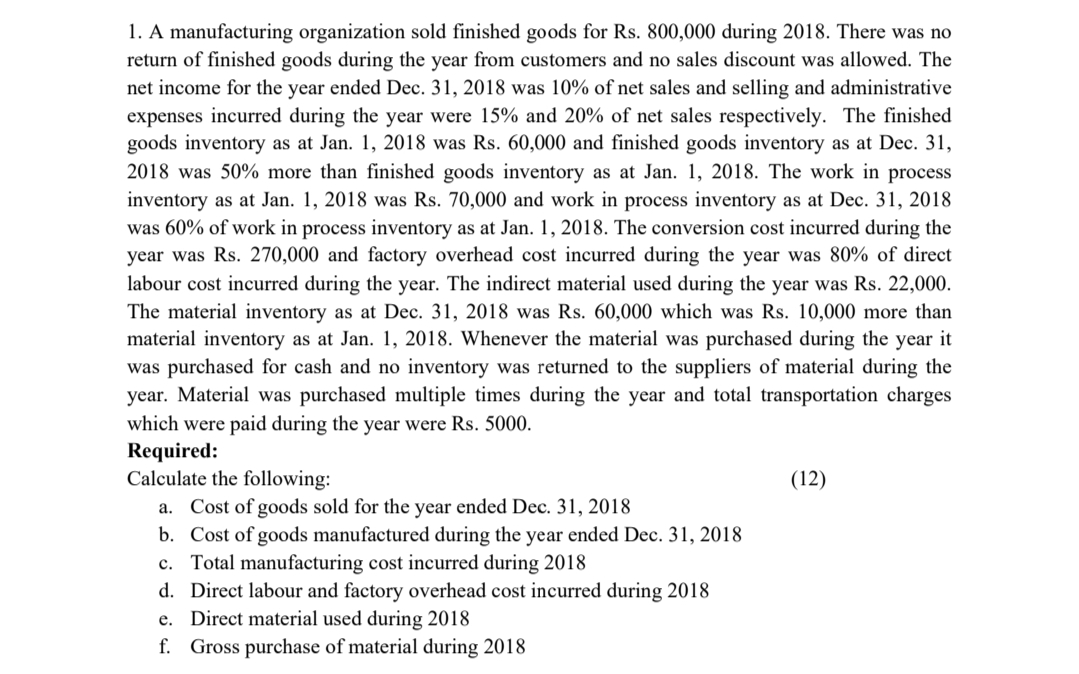

1. A manufacturing organization sold finished goods for Rs. 800,000 during 2018. There was no return of finished goods during the year from customers and no sales discount was allowed. The net income for the year ended Dec. 31, 2018 was 10% of net sales and selling and administrative expenses incurred during the year were 15% and 20% of net sales respectively. The finished goods inventory as at Jan. 1, 2018 was Rs. 60,000 and finished goods inventory as at Dec. 31, 2018 was 50% more than finished goods inventory as at Jan. 1, 2018. The work in process inventory as at Jan. 1, 2018 was Rs. 70,000 and work in process inventory as at Dec. 31, 2018 was 60% of work in process inventory as at Jan. 1, 2018. The conversion cost incurred during the year was Rs. 270,000 and factory overhead cost incurred during the year was 80% of direct labour cost incurred during the year. The indirect material used during the year was Rs. 22,000. The material inventory as at Dec. 31, 2018 was Rs. 60,000 which was Rs. 10,000 more than material inventory as at Jan. 1, 2018. Whenever the material was purchased during the year it was purchased for cash and no inventory was returned to the suppliers of material during the year. Material was purchased multiple times during the year and total transportation charges which were paid during the year were Rs. 5000. Required: Calculate the following: a. Cost of goods sold for the year ended Dec. 31, 2018 b. Cost of goods manufactured during the year ended Dec. 31, 2018 c. Total manufacturing cost incurred during 2018 (12)

1. A manufacturing organization sold finished goods for Rs. 800,000 during 2018. There was no return of finished goods during the year from customers and no sales discount was allowed. The net income for the year ended Dec. 31, 2018 was 10% of net sales and selling and administrative expenses incurred during the year were 15% and 20% of net sales respectively. The finished goods inventory as at Jan. 1, 2018 was Rs. 60,000 and finished goods inventory as at Dec. 31, 2018 was 50% more than finished goods inventory as at Jan. 1, 2018. The work in process inventory as at Jan. 1, 2018 was Rs. 70,000 and work in process inventory as at Dec. 31, 2018 was 60% of work in process inventory as at Jan. 1, 2018. The conversion cost incurred during the year was Rs. 270,000 and factory overhead cost incurred during the year was 80% of direct labour cost incurred during the year. The indirect material used during the year was Rs. 22,000. The material inventory as at Dec. 31, 2018 was Rs. 60,000 which was Rs. 10,000 more than material inventory as at Jan. 1, 2018. Whenever the material was purchased during the year it was purchased for cash and no inventory was returned to the suppliers of material during the year. Material was purchased multiple times during the year and total transportation charges which were paid during the year were Rs. 5000. Required: Calculate the following: a. Cost of goods sold for the year ended Dec. 31, 2018 b. Cost of goods manufactured during the year ended Dec. 31, 2018 c. Total manufacturing cost incurred during 2018 (12)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 33BE

Related questions

Question

100%

Transcribed Image Text:1. A manufacturing organization sold finished goods for Rs. 800,000 during 2018. There was no

return of finished goods during the year from customers and no sales discount was allowed. The

net income for the year ended Dec. 31, 2018 was 10% of net sales and selling and administrative

expenses incurred during the year were 15% and 20% of net sales respectively. The finished

goods inventory as at Jan. 1, 2018 was Rs. 60,000 and finished goods inventory as at Dec. 31,

2018 was 50% more than finished goods inventory as at Jan. 1, 2018. The work in process

inventory as at Jan. 1, 2018 was Rs. 70,000 and work in process inventory as at Dec. 31, 2018

was 60% of work in process inventory as at Jan. 1, 2018. The conversion cost incurred during the

year was Rs. 270,000 and factory overhead cost incurred during the year was 80% of direct

labour cost incurred during the year. The indirect material used during the year was Rs. 22,000.

The material inventory as at Dec. 31, 2018 was Rs. 60,000 which was Rs. 10,000 more than

material inventory as at Jan. 1, 2018. Whenever the material was purchased during the year it

was purchased for cash and no inventory was returned to the suppliers of material during the

year. Material was purchased multiple times during the year and total transportation charges

which were paid during the year were Rs. 5000.

Required:

Calculate the following:

a. Cost of goods sold for the year ended Dec. 31, 2018

b. Cost of goods manufactured during the year ended Dec. 31, 2018

c. Total manufacturing cost incurred during 2018

d. Direct labour and factory overhead cost incurred during 2018

e. Direct material used during 2018

f. Gross purchase of material during 2018

(12)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College