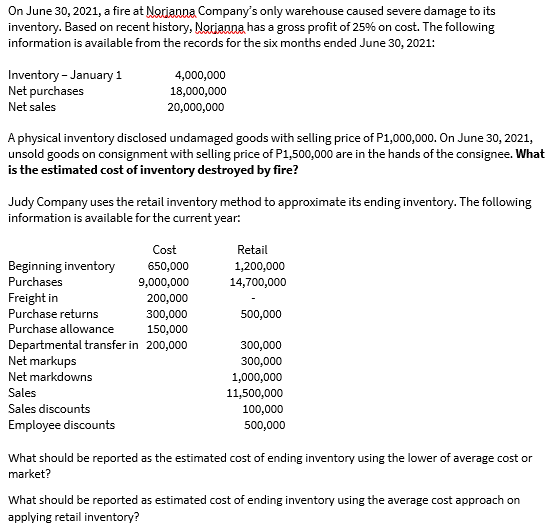

On June 30, 2021, a fire at Norianna Company's only warehouse caused severe damage to its inventory. Based on recent history, Norianna has a gross profit of 25% on cost. The following information is available from the records for the six months ended June 30, 2021: Inventory- January 1 Net purchases 4,000,000 18,000,000 Net sales 20,000,000 A physical inventory disclosed undamaged goods with selling price of P1,000,000. On June 30, 2021, unsold goods on consignment with selling price of P1,500,000 are in the hands of the consignee. What is the estimated cost of inventory destroyed by fire? Judy Company uses the retail inventory method to approximate its ending inventory. The following information is available for the current year: Cost Retail Beginning inventory Purchases 650,000 1,200,000 9,000,000 14,700,000 Freight in Purchase returns 200,000 300,000 500,000 Purchase allowance 150,000 Departmental transfer in 200,000 Net markups 300,000 300,000 Net markdowns 1,000,000 Sales 11,500,000 Sales discounts 100,000 Employee discounts 500,000 What should be reported as the estimated cost of ending inventory using the lower of average cost or market? What should be reported as estimated cost of ending inventory using the average cost approach on applying retail inventory?

On June 30, 2021, a fire at Norianna Company's only warehouse caused severe damage to its inventory. Based on recent history, Norianna has a gross profit of 25% on cost. The following information is available from the records for the six months ended June 30, 2021: Inventory- January 1 Net purchases 4,000,000 18,000,000 Net sales 20,000,000 A physical inventory disclosed undamaged goods with selling price of P1,000,000. On June 30, 2021, unsold goods on consignment with selling price of P1,500,000 are in the hands of the consignee. What is the estimated cost of inventory destroyed by fire? Judy Company uses the retail inventory method to approximate its ending inventory. The following information is available for the current year: Cost Retail Beginning inventory Purchases 650,000 1,200,000 9,000,000 14,700,000 Freight in Purchase returns 200,000 300,000 500,000 Purchase allowance 150,000 Departmental transfer in 200,000 Net markups 300,000 300,000 Net markdowns 1,000,000 Sales 11,500,000 Sales discounts 100,000 Employee discounts 500,000 What should be reported as the estimated cost of ending inventory using the lower of average cost or market? What should be reported as estimated cost of ending inventory using the average cost approach on applying retail inventory?

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Topic Video

Question

Transcribed Image Text:On June 30, 2021, a fire at Norianna Company's only warehouse caused severe damage to its

inventory. Based on recent history, Norianna has a gross profit of 25% on cost. The following

information is available from the records for the six months ended June 30, 2021:

Inventory - January 1

Net purchases

Net sales

4,000,000

18,000,000

20,000,000

A physical inventory disclosed undamaged goods with selling price of P1,000,000. On June 30, 2021,

unsold goods on consignment with selling price of P1,500,000 are in the hands of the consignee. What

is the estimated cost of inventory destroyed by fire?

Judy Company uses the retail inventory method to approximate its ending inventory. The following

information is available for the current year:

Cost

Retail

Beginning inventory

650,000

1,200,000

Purchases

9,000,000

14,700,000

Freight in

200,000

Purchase returns

300,000

150,000

500,000

Purchase allowance

Departmental transfer in 200,000

Net markups

Net markdowns

300,000

300,000

1,000,000

11,500,000

Sales

Sales discounts

100,000

Employee discounts

500,000

What should be reported as the estimated cost of ending inventory using the lower of average cost or

market?

What should be reported as estimated cost of ending inventory using the average cost approach on

applying retail inventory?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,