Meanwhile, the SGD…

A: Arbitrage profit is generated by purchasing and selling a same securities or portfolio at varying…

Q: The Federal Reserve Bank's goal is to increase the amount in lending in the economy by $102,000. If…

A: The amount of securities purchase will be calculated by multiplier formula Securities purchased…

Q: Given the following data R=$1.00N100 F $1.00N90 lus5% If the interest parity ocondition is expected…

A: Given: Spot rate $1 = ¥100 Forward rate $1 = ¥90 US interest rate = 5%

Q: 9. A $12,000 car loan at 2.5% for 4 years has a monthly payment of $2E for 3 years has a monthly…

A: Loan payments are paid by the monthly payment that carry the payment for interest and payment for…

Q: An investor holds a portfolio of stocks and is considering investing in the DBB Company. The firm’s…

A: Here,

Q: A personal account earmarked as a retirement supplement contains $242,300. Suppose $200,000 is u…

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at…

Q: A loan of $27900 is repaid by payments of $675 at the end of every quarter. Interest is 4%…

A: Given: Particulars Amount Loan(PV) $27,900 Payment(PMT) $675 Quarters 4 Interest rate 4%

Q: A bank reports that the total amount of its net loans and leases outstanding is $936 million, its…

A: The risk measure is a statistical measure that is a historical predictor of investment risk and…

Q: Mr. Nowak has contributed $113.00 at the end of each month into an RRSP paying 5% per annum…

A: Given That: Quarterly Deposit=$113 Interest rate=5% per annum=1.25% per quarter(i) Term (n)=20…

Q: albraith Co. is considering a four-year project that will require an initial investment of $9,000.…

A: NPV or the net present value is an important capital budgeting tool. It is the value of all future…

Q: A $140,000 mortgage was amortized over 25 years by monthly repayments. The interest rate on the…

A: Price of house $ 1,40,000.00 Time Period 25 Interest Rate 4.10%

Q: A. 20Y5 Annual net cash flow is incorrect. B. Present value of annual net cash flow Less…

A:

Q: Suppose that the R&B Beverage Company has a soft drink product that shows a constant annual demand…

A: Economic order quantity (EOQ) is a computation that businesses use to determine their ideal order…

Q: A Industries is considering an expansion. The necessary equipment would be purchased for 2 million…

A: Initial investment outlay is the total capital expenditure incurred at time zero. The initial…

Q: Hayward Enterprises, a successful imaging products firm, is considering expanding into the lucrative…

A: Revenue in year 1 = 1,800,000 Revenue in Year 3 = 1,800,000 *(1+0.11)2 = 2,217,780 Operating costs…

Q: Network Systems is introducing a new network card. Suppose Network Systems knows its fixed costs are…

A: Breakeven refers to the point at which the original cost equals the market price which is determined…

Q: DEFERRED ANNUITY (please don’t use excel) Find the present value of a deferred annuity of P465 every…

A: Deferred annuity is the annuity where payment is not made at the beginning or end of the period but…

Q: Tan Company purchased a large server for $29,000. The company paid 30% of the value as a…

A: Loans are paid by monthly payment that carry the payment of interest and principal amount payment…

Q: Stock A has a capital gains yield of 10% and a dividend yield of 4%. Stock B has a capital gains…

A: The return that a security must generate to satisfy the expectations of investor is called required…

Q: Stock X has a 10% expected return, a beta coefficient of 0.9, and a 35% standard deviation of…

A: a) To find out which stock is riskier, should calculate Coefficient of Variation. Coefficient of…

Q: he income statement comparison for Forklift Material Handling shows the income statement for the…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Marcos purchases a top-up card for his pre-paid cell phone. His remaining balance, B, can be modeled…

A: Finance is defined as the creation, management, and also study of an investments as well as funds.…

Q: What are the basic risks faced by financial intermediaries? Discuss each thoroughly.

A: The following are the basic risks that financial intermediaries face: 1. Interest rate risk: This…

Q: Delos Debt Renegotiations (B). Delos is continuing to renegotiate its prior loan agreement (E80…

A: The remaining outstanding loan balance after two years is $57,604,807.60.

Q: is equivalent to 4.2% APR, compounded semiannually. Choose all that apply. 8.4% R6MO 4.2% BEY 2.1%…

A: Effective annual rate (EAR) refers to a real interest rate which an investor is expect from his…

Q: What is the value today of receiving $4,000 at the end of two years, assuming an interest rate of 4%…

A: Present value of an amount can be calculated as: = Future Value / (1 + i)^n Where, i = rate of…

Q: Understanding the optimal capital structure Review this situation: Universal Exports Inc. is…

A: A company needs capital to run its business. This is raised by way of debt and equity each of which…

Q: Unilever (UK firm) would like to borrow USD, and Coca-Cola (US firm) wants to borrow GBP. Coca-Cola…

A: Interest rates of Unilever (UK firm) and Coca-cola (US firm) Borrowing needed in USD rate GBP…

Q: Give an industry analysis on publicly and privately own medical institutions. within the comparison…

A: The government of a country owns and controls the public sector, which comprises of enterprises.…

Q: A manager in a MNC should understand that appreciation in a firm's local currency causes a ____ in…

A: Local currency has direct relationship with cash flows.

Q: Fatima recently set up a tax-deferred annuity to save for her retirement. She arranged to have BD…

A: Working Note # 1 : P= Payment per period = BD 110 R= Rate of interest per period =2%/12 =…

Q: Cameron Corporation purchase land for $434,000. Later in the year, the company sold a different…

A: Under cash flow statement, cash flows are segregated into three categories which includes Operating…

Q: Common Bond Investment Strategies: Interest Rate Strategy: Passive Strategy:…

A: Step 1 Your investment goals and time frames, the amount of risk you are willing to face, and your…

Q: Problem 19-05 Three investments cost $6,000 each and have the following cash flows. Rank them on…

A: Payback period is the amount of time required to recover initial investment. Payback period =Initial…

Q: A car costs $19,900. Alternatively, the car can be leased for 6 years by making payments of $251 at…

A: Lease monthly payment (L) = $251 Lease final payment (F) = $5692 Interest rate = 6% semiannually…

Q: 6. Given the following information for Computech, compute the firm's degree of combined leverage…

A: Since: Degree of combined Leverage=Percentage change in EPSPercentage change in sales here…

Q: What is the Joint Hypothesis and what are its implications for tests of asset pricing models?

A: The Capital Asset Pricing Model (CAPM) is a model that explains the relationship between expected…

Q: Which of the following is matter if a U.S. parent firm plans to completely finance the establishment…

A: Retained earnings- are the cumulative profit of a firm that is retained after accounting for…

Q: True or False. and briefly explain. a. Under the Capital Asset Pricing Model (CAPM), if a stock has…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Describe Why Some Bonds are Risky: Default Risk: Risk Premium: Impact of Economic Conditions

A: Bonds are a type of a financial security or a financial asset (for the investor) and like all…

Q: What is the balance due on the water tower? $ b) How much will the village need to invest at this…

A: Present Value: It represents the present worth of the future sum of the amount and is computed by…

Q: Charlie wants to withdraw $12,000 each year forever from his account. At an interest rate of 6% per…

A: Annual withdraw = $12,000 Interest rate = 6%

Q: Question 7 of 16 Erin purchased a house for $375,000. He made a downpayment of 20% of the value of…

A: Purchased a house - $375,000 Downpayment - 20% of the value of the house Mortgage for the rest of…

Q: Why is the strait of Hormuz important to Iran and how do they use the strait of hormuz?

A: Strategic management is the management of a company's resources to successfully achieve its goals…

Q: Greg is bullish on the stock of Google and expects the company to deliver excellent results. The…

A: Given, The theoretical value of an option is calculated by the Black Scholes model . Assumptions…

Step by step

Solved in 2 steps

- APT An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate is 6%, the expected return on the first factor (r1) is 12%, and the expected return on the second factor (r2) is 8%. If bi1 = 0.7 and bi2 = 0.9, what is Crisp’s required return?The market has three risky assets. The variance-covariance matrix of the risky assets are as follows: r1 r2 r3 r1 0.25 0 -0.2 r2 0 4 0.1 r3 -0.2 0.1 1 Assume the market portfolio is M = 0.2 ◦ r1 + 0.5 ◦ r2 + 0.3 ◦ r3. Further assume E(rM) = 0.08. (1) What is the variance of M?(2) What is the covariance of r2 and M?(3) What is β2?(4) If the rate of return of the risk-free asset is 0.02. Then what is the fair expected rate of return of security 2?(5) An investor wants to invest in a portfolio P = 0.4◦r1+0.6◦r3. What is its “fair” expected rate of return?The following table provides information relating to Omega Ltd, as well as the market portfolio. The risk-free rate of return is 3.4% . Asset Excess Return Variance Beta Omega 12% 0.021904 1.4 M 8.1% 0.010201 1 What is Omega's M2 value? a. 7.41% b. 11.59% c. 8.99% d. 9.27% What is Omega's Sharpe Ratio? a. 0.061 b. 0.811 c. 0.086 d. 0.581 please explain the calculation step by step

- 3. Suppose the index model for stocks A and B is estimated with the following results:rA = 2% + 0.8RM + eA, rB = 2% + 1.2RM + eB , σM = 20%, and RM = rM − rf . The regressionR2 of stocks A and B is 0.40 and 0.30, respectively. Answer the following questions. (a) What is the variance of each stock? (b) What is the firm-specific risk of each stock? (c) What is the covariance between the two stocks?Suppose the index model for stocks A and B is estimated with the following results:rA = 2% + 0.8RM + eA, rB = 2% + 1.2RM + eB , σM = 20%, and RM = rM − rf . The regressionR2 of stocks A and B is 0.40 and 0.30, respectively.(a) What is the variance of each stock? (b) What is the firm-specific risk of each stock? (c) What is the covariance between the two stocks?Suppose the index model for stocks A and B is estimated with the following results: rA = 2% + 0.8RM + eA, rB = 2% + 1.2RM + eB, σM = 20%, and RM = rM − rf . The regression R2 of stocks A and B is 0.40 and 0.30, respectively. Answer the following questions. Total: (a) What is the variance of each stock? (b) What is the firm-specific risk of each stock? (c) What is the covariance between the two stocks?

- Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA= 4.0% + 0.50RM + eA RB= -1.2% + 0.7RM + eB sigmaM= 17% ; R-squareA = 0.26 ; R-squareB= 0.18 Break down the variance of each stock to the systematic and firm-specific components (write in decimal form, rounded to 4 decimal places). Risk for A Risk for B Systematic Firm-specificSuppose that the index model for stocks A and B is estimated from excess returns with the following results:RA = 3% + .7RM + eARB = −2% + 1.2RM + eBσM = 20%; R-squareA = .20; R-squareB = .12Break down the variance of each stock into its systematic and firm-specific components.Assume that security returns are generated by the single-index model, Ri = αi + βiRM + ei where Ri is the excess return for security i and RM is the market’s excess return. The risk-free rate is 3%. Suppose also that there are three securities A, B, and C, characterized by the following data: Security βi E(Ri) σ(ei) A 1.4 14 % 23 % B 1.6 16 14 C 1.8 18 17 a. If σM = 22%, calculate the variance of returns of securities A, B, and C. b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively. What will be the mean and variance of excess returns for securities A, B, and C? (Enter the variance answers as a percent squared and mean as a percentage. Do not round intermediate calculations. Round your answers to the nearest whole number.)

- Assume that security returns are generated by the single-index model, Ri = alphai + BetaiRM + ei where Ri is the excess return for security i and RM is the market's excess return. The risk-free rate is 2%. Suppose also that there are three securities A, B, and C, characterized by the following data. Security Betai E(Ri) sigma(ei) A 1.4 15% 28% B 1.6 17% 14% C 1.8 19% 23% a. If simaM = 24%, calculate the variance of returns of securities A, B, and C (round to whole number). Variance Security A Security B Security C b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively. What will be the mean and variance of excess returns for securities A, B, and C (enter the variance answers as a whole number decimal and the mean as a whole number percentage)? Mean Variance Security A ?% Security B ?% Security C ?%Assume the CAPM holds and consider stock X, which has a return variance of 0.09 and a correlation of 0.75 with the market portfolio. The market portfolio's Sharpe ratio is 0.30 and the the risk-free rate is 5%. (a) What is Stock X's expected return? (b) What proportion of Stock X's return volatility (i.e. standard deviation) is priced by the market? Explain why this number is less than 1.Suppose that the capital asset pricing model (CAPM) applies. The risk premium of a stock is 3 percent and the risk premium of the market portfolio is 2. The standard deviation of the market portfo- lio is 6. Compute the covariance between the stock and the market portfolio.